Global stock markets are paring some of yesterday’s strong gain, together with slight pull back in oil price. The development translates into mild weakness in commodity currencies. Yet Dollar is not gaining much for now, as it’s overshadowed by the rally in European majors and Yen. But for now, the greenback is still holding above near term support against other major currencies. Breakout is still awaited.

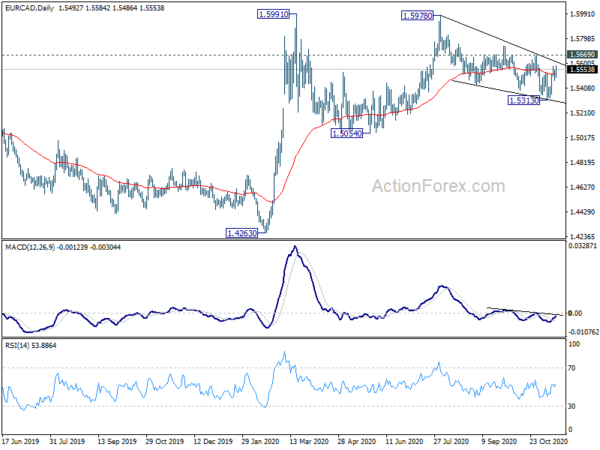

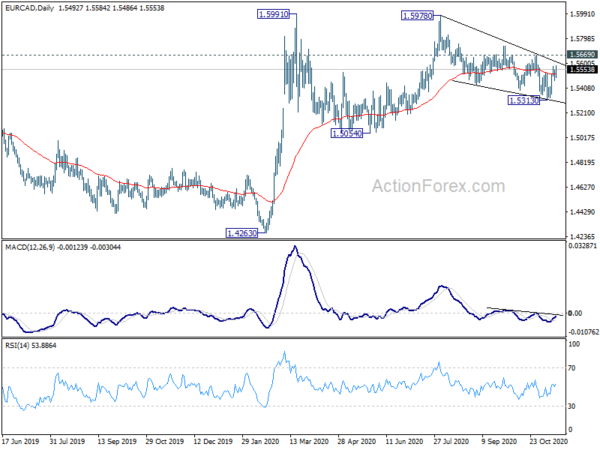

Technically, USD/CAD appears to be stabilizing ahead of 1.3057 minor support, as WTI oil price failed to break through 42.98 resistance. EUR/CAD is also attempting to resume the rebound from 1.5313. Focus is back on 1.5669 resistance and break will indicate completion of pull back from 1.5978. In this case, further rise would be seen towards 1.5978/5991 resistance zone. If that happens USD/CAD might extend the rebound from 1.2928 through 1.3172 resistance.

In Europe, currently, FTSE is down -1.49%. DAX is down -0.38%. CAC is down -0.31%. Germany 10-year yield is down -0.0152 at -0.557. Earlier in Asia, Nikkei rose 0.42%. Hong Kong HSI rose 0.13%. China Shanghai SSE dropped -0.21%. Singapore Strait Times rose 1.11%. Japan 10-year JGB yield dropped -0.0012 to 0.023.

US retail sales rose 0.3% in Oct, ex-auto sales rose 0.2%

US retail sales rose 0.3% mom to USD 553.3B in October, below expectation of 0.5% mom. Ex-auto sales rose 0.2% mom, below expectation of 0.6% mom. Ex-gasoline sales rose 0.2% mom. Ex-auto, ex-gasoline sales rose 0.2% mom too. IMport price index dropped -0.1% mom in October versus expectation of 0.3% mom. Industrial production rose 1.1% mom in October, slightly above expectatoin of 1.0% mom. Capacity utilization rose to 72.8% in October, above expectation of 72.3%.

Canada wholelsales sales rose 0.9% mom in September, versus expectation of 0.4% mom. Foreign securitiy purchases dropped to CAD 4.46B in Septmber. Housing starts rose to 215k in October.

BoE Bailey: Covid more likely leads to intra-sectoral changes in the economy

In a speech, BoE Governor Andrew Bailey noted three component of structural changes in the economies in the future, with legacy of Covid too: “How what we buy has changed and the way we buy it; how the way we work has changed; and how what we make may need to change”

He said, “my best guess is that there will be lasting changes”. Further, there may be a “reversal of the period of low productivity growth”, with Covid as the spur, the change agent. Also, a the change the direction of climate requires investment on a much larger scale.

Nevertheless, Bailey doesn’t see Covid leading to the soft of inter-sectoral change in 80s and 90s. It’s “more likely to be a case of intra-sectoral change”, which ” may also increase the likelihood that more capital can be redeployed, and more rapidly.”

EU continue to negotiate intensively with UK

European Commission Eric Mamer said in a press conference today, “what is clear is that we continue to negotiate intensively with our UK partners and we aim, obviously, to find a deal when the conditions will be there.” But he added, “we are not going to give a blow-by-blow account of what negotiators are working towards.”

Regarding the relations with US, Mamer said “It is still very, very early days and therefore at the moment … the EU is waiting for the new president-elect to take office before starting to comment on what this will imply when it comes to our relationship.”

RBA minutes: Focus ahead would be government bond purchase program

Minutes of the November 3 RBA meeting noted that the board is “prepared to do more if necessary”, after delivering a package of additional stimulus. Though, “focus over the period ahead will be the government bond purchase program”.

Under the current program to purchase longer-dated bonds, RBA would buy nominal bonds issued by the Australian Government and by the states and territories, with an expected 80/20 split. Purchases would be done through secondary market, but not directly from the government. Also, RBA “remained prepared to purchase bonds in whatever quantity is required to achieve the 3-year yield target.”

As for interest rate, with cash rate target at 0.10% and exchange settlement rate at 0%, they would have been “lowered as far as it made sense to do so in the current environment”. There is “little to be gained from short-term interest rates moving into negative territory”. Negative policy rate is seen as “extraordinarily unlikely”.

Suggested readings on RBA:

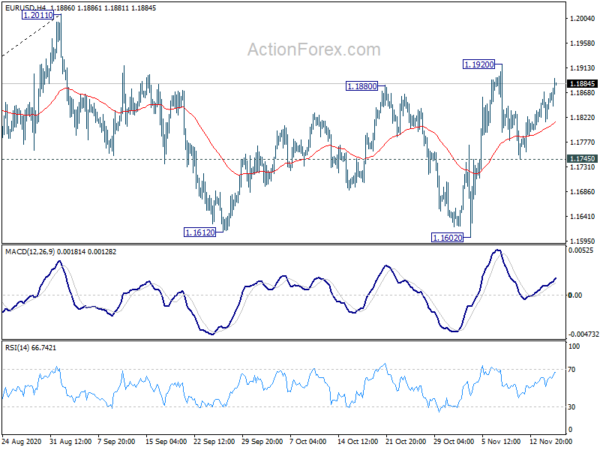

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1824; (P) 1.1846; (R1) 1.1879; More…..

EUR/USD’s rebound from 1.1745 extends higher today but stays below 1.1920 resistance. Intraday bias remains neutral first. On the upside, break of 1.1920 will reaffirm the case that consolidation from 1.2011 has completed at 1.1602. Further rise would be seen to retest 1.2011 high. However, break of 1.1745 support will turn bias to the downside to extend the consolidation with another falling leg.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minutes | ||||

| 09:00 | EUR | Italy Trade Balance (EUR) Sep | 5.85B | 3.93B | ||

| 13:15 | CAD | Housing Starts Y/Y Oct | 215K | 220K | 209K | |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Sep | 4.46B | 5.00B | 15.51B | |

| 13:30 | CAD | Wholesale Sales M/M Sep | 0.90% | 0.40% | 0.30% | |

| 13:30 | USD | Retail Sales M/M Oct | 0.30% | 0.50% | 1.90% | 1.60% |

| 13:30 | USD | Retail Sales ex Autos M/M Oct | 0.20% | 0.60% | 1.50% | 1.20% |

| 13:30 | USD | Import Price Index M/M Oct | -0.10% | 0.30% | 0.30% | 0.20% |

| 14:15 | USD | Industrial Production M/M Oct | 1.10% | 1.00% | -0.60% | -0.40% |

| 14:15 | USD | Capacity Utilization Oct | 72.80% | 72.30% | 71.50% | |

| 15:00 | USD | Business Inventories Sep | 0.40% | 0.30% | ||

| 15:00 | USD | NAHB Housing Market Index Nov | 85 | 85 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals