Risk appetite recedes mildly today as European indices turn negative after initial gain, dragging US futures lower too. Euro is originally rather unmoved by ECB’s policy decision as well as press conference. But some weakness is seen at the time of writing. Traders seem to be betting more on Dollar’s recovery on stocks pull back. The development also drags down gold notably, which hit as high as 1721 earlier today, but it’s now back at around 1700 handle. For today so far, Australian Dollar is the weakest one, leading commodity currencies lower. Sterling is the strongest, followed by Sterling and then Swiss Franc.

Technically, Aussie is finally showing sign of a pull back against others, including Dollar, Yen, Canadian and even Euro. 0.6444 resistance turned support in AUD/USD is a level to watch. Break could prompt more broad based decline in Aussie. EUR/USD seems to be rejected by 1.0865 minor resistance again. But intraday bias will stay neutral first as it’s holding well above 1.0727 support. Nevertheless, EUR/GBP’s breach of 0.8681 support suggests resumption of fall from 0.9499. 115.44 temporary low in EUR/JPY will be watched for more broad based weakness in Euro.

In Europe, currently, FTSE is down -2.15%. DAX is down -1.41%. CAC is down -1.43%. German 10-year yield is down -0.060 at -0.553. Earlier in Asia, Nikkei rose 2.14%. Hong Kong HSI rose 0.28%. China Shanghai SSE rose 1.33%. Singapore Strait Times rose 1.92%. Japan 10-year JGB yield rose 0.0077 to -0.037.

US personal income dropped -2.0%, spending dropped -7.5%, initial claims dropped to 3.8m

US personal income dropped -2.0%, or USD 382.1B in March, below expectation of -1.4%. Personal spending dropped -7.5% or USD 1127.3B, below expectation of -5.0%. Headline PCE price index slowed to 1.3% yoy, down from 1.8% yoy, below expectation of 1.6% yoy. Core PCE price index slowed to 1.7% yoy, down from 1.8% yoy, matched expectations.

Initial jobless claims dropped -603k to 3839k in the week ending April 25. Four-week moving average of initial claims dropped -757k to 5033k. Continuing claims rose 2174k to 17.992m in the week ending April 18. Four-week moving average of continuing claims rose 3733k to 13.293m.

Released from Canada, GDP grew 0.0% mom in February. IPPI dropped -0.9% in March, while RMPI dropped -15.6%.

ECB expects eurozone economy to contract -5% to -12% this year

ECB keeps interest rates unchanged. Marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. Forward guidance is also unchanged that “the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.” There is also no change to the pandemic emergency purchase programme (PEPP), which has an overall envelop of EUR 750B. Next asset purchase will continue at EUR 20B per month.

In the post meeting press conference, ECB President Christine Lagarde said said the Eurozone is “facing an economic contraction of a magnitude and speed that are unprecedented in peacetime”. While GDP shrank by -3.8% qoq, “sharp downturn in economic activity in April suggests that the impact is likely to be even more severe in the second quarter”. Though, growth is expected to “resume as the containment measures are gradually lifted, supported by favourable financing conditions, the euro area fiscal stance and a resumption in global activity.”

Eurosystem staff macroeconomic projections indicate that GDP could contract by between -5% and -12% in 2020. Recovery and normalization of growth will follow in “subsequent years”. But the “extent of the contraction and the recovery will depend crucially on the duration and the success of the containment measures, how far supply capacity and domestic demand are permanently affected, and the success of policies in mitigating the adverse impact on incomes and employment.”

HICP inflation slowed to 0.4% in April, “driven by lower energy price inflation, but also slightly lower HICP inflation excluding energy and food”. On the basis of sharp decline in oil prices, “headline inflation is likely to decline considerably further over the coming months”. Sharp down turn in economic activity would lead to “negative effects on underlying inflation over the coming months” too. But medium0term implications of coronavirus pandemic for inflation are “surrounded by high uncertainty”.

Eurozone GDP shrank -3.8% in Q1, CPI slowed to 0.4% in Apr

Eurozone GDP contracted -3.8% qoq in Q1, larger than expectation of -3.3% qoq. EU GDP contracted -3.5% qoq. These were the sharpest decline since the series started in 1995. Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 3.3% yoy in the Eurozone and by 2.7% yoy in the EU in Q1.

Eurozone unemployment rate rose to 7.4% in March, up from February’s 7.3%, better than expectation of 7.7%. EU unemployment rate also rose 0.1% to 6.6%. Eurostat estimates that 14.141 million men and women in the EU, of whom 12.156 million in the euro area, were unemployed in March 2020. Compared with February 2020, the number of persons unemployed increased by 241 000 in the EU and by 197 000 in the euro area.

Eurozone CPI slowed to 0.4% yoy in April, down from March’s 0.7% yoy, but beat expectation of 0.1% yoy. CPI core slowed to 0.9% yoy, down form 1.0% yoy, beat expectation of 0.7% yoy.

France GDP shrank record -5.8%, worse than 2009 and 1968

France GDP dropped by -5.8% qoq in Q1, worse than expectation of -4.0% qoq. That’s also the largest contraction since record started in 1949. In particular, it’s bigger than the ones recorded in Q1 2009 (-1.6%) or in Q2 1968 (-5.3%). INSEE also noted that GDP’s negative evolution in Q1 2020 is primarily linked to the shut-down of “non-essential” activities in the context of the implementation of the lockdown since mid-March.

Looking at the main components, imports dropped -5.9% qoq. Household consumption expenditure dropped -6.1% qoq. General government consumption expenditure dropped -2.4% qoq. Gross fixed capital formation dropped -11.8% qoq. Exports dropped -6.5% qoq.

Also released, consumption spending dropped -17.9% mom in March, well below expectation of -5.5% mom. It’s the largest monthly contraction since record began in 1980. Manufactured good consumption dropped sharply (-42.3% after -0.6%) and energy expenditure decreased markedly (-11.4% after -0.9%). Only food consumption increased (+7.8% after -0.1%).

Also released, Italy GDP contracted -4.7% qoq in Q1, above expectation of -5.0% qoq. Italy unemployment rate dropped to 8.4% in March, down from 9.3%, beat expectation of 10.5%. Germany unemployment rate jumped to 5.8% in April, above expectation of 5.2%. Germany retail sales dropped -5.6% mom in March, better than expectation of -7.5% mom.

Swiss KOF dropped to 63.5, all indicator groups pushing the barometer downward

Swiss KOF Economic Barometer dropped to 63.5 in April, down from 91.7, above expectation of 58.0. Nevertheless, that’s still a historical decline, sharper than that in 2009 financial crisis.

KOF said: “Currently, nearly all indicator groups are pushing the barometer sharply downward. The decline is led by the indicators for the manufacturing industry and other services. However, the indicators for the accommodation and food service activities, foreign demand, construction, consumption and for financial and insurance service providers are also heavily in the red.

Also released, real retail sales dropped -5.6% yoy in March, below expectation of -3.6% yoy.

EUR/USD Mid-Day Outlook

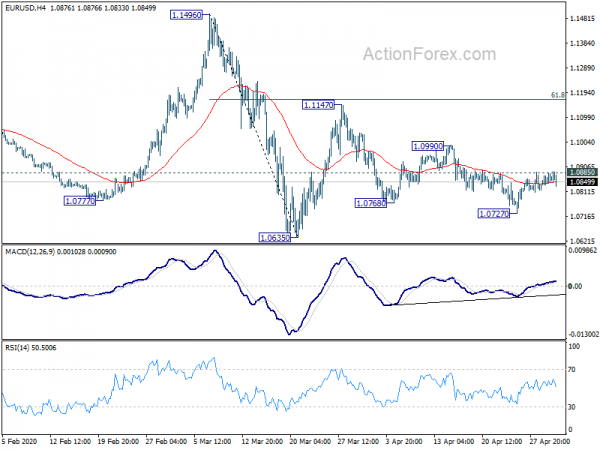

Daily Pivots: (S1) 1.0836; (P) 1.0861; (R1) 1.0903; More…

EUR/USD edged higher to 1.0891 today but fail to sustain above 1.0885 minor resistance. Intraday bias remains neutral first. Outlook is unchanged that price actions from 1.0635 are seen as a corrective pattern. on the upside, break of 1.0891 minor resistance will start the third leg, towards 1.1147 resistance. But upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, break of 1.0727 will target a test on 1.0635 low.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Mar P | -3.70% | -5.20% | -0.30% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | -4.60% | -4.70% | 1.60% | |

| 01:00 | CNY | NBS Manufacturing PMI Apr | 50.8 | 51 | 52 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Apr | 53.2 | 52.8 | 52.3 | |

| 01:00 | NZD | ANZ Business Confidence Apr | -66.6 | -73.1 | ||

| 01:30 | AUD | Private Sector Credit M/M Mar | 1.10% | 0.30% | 0.40% | |

| 01:30 | AUD | Import Price Index Q/Q Q1 | -1.00% | 1.00% | 0.70% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | -7.60% | -16.00% | -12.30% | |

| 05:30 | EUR | France GDP Q/Q Q1 P | -5.80% | -4.00% | -0.10% | |

| 06:00 | EUR | Germany Retail Sales M/M Mar | -5.60% | -7.50% | 1.20% | 0.80% |

| 06:30 | CHF | Real Retail Sales Y/Y Mar | -5.60% | -3.60% | 0.30% | |

| 06:45 | EUR | France Consumer Spending M/M Mar | -17.90% | -5.50% | -0.10% | -0.50% |

| 07:00 | CHF | KOF Economic Barometer Apr | 63.5 | 58 | 92.9 | 91.7 |

| 07:55 | EUR | Germany Unemployment Change Apr | 373K | 70K | 1K | |

| 07:55 | EUR | Germany Unemployment Rate Apr | 5.80% | 5.20% | 5.00% | |

| 08:00 | EUR | Italy Unemployment Rate Mar | 8.40% | 10.50% | 9.70% | 9.30% |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | -3.80% | -3.30% | 0.10% | |

| 09:00 | EUR | Eurozone GDP Y/Y Q1 P | -3.30% | -2.80% | 1.00% | |

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 7.40% | 7.70% | 7.30% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 0.40% | 0.00% | 0.70% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr P | 0.90% | 0.70% | 1.00% | |

| 10:00 | EUR | Italy GDP Q/Q Q1 P | -4.70% | -5.00% | -0.30% | |

| 10:00 | EUR | Italy GDP Y/Y Q1 P | -4.80% | -3.90% | 0.10% | |

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | GDP M/M Feb | 0.00% | 0.10% | 0.10% | |

| 12:30 | CAD | Raw Material Price Index Mar | -15.60% | -15.50% | -4.70% | |

| 12:30 | CAD | Industrial Product Price M/M Mar | -0.90% | -1.90% | -0.50% | |

| 12:30 | USD | Personal Income M/M Mar | -2.00% | -1.40% | 0.60% | |

| 12:30 | USD | Personal Spending Mar | -7.50% | -5.00% | 0.20% | |

| 12:30 | USD | PCE Price Index M/M Mar | -0.30% | 0.10% | ||

| 12:30 | USD | PCE Price Index Y/Y Mar | 1.30% | 1.60% | 1.80% | |

| 12:30 | USD | Core PCE Price Index M/M Mar | -0.10% | -0.10% | 0.20% | |

| 12:30 | USD | Core PCE Price Index Y/Y Mar | 1.70% | 1.70% | 1.80% | |

| 12:30 | USD | Initial Jobless Claims (Apr 24) | 3839K | 4427K | 4442K | |

| 12:30 | USD | Employment Cost Index Q1 | 0.80% | 0.70% | 0.70% | |

| 13:45 | USD | Chicago PMI Apr | 36 | 47.8 | ||

| 14:30 | USD | Natural Gas Storage | 70B | 43B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals