Sterling is trading as the weakest one for today as it suffers renewed selling ahead of holidays. Canadian Dollar is currently the second weakest, weighed down by unexpected contraction in October GDP. Meanwhile New Zealand and Australian Dollars are the strongest ones, lifted by China’s move to lower import tariffs. Dollar shrugs off much weaker than expected durable goods orders.

In other markets, FTSE is currently up 0.57%. DAX is down -0.14%. CAC is up 0.06%. German 10-year yield is down -0.0026 at -0.253. Earlier in Asia, Nikkei rose 0.02%. Hong Kong HSI rose 0.13%. China Shanghai SSE dropped -1.4%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield dropped -0.0003 to -0.011.

Merry Christmas to our readers. We’ll be back on Dec 26.

US durable goods orders dropped -2%, second decline in three months

US durable goods orders dropped -2.0% mom to USD 242.6B, well below expectation of 0.2%. Headline orders was down in two of the last three months. Ex-transport orders was flat, missed expectation of 1.5% rise. Ex-defense orders, on the other hand, rose 0.8%.

Canada GDP posted first monthly decline in 8 months, by -0.1%

Canada GDP contracted -0.1% mom in October, below expectation of 0.1% mom. That’s also the first decline in eight months. Goods-producing industries had the second consecutive monthly decline, by -0.5% mom. Services-producing industries were essentially unchanged. Overall, 13 of 30 industrial sectors still posted growth in the month.

China lowers tariffs on 859 imports types to below MFN rates

China’s Ministry of Finance announced to cut import tariffs for range of products starting January 1. A total of 859 product types will enjoy provisional import tariffs lower than the Most-Favored-Nation (MFN) rates charged in 2020. The move aimed at meeting specific domestic demands but not totally related to US-China trade deal. The MOF also said that Goods from New Zealand, Peru, Costa Rica, Switzerland, Iceland, Singapore, Australia, South Korea, Georgia, Chile and Pakistan will have even lower levies under the re-negotiated free trade agreements with China.

In particular, tariffs for frozen pork will be lowered from the MFN rate of 12% to 8%. Also, rate for frozen avocado will be lowered from MFN rate from 30% to 7%. Tariffs for some asthma and diabetes medications will be set at zero. Import tariffs on multi-component semiconductors will be cut to zero.

GBP/USD Mid-Day Outlook

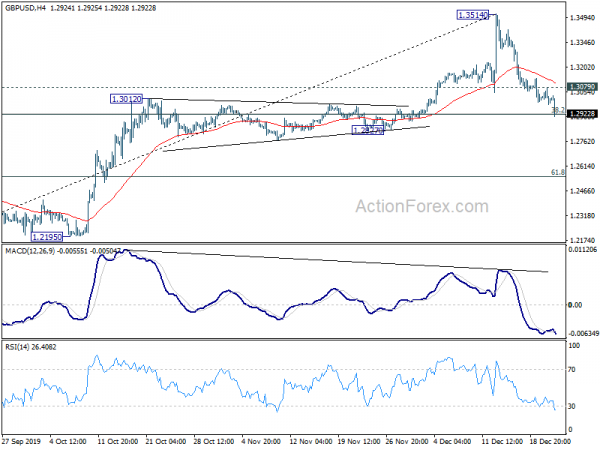

Daily Pivots: (S1) 1.2960; (P) 1.3020; (R1) 1.3060; More….

GBP/USD’s decline re-accelerates to as low as 1.2905 so far. Intraday bias remains on the downside at this point. Sustained break of 38.2% retracement of 1.1958 to 1.3514 at 1.2920 will pave the way to 61.8% retracement at 1.2552. On the upside, break of 1.3079 minor resistance will turn bias back to the upside for retesting 1.3514 high.

In the bigger picture, rise from 1.1958 medium term bottom is on track to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2582 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Private Sector Credit M/M Nov | 0.10% | 0.30% | 0.10% | |

| 04:30 | JPY | All Industry Activity Index M/M Oct | -4.30% | -4.30% | 1.50% | 1.90% |

| 13:30 | CAD | GDP M/M Oct | -0.10% | 0.10% | 0.10% | |

| 13:30 | USD | Durable Goods Orders Nov | -2.00% | 0.20% | 0.50% | |

| 13:30 | USD | Durable Goods Orders ex Transportation Nov | 0.00% | 1.50% | 0.50% | |

| 15:00 | USD | New Home Sales Nov | 730K | 733K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals