The financial markets are pretty steady in Asian session today, digesting some of last week’s wide moves. Asian markets are generally higher today, in particular, Chinese stocks shrug off poor PMI data and rebounded strongly. Gold is pressing 1600 handle, recovering mildly, while WTI oil is also back above 45. In the currency markets, Canadian and Australian Dollars are currently the strongest one for today, but New Zealand is the weakest. Yen and Dollar also generally softer.

Technically, 1.1063 fibonacci resistance in EUR/USD is a focus today. We’d still expect it to hold to bring retest of 1.0777 low as next step. But sustained break there will be an early sign of bullish reversal and turn focus to 1.1239 high. There is no extended weakness in Aussie even though markets are increasing bet on an RBA cut this week. 0.6592 minor resistance in AUD/USD and 1.6827 minor resistance in EUR/AUD are the levels to indicate temporary bottoming, at least, in Aussie.

In Asia, Nikkei closed up 0.95%. Hong Kong HSI is up 0.53%. China Shanghai SSE is up 3.08%. Singapore Strait Times is up 0.22%. Japan 10-year JGB yield is up 0.0297 at -0.124.

Global coronavirus cases surge, China’s slowing, Yuan rebounds

Global spread of China’s Wuhan coronavirus continued to intensify over the weekend. Total number of cases outside China reached 9051 with 141 deaths. Situation in South Korea remains the worse, with 4212 cases and 22 deaths. Italy reported 1701 cases with 41 deaths. Iran’s cases also jumped to 978 with 54 deaths.

Contagion to other European countries is also increasing, in particular to France (130 cases, deaths), Germany (130 cases) and Spain (84 cases). Japan (256 cases), Singapore (106 cases) and Hong Kong (100 cases) are relatively steady.

On the other hand, China’s own news cases continued to slow, with 573 new cases and 35 new deaths on February 29, 202 new cases and 42 new deaths on March 1. As of end of yesterday, there are an accumulated total of 80026 confirmed cases and 2912 deaths.

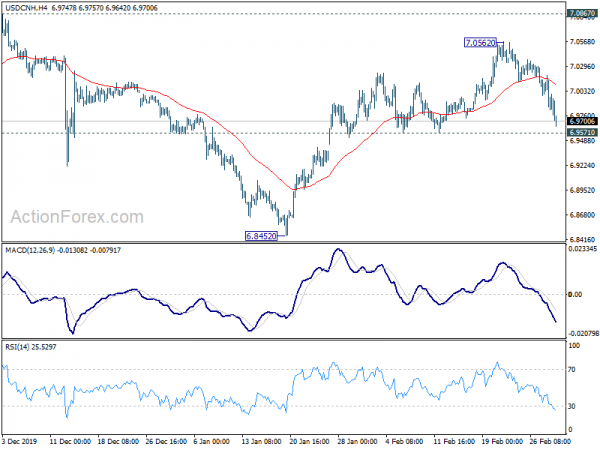

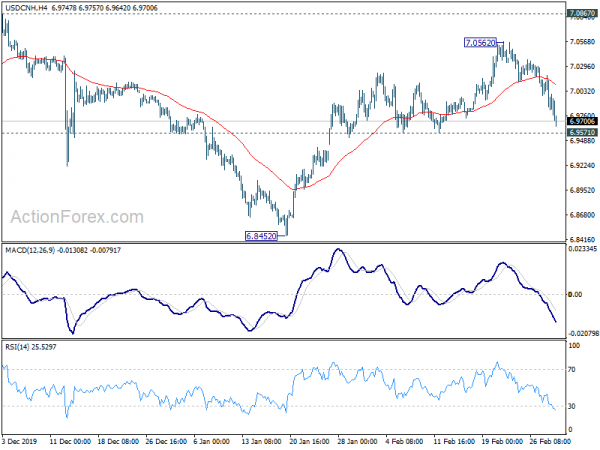

Chinese Yuan is extending last week’s rebound, partly as situation in China eased, and partly on weakness on Dollar. USD/CNH’s decline from 7.0562 suggests that rebound from 6.8452 has completed, ahead of 7.0867 resistance. Focus is now on 6.9571 support. Break there will confirm this case and bring deeper decline through 06.8452 to resume whole corrective fall from 7.1953.

China Caixin PMI manufacturing dropped to 40.5, supply and demand sides both weak

China’s Caixin PMI Manufacturing dropped to 40.5 in February, down form 51.1, missed expectation of 45.7. That’s a record low since survey began in April 2004. Markit noted record falls in output, new orders and employment. Travel restrictions led to sharp deterioration in supply chains. But business confidence rose on hopes of output recovering.

Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said: “The sharp decline was due to stagnant economic activity across the country disrupted by the pneumonia epidemic caused by a novel coronavirus. The supply and demand sides of the manufacturing sector were both weak.”

Released over the weekend, official NBS PMI Manufacturing dropped to 35.7 in February, down from 50.0, worst on record. PMI Non-Manufacturing dropped to 29.6, down from 54.1, lowest since November 2011.

BoJ Kuroda suggests no imminent easing in emergency statement

BoJ Governor Haruhiko Kuroda issued a rare emergency statement today, warning of the spread of the Wuhan coronavirus. He said, “Overseas and domestic financial markets continue to make unstable movements due to heightening uncertainty over the impact on the economy from the spread of the coronavirus. The BOJ will monitor developments carefully, and strive to stabilize markets and offer sufficient liquidity via market operations and asset purchases.”

The statement argues that BoJ would use the current tools to counter the impact of coronavirus outbreak first. That is, focuses will be on market operations and liquidity. Apparently, further monetary easing is not seen as an imminent step that BoJ would take.

Japan PMI manufacturing finalized at 47.8, near term prospect very bleak

Japan PMI Manufacturing was finalized at 47.8 in February, down from 48.8 in January. Markit noted that company cut production as demand deteriorates markedly. Supply chains were also adversely impacted by the coronavirus outbreak. Output growth expectations also weakened.

Joe Hayes, Economist at IHS Markit, said: Near-term prospects for industrial sector appear “very bleak”. “Consumer, intermediate and capital goods producers recorded faster declines in demand and overall order books fell at the sharpest rate in over seven years”. The manufacturing recession “goes much deeper” than the coronavirus outbreak, but lower sales in China “further woes to an already-fragile external environment.”.

Also from Japan, capital spending dropped -3.5% in Q4, below expectation of -2.5%.

Australia manufacturing in worst contraction in five years, coronavirus disruption deepens slowdown

Australian AiG Performance of Manufacturing index dropped to 44.3 in February, down from 45.4. That’s the fourth straight months of contraction in the manufacturing sector, last occurred back in 2014. It’s also the lowest monthly reading in nearly five years. All sectors were in contraction except for food & beverages.

Australian Industry Group chief executive Innes Willox warned, “The disruptive effects of the coronavirus, including on supply chains, are deepening and adding to the slowdown that has been in train since the closing months of 2019… The coronavirus is negatively impacting the exports of fast-moving consumable items to China and a number of businesses reported supply chain difficulties arising from factory shutdowns in China.”

TD securities inflation gauge dropped -0.1% mom in February. Company gross operating profits dropped -3.5% qoq in Q4 versus expectation of -1.2% qoq.

RBA to cut, BoC to hold, US ISMs and NFP to watch

Two central banks will meet this week, RBA and BoC. RBA was originally expected to cut interest rate in April. But recent global coronavirus outbreak and free fall in stock markets prompted speculation of a cut this week. We’ll see if RBA would meet market expectations and deliver. Australian Dollar will also faces tests from Chinese data, Australia GDP, trade balance and retail sales.

BoC, on the other hand, are expected to stand pat for now. WTI crude oil is now close to key support at 42 handle and further deterioration is unlikely. At this point, coronavirus spread is relatively contained in North America. Though, Canadian Dollar could also be vulnerable to a dovish turn in the BoC statement, even if the decision is on hold. Canada will also release employment data.

US data will also be very closely watched. Expectations for a March Fed cut surged last week, with marketing pricing in over 90% chance of a -50bps cut. But other than the stock market crash, Fed policy markets should also look into this week’s high profile data, including ISM manufacturing and non-manufacturing, as well as non-farm payroll report before taking their stances. Hence, while a cut is more likely than not in two weeks, the size is still uncertain.

- Monday: Australia AiG manufacturing; Japan PMI manufacturing final; China Caixin PMI manufacturing; Swiss PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final, M4 money supply, mortgage approvals; Canada PMI manufacturing; US ISM manufacturing, construction spending.

- Tuesday: RBA rate decision, Australia building approvals, current account; Japan consumer confidence; Swiss GDP; UK PMI construction; Eurozone CPI flash, PPI, unemployment rate.

- Wednesday: Australia AiG construction, GDP; New Zealand building permits; China Caixin PMI services; Swiss CPI; Germany retail sales; Eurozone PMI services finally, retail sales; UK PMI services final; US ADP employment, Fed’s Beige book; BoC rate decision.

- Thursday: Australia trade balance; US Challenger job cuts, non-farm productivity, jobless claims, factory orders.

- Friday: Australia AiG services, retail sales; Japan average cash earnings, household spending, leading indicators; Germany factory orders; Swiss foreign currency reserves; Canada employment, Ivey PMI, trade balance; US non-farm payroll, trade balance.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3362; (P) 1.3413; (R1) 1.3449; More….

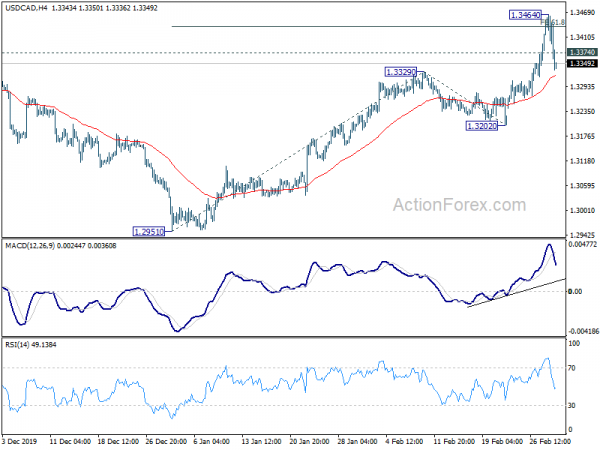

USD/CAD’s break of 1.3374 minor support suggests temporary topping at 1.3464, after hitting 61.8% projection of 1.2951 to 1.3329 from 1.3202 at 1.3436. Intraday bias is turned neutral for consolidations. But downside of retreat should be contained well above 1.3202 support to bring another rise. On the upside, break of 1.3464 will target 100% projection at 1.3580 next.

In the bigger picture, price actions from 1.3664 (2018 high) are seen as a corrective move that has likely completed. Rise from 1.2061 (2017 low) might be ready to resume. Decisive break 1.3664 will target 61.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.3941 next. For now, this will remain the favored case as long as 1.3202 support holds, in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Feb | 44.3 | 45.4 | ||

| 23:50 | JPY | Capital Spending Q4 | -3.50% | -2.50% | 7.10% | |

| 0:00 | AUD | TD Securities Inflation M/M Feb | -0.10% | 0.30% | ||

| 0:30 | AUD | Company Gross Operating Profits Q/Q Q4 | -3.50% | -1.20% | -0.80% | -0.60% |

| 0:30 | JPY | Manufacturing PMI Feb F | 47.8 | 47.6 | 47.6 | |

| 1:45 | CNY | Caixin Manufacturing PMI Feb | 40.3 | 45.7 | 51.1 | |

| 8:30 | CHF | SVME – Purchasing Managers’ Index Feb | 48.9 | 47.8 | ||

| 8:45 | EUR | Italy Manufacturing PMI Feb | 48.1 | 48.9 | ||

| 8:50 | EUR | France Manufacturing PMI Feb F | 49.7 | 49.7 | ||

| 8:55 | EUR | Germany Manufacturing PMI Feb F | 47.8 | 47.8 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Feb F | 49.1 | 49.1 | ||

| 9:30 | GBP | Manufacturing PMI Feb F | 51.9 | 51.9 | ||

| 9:30 | GBP | Mortgage Approvals Jan | 68K | 67K | ||

| 9:30 | GBP | M4 Money Supply M/M Jan | 0.20% | 0.10% | ||

| 14:45 | USD | Manufacturing PMI Feb F | 50.8 | 50.8 | ||

| 15:00 | USD | ISM Manufacturing PMI Feb | 50.5 | 50.9 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Feb | 50.8 | 53.3 | ||

| 15:00 | USD | Construction Spending M/M Jan | 0.40% | -0.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals