Risk appetite was firm overnight as NASDAQ made another record high. Yet, Asian markets are rather quietly treading water. New Zealand Dollar tumbles broadly today as dovish RBNZ hints on further easing. There are talks that the central bank would expand asset purchases in August meeting. On the other hand, Aussie is the strongest one for today, followed by Euro. As for the week, Dollar remains the weakest one even though there is no clear follow through selling so far.

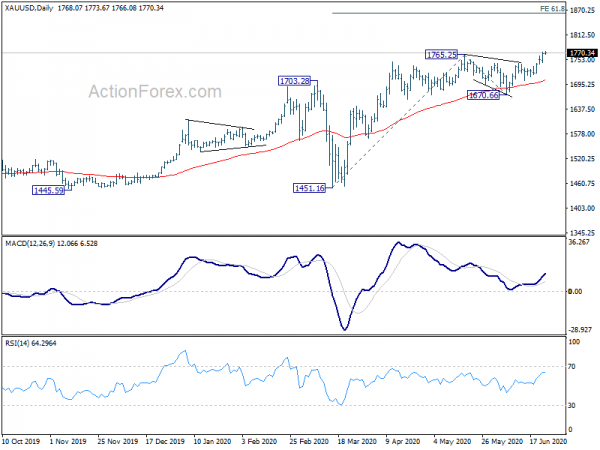

Technically, Gold’s break of 1765.25 resistance indicates up trend resumption. Next target is 61.8% projection of 1451.16 to 1765.25 from 1670.66 at 1864.76. USD/JPY broke 106.57 overnight to resume the fall from 109.85, to 105.98 support and below. USD/CHF is on track to retest 0.9376 low. EUR/USD is eyeing 1.1353 minor resistance. Break will likely resume recent rise from 1.0635 through 1.1422 to take on 1.1496 key resistance. Outlook in Dollar isn’t too good for the near term.

In Asia, currently, Nikkei is up 0.02%. Hong Kong HSI is up 0.06%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.09%. Japan 10-year JGB yield is up 0.0040 at 0.014. Overnight, DOW rose 0.50%. S&P 500 rose 0.43%. NASDAQ rose 0.74% to 10131.37, new record. 10-year yield rose 0.005 to 0.709.

NZD falls after dovish RBNZ hints on additional easing

New Zealand Dollar weakens broadly after RBNZ kept policy unchanged and issued a dovish statement, which hinted at further easing ahead. OCR was kept at 0.25% while quantum of the LSAP QE program was held at NZD 60B. In the discussions of the board meeting, the committee acknowledged the “improvements” in the outlook as the country has moved to coronavirus Alert Level 1 sooner than assumed. The government’s spending intentions was also larger than assumed and would provide more spending support than previously estimated.

However, members were concerned that the “positives could be short-lived given the fragile nature of the global pandemic containment”. It’s “not yet clear whether the monetary stimulus delivered to date is sufficient” and risks remain “skewed to the downside”. More importantly, members discussed the pros and cons of “expanding” the LSAP program, which would be driven by the outlook. A change in asset purchase size needs to be of “sufficient magnitude”. Staff are also “working towards ensuring a broader range of monetary policy tools would be deployable in coming months, including a term lending facility, reductions in the OCR, and foreign asset purchases, as well as reassessing the appropriate quantum of the current LSAP.”

NZD/JPY dips notably after the release Current development suggests that price actions from 68.19 are merely a consolidation pattern, which could have completed at 69.66. Immediate focus is back on this 68.19 support. Break will extend the fall from 71.66.

The decline from 71.66 is seen as a correction to the rebound form 59.49. It could dip into the 66.16/37.01 target zone (100% projection of 71.66 to 68.19 from 69.66 at 66.16, 38.2% retracement of 59.49 to 71.66 at 67.01) before completion.

BoJ: Desirable to confirm and examine the effects of adopted easing measures for now

In the summary of opinions of BoJ’s June 15-16 meeting, it’s noted that the economy is “likely to remain in a severe situation for the time being” due to coronavirus pandemic. But the economy “recently appears to have bottomed out. But the “pace of economic recovery will likely be slow”. regarding prices, it’s “unlikely at present that the inflation rate will approach 2 percent with momentum in the foreseeable future”.

It’s also noted that the current three monetary easing measures, the financing program, provision of yen and foreign currency funds, and asset purchases, are “flexible” and “highly adaptable” to various developments. The measures adopted since March “have been exerting their intended effects”. It’s “desirable to carefully confirm and examine their effects for the time being”.

Also from Japan, corporate service price index rose 0.8% yoy in May, below expectation of 1.1% yoy.

Looking ahead

Swiss will release ZEW expectations. But main focus will be on Germany Ifo business climate. Later in the day, US will release house price index and crude oil inventories.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9415; (P) 0.9454; (R1) 0.9489; More…

Intraday bias in USD/CHF remains on the downside for 0.9376 support. Firm break there will resume whole decline from 0.9901. Next downside target will be 100% projection of 0.9901 to 0.9502 from 0.9736 at 0.9337. On the upside, though, above 0.9493 minor resistance will argue that fall from 0.9554 is just a pull back and has completed. Intraday bias will be turned back to the upside for 0.9554 and above to resume the rebound from 0.9376.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound from 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 0.80% | 1.10% | 1.00% | 0.80% |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 2:00 | NZD | RBNZ Rate Decision | 0.25% | 0.25% | 0.25% | |

| 8:00 | CHF | ZEW Expectations Jun | 31.3 | |||

| 8:00 | EUR | Germany IFO Business Climate Jun | 85 | 79.5 | ||

| 8:00 | EUR | Germany IFO Current Assessment Jun | 84 | 78.9 | ||

| 8:00 | EUR | Germany IFO Expectations Jun | 85.2 | 80.1 | ||

| 13:00 | CHF | SNB Quarterly Bulletin Q2 | ||||

| 13:00 | USD | Housing Price Index M/M Apr | 0.00% | 0.10% | ||

| 14:30 | USD | Crude Oil Inventories | 1.2M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals