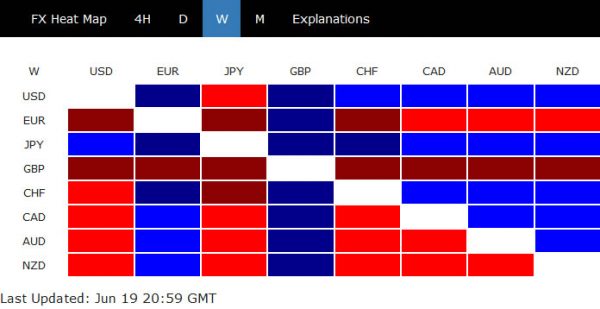

Just like many governments and central bankers, the markets were torn between the optimism over re-opening of the economic, and the imminent risk of coronavirus second wave. This is reflected in the general strength in Yen, Dollar and Swiss Franc last week. Yet, commodity currencies were relatively resilient, as the stock markets just turned range bound. Instead, Sterling ended as the worst performing one after BoE expanded asset purchase as widely expected, while Euro was the second worst.

The market outlook is not too clear for now as discussed before. GBP/CHF’s selloff is a sign of come back of risk aversion. Yet, AUD/JPY, the even better risk indicating pair, held on to near term range. DOW also maintained near term bullishness for now. Dollar index’s recovery was also unconvincing. Investors would probably need to take more time make up their mind.

The development onwards will heavily depend on how the coronavirus pandemic plays out. We’d emphasize that the figures are indeed worsening much. Global daily new cases jumped to a new high above 181k on June 19. Situation in Brazil and Mexico is still out of control, and could easily spread further to the US. India and Pakistan are showing no improvement and could spread to other parts of Asia. Vigilance is needed for everybody.

GBP/CHF could have completed rebound from 1.1102

GBP/CHF was one of the biggest mover last week, ended down -1.56%, as fall from 1.2259 resumed. The development argues that corrective rebound from 1.1102 has completed with three waves up to 1.2259. Immediate focus will be on 1.1716 support this week. Sustained break will will bring deeper fall to 61.8% retracement of 1.1102 to 1.2259 at 1.1544, with prospect of retesting 1.1102 low. Such development would be a sign of risk-off sentiments in the overall markets. Though, break of 1.2036 minor resistance would negative the bearish development.

But AUD/JPY remained resilient in range

However, the risk-off development was not displayed in AUD/JPY yet. It stayed in range above 72.52 last week, with some resilience. We’re favoring the case that a short term top was formed at 76.78, ahead of long term fibonacci at 77.28 (38.2% retracement of 105.42 to 59.89). Further decline is in favor in the near term as long as 75.09 minor resistance holds. Break of 72.52 will target 38.2% retracement of 59.89 to 76.78 at 70.32. If that happens, it would be a sign of risk-off and suggests at least a corrective near term correction in stocks. But, only when that happens.

DOW rebounded with support from 55 day EMA

Despite prior week’s selloff, DOW also showed much resilience last week and rebounded after drawing support from 55 day EMA. Sideway consolidation could extend for a while, but near term outlook is relatively neutral for the moment. As long as 38.2% retracement of 18213.65 to 27580.21 at 24002.18 holds, rise form 18213.65 is still in favor to extend through 27580.21 at a later stage. On the other hand, firm break of 24002.18 would argue that fall from 27580.21 is the third leg of the pattern from 29568.57. Deeper decline would be seen to 61.8% retracement at 21791.67 and below. It may take a bit more time to reveal which case it is.

Dollar index extended corrective looking recovery

Dollar index’s recovery from 95.71 extended higher last week. It’s still on track to take on 38.2% retracement of 102.99 to 95.71 at 98.49, which is close to 55 day EMA (now at 98.42). But the structure is rather corrective so far. Upside momentum also doesn’t warrant a break of 98.49 resistance zone. Hence, we’d be cautious on topping around there. Meanwhile, break of 96.43 will argue that the recovery has completed and larger fall from 102.99 might extend through 95.71 low in this case.

Gold’s bullish case intact despite brief dip

Despite initial dip to 1704.12, Gold quickly recovered and the late break of 1744.61 resistance revived the original bullish case. That is, corrective fall from 1765.25 has completed at 1670.66 already. Larger up trend is ready to resume. Further rise should be seen this week to retest 1765.25 high first. Break will confirm and target 61.8% projection of 1451.16 to 1765.25 from 1670.66 at 1864.76. If that happens, we’ll see if it goes with a stronger rebound with Dollar, or would cap the greenback’s strength.

EUR/GBP’s break of 0.9054 resistance last week suggests resumption of whole rebound from 0.8670. Initial bias stays on the upside this week for 61.8% retracement of 0.9499 to 0.8670 at 0.9182. Sustained trading above there would pave the way back to retest 0.9499 high. On the downside, through, break of 0.8938 minor support will turn bias back to the downside for 0.8864 support.

In the bigger picture, while the pull back from 0.9499 was deep, there is no sign of trend reversal yet. The up trend from 0.6935 (2015 low) should resume at a later stage to 61.8% projection of 0.6935 to 0.9263 from 0.8276 at 0.9715. This will remain the favored case as long as 0.8276 support holds.

In the long term picture, rise from 0.6935 (2015 low) is still in progress. It could be resuming long term up trend from 0.5680 (2000 low). Decisive break of 0.9799 will target 100% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals