European majors tumble broadly today as UK and EU reminded us that Brexit negotiation remained in deadlock. Additionally, some PMI data from Eurozone suggested that momentum of recovery was quickly fading, in particular in the services sector. Yen is rising broadly today as stock markets turn into risk-off mode. Dollar is following closely as the second strongest. As for the week, Euro is currently the worst performing, followed by Swiss Franc. Yen is strongest, followed by Canadian.

Technically, despite today’s move, no particular technical levels are violated for now, and probably not before weekly close. The levels include 1.1711 support in EUR/USD. 1.3005 support in GBP/USD. 0.7109 support in AUD/USD. 0.9197 resistance in USD/CHF. 1.3271 resistance in USD/CHF. 124.31 support in EUR/JPY. 137.84 support in GBP/JPY. 79.86 support in CAD/JPY. 74.82 support in AUD/JPY.

In Europe, currently, FTSE is down -0.93%. DAX is down -1.22%. CAC is down -1.26%. Germany 10-year yield is down -0.017 at -0.510. Earlier in Asia, Nikkei rose 0.17%. Hong Kong HSI rose 1.30%. China Shanghai SSE rose 0.50%. Singapore Strait Times rose 0.02%. Japan 10-year JGB yield rose 0.0048 to 0.035.

Canada retail sales rose 23.7% in June, back above February’s level

Canada retail sales rose 23.7% mom in June, to CAD 53.0. That’s slightly below expectation of 24.7% mom rise. Nevertheless, it’s finally 1.3% highly than February’s pre-pandemic levels. Sales were up in all subsectors, primarily led by motor vehicle and parts dealers, as well as clothing and clothing accessories stores. Rounding out Q2, sales were still down -13.3% qoq comparing with Q1.

New housing price index rose 0.4% mom in July, above expectation of 0.1% mom.

Little progress made at 7th Brexit talks

Little to no progress was made in at the seventh round of Brexit negotiations. EU’s chief negotiator Michel Barnier said “those who were hoping for negotiations to move swiftly forward this week will have bee disappointed and unfortunately I too am frankly disappointed and concerned, and surprised as well.”

Barnier further criticized, “the British negotiators have not shown any real willingness to move forward on issues of fundamental importance for the European Union and this despite the flexibility which we have shown over recent months.”

On the other hand, UK’s chief negotiator David Frost said, “substantive work continues to be necessary across a range of different areas of potential UK-EU future cooperation if we are to deliver it. We have had useful discussions this week but there has been little progress.”

Frost also blamed that “the EU is still insisting not only that we must accept continuity with EU state aid and fisheries policy, but also that this must be agreed before any further substantive work can be done in any other area of the negotiation, including on legal texts. This makes it unnecessarily difficult to make progress.”

UK PMI composite rose to 7-yr high, recovery gained speed

UK PMI Manufacturing rose to 55.3 in August, up from 53.3, beat expectation of 53.6. That’s the highest level in 30 months. PMI Services jumped to 60.1, up from 56.5, above expectation of 57.0, a 72-month high. PMI Composite rose to 60.3, up from 567.0, a 82-month high.

Tim Moore, Economics Director at IHS Markit, said: “August’s data illustrates that the recovery has gained speed across both the manufacturing and service sectors since July. The combined expansion of UK private sector output was the fastest for almost seven years, following sharp improvements in business and consumer spending from the lows seen in April…. Positive signals for the recovery of course need to be considered in the context of UK GDP shrinking by around one-fifth during the second quarter of the year. Survey respondents often noted that it could take more than a year to return output to pre-pandemic levels and there were widespread concerns that the honeymoon period for growth may begin to fade through the autumn months.”

Retails sales rose 3.6% mom, 1.4% yoy in July, above expectation of 2.0% mom, 0.0% yoy. Retail sales ex-fuel rose 2.0% mom, 3.1% yoy, versus expectation of 0.2% mom, 1.5% yoy. Public sector net borrowing dropped to GBP 25.9B in July. Gfk Consumer Confidence was unchanged at -27 in August, worse than expectation of -25.

Eurozone PMI composite dropped to 51.6, recovery undermined by rising virus cases

Eurozone PMI Manufacturing dropped slightly to 51.7 in August, down from 51.8, below expectation of 53.0. PMI services tumbled to 50.1, down from 54.7, missed expectation of 54.0. PMI Composite dropped to 51.6, down from 54.9.

Andrew Harker, Economics Director at IHS Markit said: “The eurozone’s rebound lost momentum in August, highlighting the inherent demand weakness caused by the COVID-19 pandemic. The recovery was undermined by signs of rising virus cases in various parts of the euro area, with renewed restrictions impacting the service sector in particular…The eurozone stands at a crossroads, with growth either set to pick back up in coming months or continue to falter following the initial post-lockdown rebound. The path taken will likely depend in large part on how successfully COVID-19 can be suppressed and whether companies and their customers alike can gain the confidence necessary to support growth.”

Germany PMIs: Slowdown centered on services, manufacturing relatively positive

Germany PMI Manufacturing rose to 53.0 in August, up from 51.0, above expectation of 52.5. That’s also the highest level in 23 months. PMI Services dropped sharply back to 50.8, down from 55.6, missed expectation of 55.6. PMI Composite eased back to 53.7, down from 55.3.

Phil Smith, Associate Director at IHS Markit said: “The slowdown was centred on the service sector, where growth was close to stalling amid renewed travel restrictions and a sustained decline in overall employment that continues to undermine domestic demand. Manufacturing was a relative positive, at least in terms of trends in output and new orders, which grew at the fastest rates for two-and-a-half years. However, the further cutbacks to factory work force numbers are a reminder that there is still ground to make up and businesses remain under pressure to cut costs.”

France PMI manufacturing back in contraction, fragile demand conditions

France PMI Manufacturing dropped to 49.0 in August, down form 52.4, well below expectation of 53.0. It’s also now back in contraction. PMI Services dropped to 51.9, down sharply from 57.3, missed expectation of 56.3. PMI Composite dropped to 51.7, down from 57.3.

Economist at IHS Markit said: “Following the sharp expansion registered in July, growth momentum has somewhat stuttered, with the expansion in new orders slowing to a snail’s pace as manufacturers fell back into contraction territory. Meanwhile, there was a reacceleration in the rate of job cutting after three months of successive easing. Overall, the results highlight the fragility of demand conditions faced by French businesses and cast further doubt over the V-shaped recovery that many had hoped for.”

Japan PMI composite unchanged at 44.9, prospect of a solid recovery remains highly uncertain

Japan PMI Manufacturing rose to 46.6 in August, up from 45.2, above expectation of 45.0. PMI Services edged down to 45.0, down from 45.4. PMI Composite was unchanged at 44.9.

Bernard Aw, Principal Economist at IHS Markit, said: “The prospect of a solid recovery remains highly uncertain as Japanese firms were pessimistic about the business outlook on balance during August. Rising unemployment may also hit domestic household income and spending in the months ahead.”

Japan core CPI unchanged at 0% in July

Japan all item inflation rose to 0.3% yoy in July, up from 0.1%. Core CPI, all item ex fresh food, was unchanged at 0.0% yoy, below expectation of 0.1% yoy. Core-core CPI, all item ex fresh food and energy was unchanged at 0.4% yoy.

Outlook for core inflation suggests that Japan is close to, if not already in, a deflationary situation. It’s becoming increasingly unrealistic to achieve BoJ’s 2% inflation target in any projection horizon.

Australia CBA PMI composite tumbled to 48.8, back in contraction

Australia CBA PMI Manufacturing dropped slightly to 53.9 in August, down from 54.0. However, PMI Services sharply sharply by more than -10 pts to 48.1, down from 58.2, back in contraction. PMI Composite also tumbled to 48.8, down from 57.8, back in contraction too.

CBA Head of Australian Economics, Gareth Aird said: “The decline in business activity over August is hardly surprising given the lockdown measures in Victoria. With the August composite flash PMI only modestly in contractionary territory it is highly likely that outside of Victoria private output continued to expand over the month”.

“The fall in employment is the inevitable consequence of shutting down large parts of the Victorian economy. Encouragingly, firms collectively retain an optimistic view on the outlook despite the setback in Victoria. Ongoing fiscal support for households and businesses remains critical to ensuring that optimism is not misplaced”.

Australia retails grew in July, except in Victoria

July’s preliminary reading showed retail sales grew 3.3% mom in Australia. Sales rose in all states and territories except Victoria, coinciding with the resurgence of coronavirus cases and reintroduction of stage 3 restrictions.

“The rise across the rest of the country was driven by continued strength in household goods retailing, and the recovery in cafes, restaurants and takeaway food services, and clothing, footwear and personal accessory retailing” said Ben James, Director of Quarterly Economy Wide Surveys.

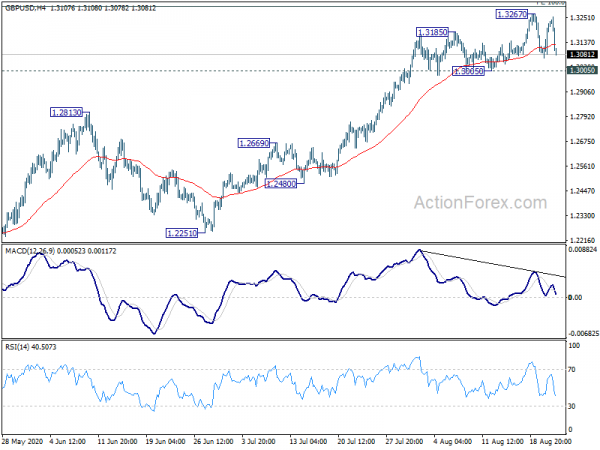

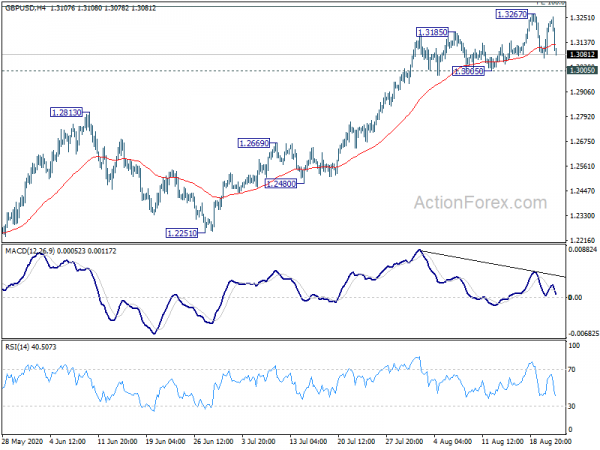

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3113; (P) 1.3168; (R1) 1.3272; More….

GBP/USD is still staying in range of 1.3005/3267 and despite today’s steep fall. Intraday bias remains neutral first and another rise could be seen as long as 1.3005 support holds. Break of 100% projection of 1.1409 to 1.2647 from 1.2065 at 1.3303 will pave the way to 1.3514 structural resistance next. However, considering bearish divergence condition in 4 hour MACD, break of 1.3006 should confirm short term topping. Intraday bias will be turned back to the downside for 55 day EMA (now at 1.2822).

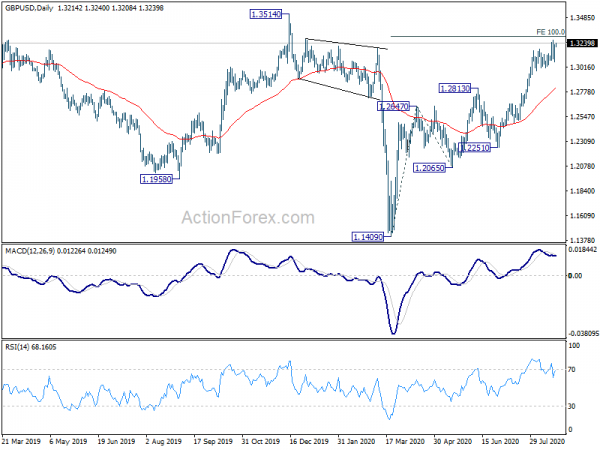

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | CBA Manufacturing PMI Aug P | 53.9 | 54 | ||

| 23:00 | AUD | CBA Services PMI Aug P | 48.1 | 58.2 | ||

| 23:01 | GBP | GfK Consumer Confidence Aug | -27 | -25 | -27 | |

| 23:30 | JPY | National CPI Core Y/Y Jul | 0.00% | 0.10% | 0.00% | |

| 00:30 | JPY | Manufacturing PMI Aug P | 46.6 | 45 | 45.2 | |

| 06:00 | GBP | Retail Sales M/M Jul | 3.60% | 2.00% | 13.90% | |

| 06:00 | GBP | Retail Sales Y/Y Jul | 1.40% | 0.00% | -1.60% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Jul | 2.00% | 0.20% | 13.50% | |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Jul | 3.10% | 1.50% | 1.70% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jul | 25.9B | 28.3B | 34.8B | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 49 | 53 | 52.4 | |

| 07:15 | EUR | France Services PMI Aug P | 51.9 | 56.3 | 57.3 | |

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 53 | 52.5 | 51 | |

| 07:30 | EUR | Germany Services PMI Aug P | 50.8 | 55.6 | 55.6 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 51.7 | 53 | 51.8 | |

| 08:00 | EUR | Eurozone Services PMI Aug P | 50.1 | 54 | 54.7 | |

| 08:30 | GBP | Manufacturing PMI Aug P | 55.3 | 53.6 | 53.3 | |

| 08:30 | GBP | Services PMI Aug P | 60.1 | 57 | 56.5 | |

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.40% | 0.10% | 0.10% | |

| 12:30 | CAD | Retail Sales M/M Jun | 23.70% | 24.70% | 18.70% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jun | 15.70% | 14.50% | 10.60% | |

| 13:45 | USD | Manufacturing PMI Aug P | 51.5 | 50.9 | ||

| 13:45 | USD | Services PMI Aug P | 50.7 | 50 | ||

| 14:00 | USD | Existing Home Sales Jul | 5.10M | 4.72M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -15 | -15 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals