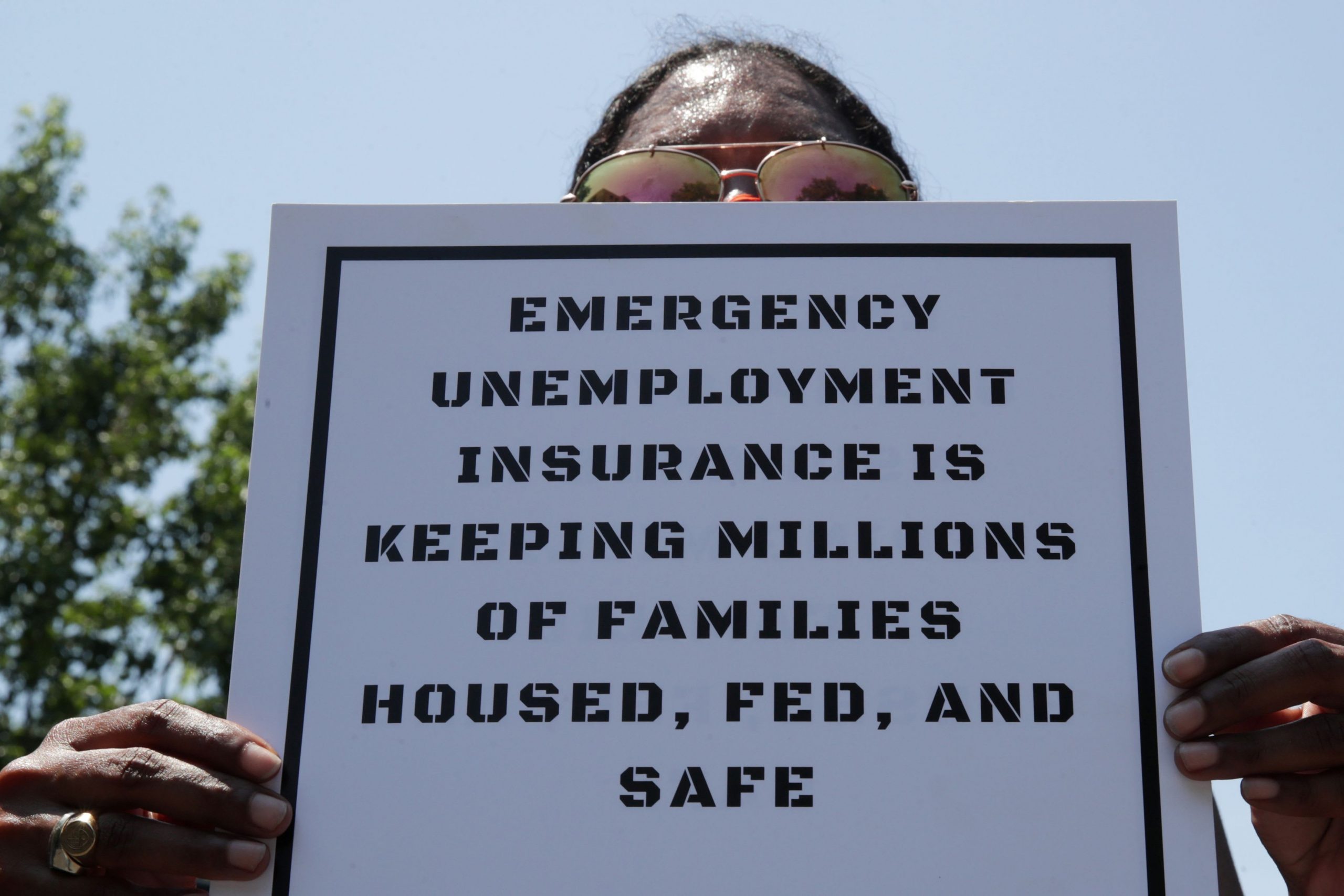

A protester blocks the street leading to the Washington, D.C., home of U.S. Senate Majority Leader Mitch McConnell, R-Ky., demanding the extension of unemployment aid, on July 22, 2020.

Jonathan Ernst | Reuters

Stimulus checks and enhanced unemployment benefits that helped the poorest Americans weather the coronavirus pandemic are in danger of ending, throwing the finances of the most economically vulnerable into a tailspin.

The Federal Reserve’s “Update on the Economic Well-Being of U.S. Households,” a highly watched annual report that has been expanded this year to reflect the coronavirus pandemic, showed that government measures have helped low and middle-income families boost savings.

To that point, in July, 48% of families making less than $40,000 annually said they’d cover a $400 emergency expense with cash or an equivalent, up from 39% in October 2019, according to the most recent supplemental survey updated Sept. 22 by the Fed.

The same study showed that 75% of families making between $40,000 and $99,000 annually said they had cash or an equivalent on hand for an emergency expense, up from 68% in October 2019. Even at the highest level surveyed, more families said they’d use cash for a $400 emergency – 91% of families making more than $100,000 per year said they’d cover such an expense with cash, up from 88% in October.

There were improvements seen in all groups from October to July as “enhanced unemployment insurance benefits, economic impact payments, and other financial support measures blunted the potential negative financial effects for many families,” according to the report.

Low- and middle-income families likely improved the most because the $1,200 stimulus payments sent to most American households and the additional $600 in weekly unemployment benefits reflect a larger share of total income, said the Fed.

Americans were smart to save

That families saved some of the emergency payments they got as a result of the crisis is a good sign, said Ernie Tedeschi, an economist at Evercore ISI.

“It turned out being particularly smart because we didn’t end up extending that emergency support,” he said.

For the roughly 12.58 million Americans collecting unemployment as of Sept. 12, saving any extra money from those federal benefits will help them avoid making devastating choices about spending cuts for a few more months, Tedeschi said.

Still, cuts may be unavoidable, he said.

“Unless the economy picks up or more emergency unemployment benefits are passed by Congress, unemployed workers will have to make spending cuts at some point,” Tedeschi said.

Other studies have confirmed that Americans used the money from stimulus checks to boost savings. A June survey from Betterment showed that 40% of respondents saved their stimulus check or put it towards an emergency fund, and 34% said they’d do the same if they got another check.

More from Invest in You:

With remote work flexibility, some people opt to relocate ahead of retirement

How to take the mystery out of picking the best retirement savings plan

Dreaming of retiring abroad? Here’s what you need to know

“I see a lot of optimism there,” said Andrew Westlin, a certified financial planner and advisor at Betterment. “This is maybe an eye-opening experience for those who are maybe low or middle income to have a higher focus on their savings, to increase their emergency fund and provide some liquidity in case something like this happens again.”

But while U.S. market sentiment indicates investors are banking on another round of aid at some point, the future of another stimulus bill is unclear. At the end of July, the additional $600 per week in unemployment benefits that replaced wages for many out-of-work American expired without a new plan in place.

Unless the economy picks up or more emergency unemployment benefits are passed by Congress, unemployed workers will have to make spending cuts at some point.

Ernie Tedeschi

Economist, Evercore ISI

President Donald Trump later extended an extra $300 in weekly unemployment benefits through an executive order, but workers are no longer receiving the benefit in some states that have run out of funds.

In the months since, Democrats and Republicans have squabbled over the next potential coronavirus aid bill, which is slated to extend some additional unemployment benefits and send another round of stimulus checks to American households.

Democrats on Monday unveiled a pared-down $2.2 trillion bill that includes both $1,200 stimulus checks and extends the additional $600 weekly unemployment benefit through January. There is still no guarantee that both sides will reach a deal and pass another bill soon.

Families shouldn’t bank on extra stimulus

In the meantime, financial advisors say families shouldn’t count on getting any extra help. Instead, they should keep working towards their financial goals amid the pandemic and ensuing recession, and saving as much as they can in an emergency fund to shield against future economic uncertainty.

To get started, Westlin recommends that folks analyze their budget and determine essential and non-essential expenses to calculate a “runway,” or amount of time before it would be necessary to take on debt to pay bills.

Once that is known, it’s easier to gauge how much folks need or want in an emergency fund to extend that runway, according to Westlin. An emergency fund is either cash or savings that one can easily access, generally meaning its not in an investment account expected to yield a high return.

Instead, it’s a buffer that will keep folks from “going into additional debt, withdrawing from your 401(k) or IRA, which are all things you want to avoid,” Westlin said.

The amount of money in the emergency fund will depend on each person’s needs, but a standard approach is three to six months of living expenses, according to Michaela McDonald, a CFP and financial advice expert at Albert, a personal finance app.

“That is going to help shield savers from having to take out loans with super-high interest rates or really racking up credit card debt,” she said.

McDonald recommends using a tool that automatically moves funds into savings without any extra action from the user amid the pandemic. If that’s not an option, she said to do some research to find the best saving method for you.

“There’s so many financial tools out there that can accommodate you no matter what type of saver you are,” she said.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals