Dollar and Yen are under pressure today as Asian markets opened the week with strong rally. In particular, Chinese stocks are extending last week’s powerful rise, taking Hong Kong equities up too. In the currency markets, though, Euro is currently the largest beneficiary and is so far the strongest. it’s followed by commodity currencies, with Australian dollar having a mild upper hand over others.

Technically, Yen crosses would be something to watch for today. EUR/JPY has taken out last week’s high to resume recovery from 119.31. But as long as it stays below 122.11 resistance, such recovery is still seen as a corrective move only. EUR/USD is also kept well below 1.1348 resistance and thus, today’s recovery could just be a leg inside the near term consolidation pattern.

In Asia, currently, Nikkei is up 1.66%. Hong Kong HSI is up 3.45%. China Shanghai SSE is up 4.24%. Singapore Strait Times is up 0.94%. Japan 10-year JGB yield is up 0.0114 at 0.035.

ECB Villeroy: Non-conventional becomes the quasi-conventional

ECB Governing Council member Francois Villeroy de Galhau said the European economic policy was permanently changed by the coronavirus pandemic. Firstly, the “exceptional, provisional weapons will be long-lasting”. Secondly, “the non-conventional becomes the quasi-conventional. The exceptional measures like negative interest rates, quantitative easing and long-term bank loans are here to stay.

The Bank of France Governor also said separately that things are going “at least as well as we forecast at the start of June, and even a bit better” in France. Economic contraction in 2020 may not be as sharp as the -10% projected. “If households have more confidence and dip into savings to feed their consumption, the recovery could be quicker and we could get to pre-covid levels of activity at the end of 2021,” Villeroy said.

ECB Lagarde: Transformation toward digitization and automation disinflationary

ECB President Christine Lagarde said the coronavirus pandemic could accelerate the economy’s transformation towards further digitization and automation, with shorter supply chain. The transition to new economic model will be “disruptive”. “They will probably be more disruptive in the first two years, obviously hitting employment and production,” she added.

“So the inflation dynamic will necessarily be impacted, probably with a disinflationary, deflationary aspect at first, and then an inflation dynamic.” ECB will need to keep monetary policy exceptionally loose in the mean time.

She added that ECB estimated supply chain to shrink by around 35%, with use of robots increased by 70% to 75%.

BoE Bailey: Negative rates were one of the potential tools under active review

The Sunday Times reported that BoE Governor Andrew Bailey has sent a letter to bankers telling them “negative rates were one of the potential tools under active review”. It’s one of the options if more stimulus was needed to lift inflation back to 2% target. And it would be a “significant operational undertaking for firms” as a year could be needed to alter computer systems and update contracts.

Additionally, it’s said that Bailey emphasized “every tool they have is on the table” at a meeting with bankers at the end of June.

RBA to stand pat, focuses on US ISM non-manufacturing and Canada employment

RBA rate decision is the only central bank feature this week. It’s widely expected to keep cash rate unchanged at 0.25%. Governor Philip Lowe has already the coronavirus pandemic prompted economic downturn was “not as severe as expected”. The central will likely reiterate that it’s firmly on hold and let the stimulus measures pass their ways through to the economy first.

The economic calendar is also relatively light. Main focuses will be on US ISM non-manufacturing and Canada employment. Here are some highlights for the week:

- Monday: Germany factory orders; Eurozone Sentix investor confidence, retail sales; UK construction PMI; US ISM non-manufacturing; BoC business outlook survey.

- Tuesday: Australia AiG services, RBA rate decision; Japan average cash earnings, household spending, leading indicators; Germany industrial production; France trade balance; Swiss foreign currency reserves; Canada Ivey PMI.

- Wednesday: Japan banking lending, current account; Swiss unemployment rate.

- Thursday: Japan machine orders, machine tools orders; New Zealand ANZ business confidence; China CPI, PPI; Canada housing starts, US jobless claims.

- Friday: Japan PPI; France industrial production; Italy industrial production; Canada employment; US PPI.

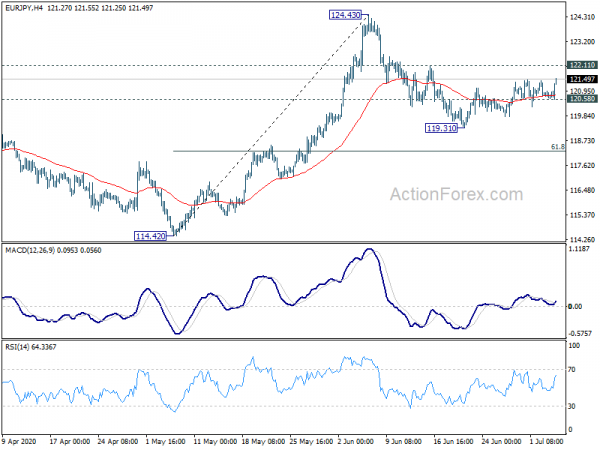

EUR/JPY Daily Outlook

Daily Pivots: (S1) 120.68; (P) 120.83; (R1) 121.05; More…..

EUR/JPY’s recovery from 119.31 resumed by taking out 121.48 temporary top. Intraday bias is mildly on the upside for 122.11 resistance. As long as 122.11 resistance holds, fall from 124.43 is expected to resume sooner or later. Break of 120.58 minor support will turn bias to the downside for 119.31 support. Break will target 61.8% retracement of 114.42 to 124.43 at 118.24. On the upside, however, break of 122.11 will argue that fall from 124.43 has completed. Stronger rise would be seen to retest 124.43.

In the bigger picture, whole down trend from 137.49 (2018 high) could have completed at 114.42 already. Rise from 114.42 would target 61.8% retracement of 137.49 to 114.42 at 128.67 next. Sustained break there will pave the way to 137.59 (2018 high). This will remain the preferred case for now, as long as 55 day EMA (now at 119.60) holds. However, sustained break of 55 day EMA will revive medium term bearishness for another low below 114.42 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M Jun | 0.60% | -1.20% | ||

| 06:00 | EUR | Germany Factory Orders M/M May | 15.00% | -25.80% | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | -11 | -24.8 | ||

| 08:30 | GBP | Construction PMI Jun | 47 | 28.9 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M May | 15.00% | -11.70% | ||

| 13:45 | USD | Services PMI Jun F | 46.7 | 46.7 | ||

| 14:00 | USD | ISM Non-Manufacturing PMI Jul | 49.5 | 45.4 | ||

| 14:00 | USD | ISM Non-Manufacturing Employment Index Jun | 30.7 | 31.8 | ||

| 14:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals