UK is at the center of focus today as BoE announced an emergency rate cut, followed by massive coronavirus relief package from the government. Yet the Pound is relatively unmoved. Stock markets also show no optimism as the outbreak continues to worsen. After initial gains, all major European indices reversed, accompanied by sharp decline in DOW futures. Back on currencies, Yen remains the strongest one for the week, followed by Euro and Swiss Franc. Canadian dollar remains the weakest one, followed by Australian.

Global coronavirus cases break 120k level to 121,355, with 4,380 deaths. Iran’s number surged to 9,000 and would likely follow Italy (10,149) to break 10k level soon. Spain’s number surge through 2k level to 2,115, followed by France (1784) and Germany (1,622). Switzerland (652), Norway (436), Sweden (436), UK (383), Netherlands (382), Denmark (340) and Belgium (314) might be catching up. In Asia, South Korea’s number jumped again by 242 to 7755 due to a call center infection. Other than Japan (587), outbreak in Asia is relatively limited. There are 1016 cases reported in the USA. Lastly, let’s not forget that the outbreak originated in China, now with 80,877 cases, and 3,158 deaths.

In Europe, currently, FTSE is down -0.17%. DAX is up 0.07%. CAC is up 0.23%. German 10-year yield is up 0.0227 at -0.770. Earlier in Asia, Nikkei dropped -2.27%. Hong Kong HSI dropped -0.63%. China Shanghai SSE dropped -0.94%. Singapore Strait Times dropped -1.72%. Japan 10-year JGB yield dropped -0.0212 to -0.063.

US CPI slowed to 2.3%, but core CPI picked up to 2.4%

US CPI rose 0.1% mom in February, above expectation of 0.0% mom. Core CPI rose 0.2% mom, matched expectations. Annually, CPI slowed to 2.3% yoy, down from 2.5% yoy, matched expectations. Core CPI accelerated to 2.4% yoy, up from 2.3% yoy, above expectation of 2.3% yoy.

UK Sunak delivers GBP 30B coronavirus relief package

UK’s new Chancellor of Exchequer Rishi Sunak delivers a massive GBP 30B stimulus package today to counter the devastating impact of coronavirus. He pledged to “doing everything we can to keep this country, and our people, healthy and financially secure.” Additionally, he said he’s in “constant communication” with BoE for “coordinated” and “comprehensive” response to the coronavirus.

The plan include GBP 5B emergency fund for the National Health Service, and “whatever it needs, whatever it costs”. People will also be given financial support if they need to cope with coronavirus, with statutory sick pay for everyone who’s been told to self-isolate, and more generous welfare rules. Additionally, the government will refund sick pay bills for 14 days in full, for two million companies with less than 250 staff.

BoE delivers emergency -50bps rate cut

BoE announced emergency measures to counter the economic shocks from coronavirus today, including a rate cut. Bank rate is lowed by -50bps to 0.25% on unanimous vote. Asset purchase target is kept unchanged at GBP 435B. Also, a new Term Funding scheme with addition a incentives for SMEs is introduced.

The central bank said, “the reduction in Bank Rate will help to support business and consumer confidence at a difficult time, to bolster the cash flows of businesses and households, and to reduce the cost, and to improve the availability, of finance.” Additionally, the Financial Policy Committee has reduced the UK countercyclical capital buffer rate to 0% of banks’ exposures to UK borrowers with immediate effect. The rate had been 1% and had been due to reach 2% by December 2020.

Carney: It’s a big package to bridge across economic disruption

After the emergency rate cut, BoE Governor Mark Carney and his successor Andrew Baily appeared as at press conference. He said today’s”comprehensive and timely package” will help households and businesses “bridge across the economic disruption” caused by the coronavirus. He hailed that it’s a “big package”, with a ” a huge term funding certainty for the financial sector”. Also, “there are fiscal measures that are coming”.

It’s “too early” to judge if there will be a recession in the UK, he added. “We have a sense of the direction, a sense of the orders of magnitude, could be large.” Though, “there is no reason for it to be as bad as 2008 if we act as we have, and if there is that targeted support.”

Australia consumer sentiment dropped 5-yr low, spectacular drop in economic expectations

Australia Westpac consumer sentiment dropped -3.8% to 91.9 in March, hitting the lowest level in five years. More importantly, it’s the second lowest level since the global financial crisis. Across the five component sub-indexes, biggest fall was around expectations for the economy, The “economy, next 12 months” sub-index recorded a spectacular -12.8% drop taking it to 77.9, a five year low.

Westpac said, “The Reserve Bank Board next meets on April 7. Given the clear risks being faced by the Australian economy over the next few months the Board is likely to lower the cash rate by a further 0.25%.”

And, cash rate will hit RBA’s lower bound of 0.25%, “the next policy approach is likely to involve a form of unconventional monetary policy where indications are that the Board favours the approach of setting a rate target further out the yield curve and signalling the commitment to defend that target”.

RBA Debelle: Too uncertain to assess coronavirus impacts beyond Q1

RBA Governor Guy Debelle said in a speech that because of the coronavirus, the global economy will be “materially weaker” in Q1 and in the period ahead. For Australia, RBA has estimated the impact of education and tourism sectors. These services exports, which account for 5% of GDP, would drop at least -10% in Q1. That translates into -0.5% subtraction of GDP just from these two sources. But that, he added, “it is just too uncertain to assess the impact of the virus beyond the March quarter.”

Debelle also said, the coronavirus is “a shock to both demand and supply”. Monetary policy “does not have an effect” on the supply side. But It can work to “ensure demand is stronger than it otherwise would be”. The government’s intention to support jobs, incomes, small business and investment will “provide welcome support” to the economy. “The combined effect of fiscal and monetary policy will help us navigate a difficult period for the Australian economy.”

Economists downgrade Singapore 2020 growth forecasts from 1.5% to 0.6%

According to a survey by Monetary Authority of Singapore, economists now expect the country’s economy to grow only 0.6% this year. That’s sharply lower than 1.5% growth as expected in the previous survey in December. That is within the government’s forecast range of -0.5% to 1.5%.

The respondents were also pessimistic across all key sectors. Manufacturing is expected to contract by -0.3% this year, versus prior forecast of 0.7% growth. Wholesale and retail are expected to contract by -0.7%, comparing to prior forecast of 0.4%. Accommodation of food services would contract -1.6%, versus prior forecast of 2.1%.

Finance and insurance are expected to growth 2.5%, lower than prior forecast of 3.5%. Construction is expected to grow 2.4%, just slightly revised down from 2.5%.

UK GDP stagnated in January, production contracted

UK GDP grew 0.0% mom in January, below expectation of 0.2% mom. Services rose 0.1% mom. Production dropped -0.1% mom. Manufacturing rose 0.2% mom. Construction contracted -0.8% mom. Agriculture rose 0.1% mom.

In the three months to January, GDP was also flat without growth. During the period, services rose 0.0% 3mo3m, production dropped -1.0% 3mon, construction rose 1.4% 3mo3m.

Industrial production came in at 0.1% mom -2.9% yoy in January, versus expectation of 0.4% mom -2.3% yoy. Manufacturing production was at 0.2% mom -3.6% yoy, versus expectation of 0.4% mom -3.3% yoy. Goods trade deficit widened to GBP -3.7B, versus expectation of GBP -7.5B.

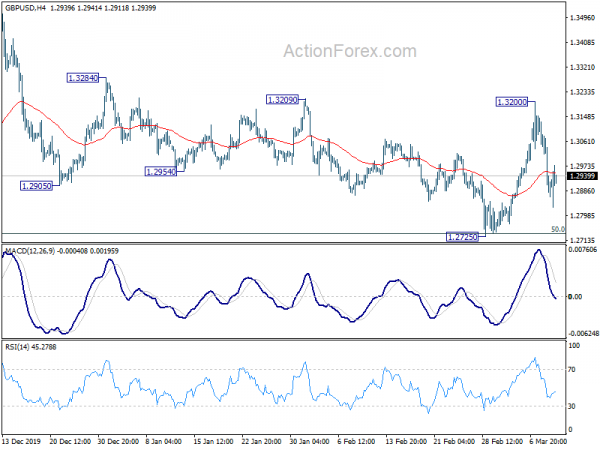

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2817; (P) 1.2971; (R1) 1.3060; More…

GBP/USD edged lower to 1.2827 today but quickly recovered. Intraday bias remains neutral for the moment. Prior rejection by 1.3209 resistance argues that corrective fall from 1.3514 might not be over yet. Break of 1.2725 will target 61.8% retracement of 1.1958 to 1.3514 at 1.2552. On the upside, though, break of 1.3209 will confirm completion of the correction from 1.3514 and bring retest of this high.

In the bigger picture, rise from 1.1958 is expected resume after correction from 1.3514 completes. Next target is 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. However, sustained break of 1.2582 resistance turned support will dampen these views and bring retest of 1.1958 low instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Mar | -3.80% | 2.30% | ||

| 07:00 | GBP | BoE Rate Decision | 0.25% | 0.75% | ||

| 07:00 | GBP | Asset Purchase Facility | 435B | 435B | ||

| 07:00 | GBP | MPC Official Bank Rate Votes | 0–9–0 | 0–2–7 | ||

| 07:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 09:30 | GBP | GDP M/M Jan | 0.00% | 0.20% | 0.30% | |

| 09:30 | GBP | Index of Services 3M/3M Jan | 0.00% | 0.00% | 0.10% | |

| 09:30 | GBP | Industrial Production M/M Jan | -0.10% | 0.40% | 0.10% | |

| 09:30 | GBP | Industrial Production Y/Y Jan | -2.90% | -2.30% | -1.80% | |

| 09:30 | GBP | Manufacturing Production M/M Jan | 0.20% | 0.40% | 0.30% | |

| 09:30 | GBP | Manufacturing Production Y/Y Jan | -3.60% | -3.30% | -2.50% | |

| 09:30 | GBP | Goods Trade Balance (GBP) Jan | -3.7B | -7.5B | 0.8B | -1.4B |

| 12:30 | USD | CPI M/M Feb | 0.10% | 0.00% | 0.10% | |

| 12:30 | USD | CPI Y/Y Feb | 2.30% | 2.30% | 2.50% | |

| 12:30 | USD | CPI Core M/M Feb | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Feb | 2.40% | 2.30% | 2.30% | |

| 12:30 | CAD | Capacity Utilization Q4 | 81.20% | 81.50% | 81.70% | 81.50% |

| 13:00 | GBP | NIESR GDP Estimate Feb | 0.00% | |||

| 14:30 | USD | Crude Oil Inventories | 2.0M | 0.8M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals