Asian markets turn softer today as boost from US stimulus package fades very quickly. Focus will instead turn to BoE rate decision and US jobless claims. In particular, the latter would reveal how serious the initial impact of coronavirus outbreak in the US is. In the currency markets, commodity currencies turn generally softer today as led by Australian Dollar. Yen and Swiss Franc reclaim some grounds.

Technically, we’d maintain the view that markets are staying in consolidations for the moment, including stocks. Dollar and Yen are both set to resume recent rally sooner or later, as the correction completes. The main question in which one would be stronger. 112.22 key resistance in USD/JPY is the level to determine the relative strength.

In Asia, Nikkei closed down -4.51%. Hong Kong HSI is down -0.50%. China Shanghai SSE is down -0.41%. Singapore Strait Times is down -0.83%. Japan 10-year JGB yield is down -0.0432 at -0.007, turned negative. Overnight, DOW rose 2.39%. S&P 500 rose 1.15%. NASDAQ dropped -0.45%. 10-year yield rose 0.042 to 0.858.

US jobless claims to show huge spike on coronavirus impacts

Initial jobless claims from the US have never been so closely watched before. A massive spike in numbers and record jump are expected, as American are suffering heavy impact from coronavirus pandemic. Estimates currently range from 1 million to 4 millions news claims for the weekending March 21. These forecasts are more academic than anything because there is just no way to gauge the impact so far.

Additionally, today’s number might not be very representative. On the one hand, it could just be the tip of the iceberg with claims capped by how quickly they’re processed. A huge number isn’t more disastrous neither as the claims could be somewhat “front-loaded”. We won’t probably know the real picture after getting at least 4 to 6 weeks of data.

US Senate passed coronavirus relief package, House to have voice vote on Friday

US Senate finally approved the USD 2T coronavirus relief package after marathon sessions. The historic legislation was passed by 96-vote just before midnight Wednesday. The package includes USD 500B in loans and assistance for large corporations, USD 300B for small businesses. Individuals will get USD 1200 for each adult and USD 500 for each child. Additionally, unemployment insurance will be expanded. There is also additional funding for hospitals.

Now, the House is set scheduled to vote on the package on Friday. House Majority Leader Steny Hoyer said the House will attempt to pass the bill through a voice vote, a process that would not require all members to be present. “In order to protect the safety of members and staff and prevent further spread of COVID-19 through Members’ travel, the Republican Leader and I expect that the House vote on final passage will be done by voice vote,” Hoyer wrote.

BoE to decide whether to expand QE again today

BoE’s scheduled monetary policy session is a main focus today. The central has already delivered emergency action last week, by cutting interest rate to 0.1% and expanded its asset purchase program by GBP 200B to GBP 645B. No further rate cut is expected for the time being.

Instead, new Governor Andrew Bailey, who has been in the job for less than two weeks, is expected to reaffirm the central bank’s commitment in fighting the impact of coronavirus pandemic. There might be a further increase in the quantitative easing program, after Fed went QE infinity earlier. Or the board could save this bullet for later use in May. There is no consensus in markets on which way BoE would take.

On the data front

Japan corporate service price index rose 2.1% yoy in February, versus expectation of 2.2% yoy. In European session, Germany Gfk consumer sentiment, Eurozone M3 money support will be featured. ECB will also release economic bulletin. UK will release retial sales. Later in the day, US will release jobless claims, Q4 GDP final, wholesale inventories and goods trade balance.

USD/JPY Daily Outlook

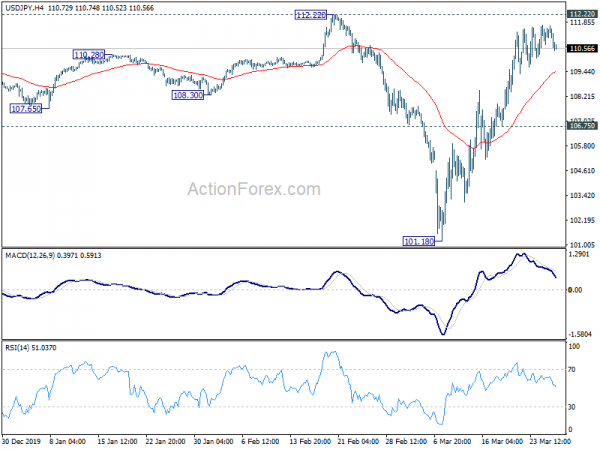

Daily Pivots: (S1) 110.74; (P) 111.21; (R1) 111.67; More…

Intraday bias in USD/JPY stays neutral at this point. More consolidative trading could be seen first. Near term outlook will remain cautiously bullish as long as 106.75 support holds. Decisive break of 112.22 key resistance will carry larger bullish implication and target 114.54 resistance next. On the downside, break of 106.75 support will turn bias back to the downside for retesting 101.18 low instead.

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | 2.10% | 2.20% | 2.30% | |

| 7:00 | EUR | Germany Gfk Consumer Confidence Apr | 8.2 | 9.8 | ||

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 5.00% | 5.20% | ||

| 9:00 | EUR | ECB Economic Bulletin | ||||

| 9:30 | GBP | Retail Sales M/M Feb | 0.00% | 0.90% | ||

| 9:30 | GBP | Retail Sales Y/Y Feb | 0.60% | 0.80% | ||

| 9:30 | GBP | Retail Sales ex-Fuel Y/Y Feb | 1.00% | 1.20% | ||

| 9:30 | GBP | Retail Sales ex-Fuel M/M Feb | -0.20% | 1.60% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 12:00 | GBP | BoE Asset Purchase Facility (GBP) | 645B | 645B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:30 | USD | Initial Jobless Claims (Mar 20) | 281K | |||

| 12:30 | USD | GDP Annualized Q4 F | 2.10% | 2.10% | ||

| 12:30 | USD | GDP Price Index Q4 F | 1.30% | 1.30% | ||

| 12:30 | USD | Wholesale Inventories Feb P | 0.00% | -0.40% | ||

| 12:30 | USD | Goods Trade Balance (USD) Feb | -64.5B | -65.9B | ||

| 14:30 | USD | Natural Gas Storage | -9B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals