Dollar’s selloff finally takes off as market enters into US session today. While the final result of US presidential election is still unknown, investors couldn’t wait to push stocks higher. At the time of writing, Canadian Dollar is trading as a distant second weakest. Sterling is also relatively weak after BoE delivered larger than expected QE expansion. Euro is for now the strongest one, followed by New Zealand Dollar and then Australia. Focus will turn to FOMC rate decision. Fed is widely expected to stand pat and deliver the same message. Thus, it’s unlikely to give the greenback any lift.

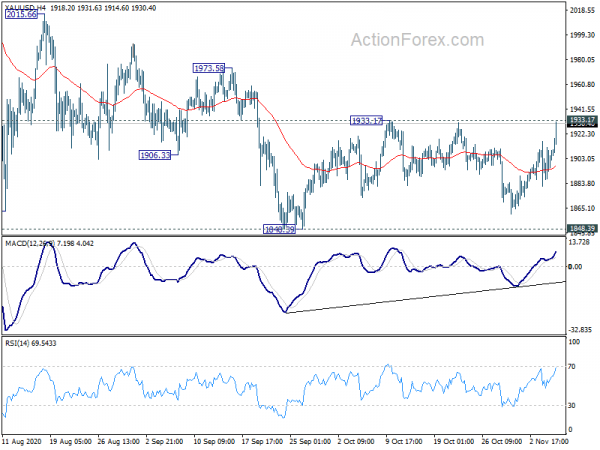

Technically, USD/JPY’s break of 104.00 support now indicates resumption of medium term fall form 111.71. EUR/USD’s break of 1.1771 resistance is the first sign of larger up trend resumption. Next hurdle is 1.1880 resistance. USD/CHF would also have a test on 0.8998 low very soon. The broad based weakness in Dollar looks rather real this time, as Gold is also heading back to 1933.17 resistance. Firm break there would firstly extend the rebound from 1848.39 towards 2075.18 high. More important, that would double confirm the Dollar’s bearishness.

In Europe, currently, FTSE is up 0.60%. DAX is up 1.50%. CAC is up 1.00%. German 10-year yield is up 0.0072 at -0.630. Earlier in Asia, Nikkei rose 1.73%. Hong Kong HSI rose 3.25%. China Shanghai SSE rose 1.30%. Singapore Strait Times rose 2.89%. Japan 10-year JGB yield dropped -0.0172 to 0.022.

US initial jobless claims dropped to 751k, continuing claims dropped to 7.3m

US initial jobless claims dropped -7k to 751k in the week ending October 31, slightly above expectation of 746k. Four-week moving average of initial claims dropped -4k to 787k. Continuing claims dropped -538k to 7285k in the week ending October 24. Four-week moving average of continuing claims dropped -827k to 8245k.

Non-farm productivity rose 4.9% in Q3 versus expectation of 3.6%. Unit labor costs dropped -8.9% versus expectation of -10.0%.

EU downgrades 2021 GDP forecast, second wave dashes hope for quick rebound

In the Autumn European Economic Forecast, European Commission revised up 2020 GDP projection to -7.8% contraction (up from -8.7%. Though, 2021 GDP growth projection was revised down to 4.2% (form 6.1%). Growth is projected to slow further to 3.0% in 2022. Inflation projection was left unchanged at 0.3% for 2020 and 1.1% for 2021. Inflation is expected to climb further to 1.3% in 2022. Unemployment rate is projected to be at 8.3% in 2020, 9.4% in 2021 and 8.9% at 2022.

Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People, said: “This forecast comes as a second wave of the pandemic is unleashing yet more uncertainty and dashing our hopes for a quick rebound. EU economic output will not return to pre-pandemic levels by 2022.”

Paolo Gentiloni, Commissioner for Economy, said: “After the deepest recession in EU history in the first half of this year and a very strong upswing in the summer, Europe’s rebound has been interrupted due to the resurgence in COVID-19 cases. Growth will return in 2021 but it will be two years until the European economy comes close to regaining its pre-pandemic level. In the current context of very high uncertainty, national economic and fiscal policies must remain supportive, while NextGenerationEU must be finalised this year and effectively rolled out in the first half of 2021.”

Eurozone retail sales dropped -2.0% mom in Sep, EU down -1.7% mom

Eurozone retail sales dropped -2.0% mom in September, worse than expectation of -1.2% mom fall. The volume of retail trade decreased by -2.6% mom for non-food products, by -1.4% mom for food, drinks and tobacco and by -0.2% mom for automotive fuels.

EU retail sales dropped -1.7 mom. Among Member States for which data are available, the largest decreases were observed in Belgium (-7.4% mom), France (-4.5% mom) and Germany (-2.2% mom). The highest increases in the total retail trade volume were registered in Bulgaria (+2.8% mom), Portugal (+1.9% mom) and Romania (+1.7% mom).

Also released in European session, Germany factor order rose just 0.5% mom in September, well below expectation of 2.6% mom. Swiss SECO consumer climate dropped to -13 in Q4, down from -12, but was slightly better than expectation of -14. UK PMI construction dropped to 53.1, down form 56.8, missed expectation of 55.0.

BoE expands QE by GBP 150B, Q4 GDP to contract on Covid

BoE voted unanimously to keep Bank Rate unchanged at 0.10% as widely expected. The government bond purchases problem is expanded the target stock of purchased UK government bonds by additional GBP 150B, taking to the total to GBP 875B. The central bank will “continue to monitor the situation closely” and “stands ready to take whatever additional action is necessary”.

Also, BoE “does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”

It’s noted in the statement that there has been a “rapid rise in rates of Covid infection and increased severity of restrictions as response. Covid development will lead to a “decline in GDP in 2020 Q4”. Economic outlook remains “unusually uncertain”, depending on the pandemic and measures, as well as post Brexit new trading arrangements.

BoE revised down 2020 GDP contraction to -11%, but sees strong rebound afterwards

In the Monetary Policy Report, BoE lowered the four-quarter GDP forecasts for 2020 Q4 to -11%, down from -5.4%. Stronger rebound was expected afterwards. Four-quarter GDP growth is revised to 11% (up from 6.2%) in 2021 Q4 and 3.1% (up fro 2.3%) in 2022 Q4.

CPI inflation for 2020 Q4 was revised up to 0.6% (from 0.3%). 2021 Q4 inflation was revised up to 2.1%, from 1.8%. 2022 Q4 inflation was revised down slightly to 2.0% (from 2.1%).

Unemployment rate is notably lower for 2020 Q4 at 6.3% (revised down from 7.5%). Though, It’s projected to rise to 6.7% in 2021 Q4 (revised up from 5.0%), then fall back to 4.9% in 2022 Q4 (revised up from 4.5%).

New Zealand ANZ business confidence ticked lower to -15.6, activity outlook also steady

Preliminary reading of New Zealand ANZ Business Confidence in November showed slight improvement to -15.6, up from October’s -15.7. Own Activity outlook dropped slightly to 4.6, down from 4.7. Looking at some details, export inte3ntions improved from -3.5 to 0.0. Investment intentions dropped from 1.9 to -3.3. Employment intentions rose from -2.5 to -1.4. Inflation expectations rose from 1.38 to 1.55.

ANZ said, “now that the wage subsidy has wound up and the lost summer for tourism looms large, business resilience will be tested. But it’s fair to say the starting point looks much more positive than looked likely a few months ago.”

From Australia, exports of goods and services rose 4% mom to AUD 33.7B in September. Imports dropped -6% mom to AUD 28.1B . Trade surplus widened to AUD 5.63B, up from AUD 2.62B, above expectation of AUD 3.70B.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.99; (P) 104.67; (R1) 105.18; More…

USD/JPY drops to as low as 130.60 so far today. The strong break of 104.00 support indicates resumption of whole decline form 111.71. Intraday bias is now on the downside for 100% projection of 106.10 to 104.02 from 105.34 at 103.26. Break will target 161.8% projection at 101.97. On the upside, break of 105.34 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Nov P | -15.6 | -15.7 | ||

| 00:30 | AUD | Trade Balance (AUD) Sep | 5.63B | 3.70B | 2.64B | 2.62B |

| 06:45 | CHF | SECO Consumer Climate Q4 | -13 | -14 | -12 | |

| 07:00 | EUR | Germany Factory Orders M/M Sep | 0.50% | 2.60% | 4.50% | 4.90% |

| 07:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 07:00 | GBP | BoE Asset Purchase Facility | 895B | 845B | 745B | |

| 07:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 07:00 | GBP | MPC Asset Purchase Facility Votes | 9–0–0 | 9–0–0 | 0–0–9 | |

| 09:30 | GBP | Construction PMI Oct | 53.1 | 55 | 56.8 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | -2.00% | -1.20% | 4.40% | 4.20% |

| 12:30 | USD | Challenger Job Cuts Y/Y Oct | 60.40% | 185.90% | ||

| 13:30 | USD | Initial Jobless Claims (Oct 30) | 751K | 746K | 751K | 758K |

| 13:30 | USD | Nonfarm Productivity Q3 P | 4.90% | 3.60% | 10.10% | |

| 13:30 | USD | Unit Labor Costs Q3 P | -8.90% | -10.00% | 9.00% | |

| 15:30 | USD | Natural Gas Storage | -34B | 29B | ||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals