Sterling and Euro rebound strongly today as lifted by solid economic data. But overall market sentiments remain weak concern of outbreak of coronavirus in China, ahead of lunar new year mass travel. Commodity currencies continue to trade as the weakest ones, following decline in stock markets. Yen is also firm on risk aversion. Dollar is mixed, awaiting fresh inspiration.

Technically, there is no clear breakout in the markets for now. EUR/USD failed to sustain below 1.1085 support and recovered. Intraday bias remains neutral first. AUD/USD also breached 0.6849 support but failed to sustain below. Intraday bias also stays neutral. GBP/USD recovers notably but stays in range of 1.2954/3118. Intraday bias also remains neutral. USD/JPY is holding above 109.79 minor support. Intraday bias also stays neutral.

In Europe, currently, FTSE is down -0.75%. DAX is down -0.08%. CAC is down -0.70%. German 10-year yield is up 0.002 at -0.214. Earlier in Asia, Nikkei dropped -0.91%. Hong Kong HSI dropped -2.81%. China Shanghai SSE dropped -1.41%. Singapore Strait Times dropped -1.00%. Japan 10-year JGB yield dropped -0.0140 to -0.005.

US Mnuchin to Italy and UK: Delay digital taxes or face tariffs

US Treasury Secretary Steven Mnuchin urged Italy and UK to suspend their plans to impose digital taxes. Or “if not they’ll find themselves faced with President Trump’s tariffs.” The warning came after France agreed to delay digital tax imposition through the end of the year, as US and France would work out a permanent resolution.

Mnuchin also said that the phase two trade deal may not be a “big bang” with all existing tariffs removed. Instead, “we may do 2A and some of the tariffs come off. We can do this sequentially along the way.”

EU to lose USD 10.8B exports due to US-China trade deal, Germany hardest hit

The Kiel Institute for World Economy warned that US-China trade agreement is “significantly damaging” to the EU. Germany is “particularly affected”, and among the sectors, especially “aircraft and vehicle manufacturing.” Gabriel Felbermayr, Kiel President, said, “the additional imports of US goods promised by China will divert imports from other countries.”

As calculated by Felbermayr and trade expert Sonali Chowdhry, EU exports to China will probably be USD 10.8B lower in 2021 compared with a scenario in which the agreement and the tariff war between China and the USA would not have existed. The EU would then have to bear about a sixth of the overall trade diversion caused by the agreement.

In absolute terms, the biggest losers in the EU are the manufacturers of aircraft (USD -3.7B), vehicles (USD -2.4B), and industrial machinery (USD – 1.4B). In terms of relative changes, the largest relative losses would again be in the aircraft sector (-28%), vehicles (-7%), and pharmaceutical products (-5%). “The affected industries are mainly located in Germany, but France has also been hit considerably”, says Felbermayr.

UK unemployment rate unchanged at 3.8%, employment rate hit record high

UK unemployment rate was unchanged at 3.8% in the three months to November, matched expectations. An estimated 1.31m people were unemployed. Employment rate increased jumped 0.5% on the quarter to 76.3%, a record high. Average earnings excluding bonus slowed to 3.4% 3moy, matched expectations. Average earnings including bonus was unchanged at 3.2% 3moy, missed expectations.

German ZEW jumped to 26.7, highest since July 2015

German ZEW Economic Sentiment rose sharply to 26.7 in January, up from 10.7, beat expectation of 15.2. That’s also the highest reading since July 2015. Current Situation Index rose to -9.5, up from -19.9, beat expectation of -12.4. Eurozone ZEW Economic Sentiment rose to 25.6, up from 11., beat expectation of 16.3. Current Situation Index rose 4.8 pts to -9.9.

“The continued strong increase of the ZEW Indicator of Economic Sentiment is mainly due to the recent settlement of the trade dispute between the USA and China. This gives rise to the hope that the trade dispute’s negative effects on the German economy will be less pronounced than previously thought. In addition, the German economy developed slightly better than expected in the previous year. Although the outlook has improved, growth is still expected to remain below average.,” comments ZEW President Achim Wambach.

BoJ stands pat, raises growth forecasts, lower inflation projections

BoJ left monetary policy unchanged as widely expected. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. Annual pace of monetary base expansion is held at around JPY 80T, to keep 10-year JGB yields at around zero percent. Harada Yutaka and Kataoka Goushi dissented again in 7-2 vote.

In the new economic projections, fiscal 2020 growth forecast was raised from 0.7% to 0.9%. CPI core forecast (ex-sales tax hike) was lowered from 1.0% to 0.9%. For fiscal 2021, growth forecast was raised from 1.0% to 1.1%. CPI core forecast was lowered form 1.5% to 1.4%. BoJ added that risks to economic activity and prices are both “skewed to the downside”. Momentum toward achieving 2% inflation target is “maintained by is not yet sufficiently firm”.

In the regular post-meeting press conference, Governor Haruhiko Kuroda said for now “the benefits of our policy still exceed the costs”. And the central bank will “continue to pursue powerful monetary easing to achieve 2% inflation.” Though, he added, “BOJ must be mindful of the impact prolonged ultra-low rates could have on financial intermediation.”

Kuroda also noted that “progress in US-China trade talks and Brexit have led to an improvement in risk sentiment”. But “uncertainty remains on the “fate” of the US-China trade talks”. Plus, “there are also geopolitical risks in the Middle East”. “If the economy accelerates dramatically, there could be some debate. But for now, it’s appropriate to maintain our current policy stance. Various overseas risks remain, so the current monetary policy with an easy bias will be sustained for some time,” he said.

EUR/USD Mid-Day Outlook

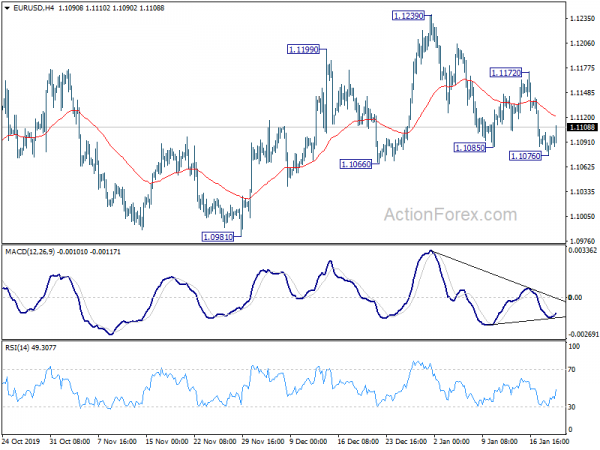

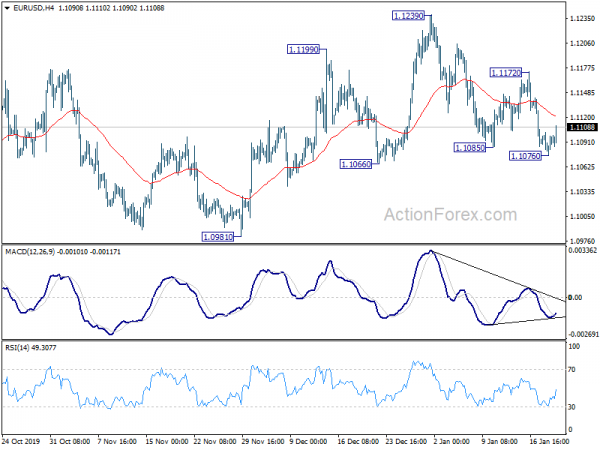

Daily Pivots: (S1) 1.1081; (P) 1.1092; (R1) 1.1106; More…

EUR/USD failed to sustain below 1.1085 support and recovered. Intraday bias remains neutral for the moment. Further fall is mildly in favor as long as 1.1172 resistance holds. Break of 1.1076 will resume the fall from 1.1239 to 1.0981 support. Decisive break there will confirm that whole corrective rise from 1.0879 has completed. On the upside, above 1.1172 will turn bias to the upside for 1.1239 instead.

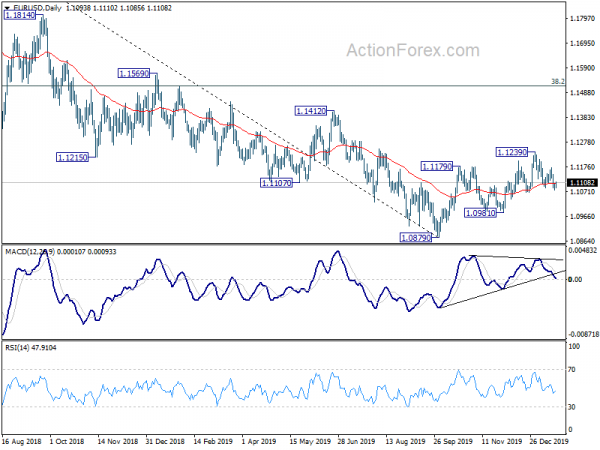

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 9:30 | GBP | Claimant Count Change Dec | 14.9K | 33.4K | 28.8K | 14.9K |

| 9:30 | GBP | Claimant Count Rate Dec | 3.50% | 3.50% | 3.40% | |

| 9:30 | GBP | ILO Unemployment Rate (3M) Nov | 3.80% | 3.80% | 3.80% | |

| 9:30 | GBP | Average Earnings Excluding Bonus 3M/Y Nov | 3.40% | 3.40% | 3.50% | |

| 9:30 | GBP | Average Earnings Including Bonus 3M/Y Nov | 3.20% | 3.40% | 3.20% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 26.7 | 15.2 | 10.7 | |

| 10:00 | EUR | Germany ZEW Current Situation Jan | -9.5 | -12.4 | -19.9 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 25.6 | 16.3 | 11.2 | |

| 13:30 | CAD | Manufacturing Sales M/M Nov | 0.30% | -0.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals