Yen and Dollar are generally softer today as markets open December on firm footing. Australia Dollar is following as third weakest as diplomatic tension with China worsens. On the other hand, Euro is leading Swiss Franc higher. Manufacturing data from China and UK indicate sustainable recovery for now, while Eurozone PMIs were not too disastrous. Focus will turn to US ISM manufacturing.

Technically, however, there isn’t much new development. Euro is held below 1.2011 resistance against Dollar, 125.13 resistance against Yen and 0.9004 resistance against Sterling. EUR/CHF is also staying below 1.0877 resistance. There is no confirmation of Euro’s underlying bullish momentum yet. Dollar, on the other hand, is held above 0.7413 support against Aussie, 0.8982 support against Swiss and well above 103.17 support against Yen. There is no confirmation of selloff resumption in Dollar neither. We’ll have to be patient.

In other markets, currently, FTSE is up 1.83%. DAX is up 0.85%. CAC is up 0.92%. German 10-year yield is up 0.0088 at -0.560. Earlier in Asia, Nikkei rose 1.34%. Hong Kong HSI rose 0.86%. China Shanghai SSE rose 1.77%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0084 to 0.022.

ECB Schnabel: It’s appropriate to preserve financing conditions rather than ease much further

Regarding the upcoming policy recalibration, ECB Executive Board member Isabel Schnabel said it’s “appropriate to focus on preserving” the financing conditions, “rather than easing much further”. She emphasized, “if it’s necessary to do something that doesn’t meet market expectations, we have to do that nevertheless.”

“I indeed hope this will be the last big push (on monetary stimulus”, but we can never know what’s going to happen,” she said. “There is a positive scenario where we get a swift recovery and the scarring is relatively limited. But there is also the risk of the crisis being more protracted.”

She’s open to extending the PEPP window by 12 months to June 2021. On the topic of further rate cut, “there is no technical reason why this could not be lowered,” she said. “The question is whether this is considered appropriate.”

Eurozone PMI manufacturing finalized at 54.8, a brighter outlook indicated by upturn in optimism for year ahead

Eurozone PMI Manufacturing was finalized at 53.8 in November, down from October’s 54.8. Markit said there were slower, but still marked gains in output and new orders. Job losses continued but confidence improved further. Looking at some member states, Germany PMI Manufacturing stood high at 57.8. The Netherlands hit 22-month high at 54.4. However, Italy hit 5-monthlow at 51.5. Spain hit 5-month low at 49.8. France hit 6-month low at 49.6. Greece hit 6-month low at 42.3.

Chris Williamson, Chief Business Economist at IHS Markit said: “Eurozone manufacturing output continued to grow at a decent pace in November… The survey therefore adds to evidence that the region will avoid in the final quarter of the year a similar scale of downturn recorded in the second quarter.

“Encouragingly, a brighter outlook is indicated by the upturn in optimism for the year ahead, suggesting that the upturn should gather strength again in the coming months as lockdown measures ease and spending, especially investment, picks up in response to the recent news on vaccine development.”

Eurozone CPI unchanged at -0.3% yoy, core CPI at 0.2% yoy

Eurozone CPI was unchanged at -0.3% yoy in November, versus expectation of -0.2% yoy. Core CPI was unchanged at 0.2% yoy. Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in November (1.9%, compared with 2.0% in October), followed by services (0.6%, compared with 0.4% in October), non-energy industrial goods (-0.3%, compared with -0.1% in October) and energy (-8.4%, compared with -8.2% in October).

UK PMI manufacturing finalized at 55.6, 35-month high

UK PMI Manufacturing was finalized at 55.6 in November, up from October’s 53.7. It’s also a 35-month high, and an expansion reading for six successive months. Markit noted that “Brexit buying” leads to higher purchasing, stocks and exports.

Rob Dobson, Director at IHS Markit: “Growth of the UK manufacturing sector picked up in November, temporarily boosted by ‘Brexit-buying’ among clients and the ongoing boost from economies re-opening following lockdowns earlier in the year…. Whether the upturn of manufacturing production can be sustained into the new year is therefore highly uncertain, especially once the temporary boosts from Brexit purchasing and stockbuilding wane.

“On this front some reassurance is provided by the survey’s gauge of business optimism. Confidence has risen to a level not seen since late-2014, with over three fifths of manufacturers (61%) still expecting to raise output over the coming year. On the other hand, many manufacturers remain very concerned about the outlook and generally reluctant to expand capacity, hence employment fell for the tenth month in a row.”

Swiss GDP grew 7.2% qoq in Q3, still -2% below pre-crisis level

Swiss GDP grew 7.2% qoq in Q3, above expectation of 5.8% qoq. Still, output was -2% below pre-crisis level, after contracting by a total of -8.6% in the first half of the year.

Looking at some details, private consumption bounded significantly by 11.9% following gradual easing of coronavirus restrictions. Investment in equipment rose 8.8% and investment in construction rose 5.1%. Final domestic demand posted 8.9% growth.

Also from Swiss, SVME PMI rose to 55.2 in November, up from 52.3, well above expectation of 51.5.

RBA stands pat, prepared to more if necessary

RBA left monetary policy unchanged as widely expected. Cash rate target and 3-year AGS yield target are kept at 0.10%. The parameters and term funding facility and government bond purchases were maintained too. It continued to expect no increase in cash rate for “at least 3 years”. Bond purchase size will continue to be under review. The Board is “prepared to do more if necessary”.

Regarding the economy, RBA said “recent data have generally been better than expected… but the recovery is still expected to be uneven and drawn out and it remains dependent on significant policy support”. GDP would not reach pre-pandemic level until the end of 2021. While employment growth was strong in October, further rise in unemployment is still expected. Inflation is expected to remain subdued till 2022.

Australia AiG manufacturing dropped to 52.1, but recovery prosect continues

Australia AiG Performance of Manufacturing Index dropped -4.2 pts to 52.1 in November, indicating expanding conditions at a slower rate. Looking at some details, all seven activity indices declined. Production dropped -2.6 to 52.5. Employment dropped -2.5 to 52.8. New orders dropped -5.1 to 53.3. Exports dropped -2.7 to 50.0. Four of the six manufacturing sectors expanded, including machinery & equipment, metal products, petroleum, textiles & clothing.

Ai Group Chief Executive Innes Willox said: “The manufacturing sector was broadly stable in November after a return to positive territory in October… Encouragingly, both new orders and employment continued to grow in November, pointing to the prospect of a continuing recovery as we head towards the end of the year”.

Also released, building permits rose 3.8% mom in October, above expectation of -3.0% mom decline. current account surplus narrowed to AUD 10.0B in Q3, larger than expectation of AUD 7.1B.

Japan PMI manufacturing finalized at 49.0, optimistic on future output

Japan PMI Manufacturing was finalized at 49.0 November, up from October’s 48.7. While still concretionary, it’s already the highest reading since August 2019. Markit also noted softer falls in both output and news orders. Businesses also remained optimistic regarding future output.

Usamah Bhatti, Economist at IHS Markit, said: “Concern remains that weaknesses caused by the COVID-19 pandemic persisted as both output and new orders both fell for the twenty-third month in a row. Furthermore, infection rates have surged in both domestic and international markets which resulted in a renewed fall in export orders, which dampened confidence further.

“However, Japanese manufacturers continue to report a positive outlook beyond the immediate concerns surrounding the sector. Around 33% of survey respondents foresee a rise in output over the coming year amid hopes that the pandemic dissipates and a robust economic recovery. Currently, IHS Markit expects industrial production to grow 7.3% in 2021 although this is from a lower base and does not fully recover the output lost to the pandemic.”

Also from Japan, unemployment rate rose to 3.1% in October versus expectation of 3.0%. Capital spending dropped -10.6% in Q3 versus expectation of -12.0%.

China Caixin PMI manufacturing rose to 54.9, highest in a decade

China Caixin PMI Manufacturing rose to 54.9 in November, up from 53.6, above expectation of 53.6. That’s also the strongest reading since November 2010. The sector improved for the seven straight months, indicating a sustained and strong recovery. Markit also noted that both output and new orders increased at the fastest rates for 10 years. Employment expanded at quickest pace since May 2011.

Wang Zhe, Senior Economist at Caixin Insight Group said: “We expect the economic recovery in the post-epidemic era to continue for several months. At the same time, deciding how to gradually withdraw the easing policies launched during the epidemic will require careful planning as uncertainties still exist inside and outside China.”

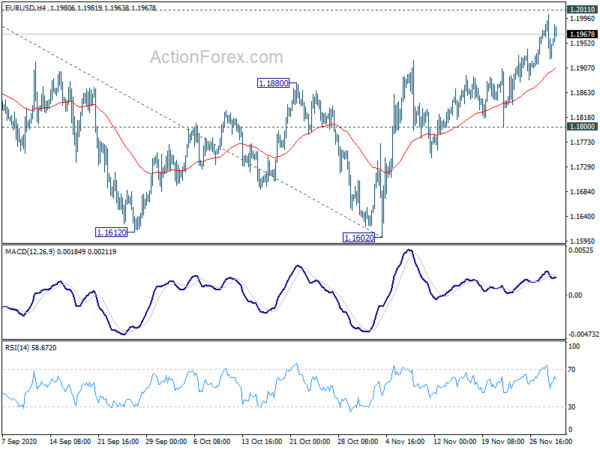

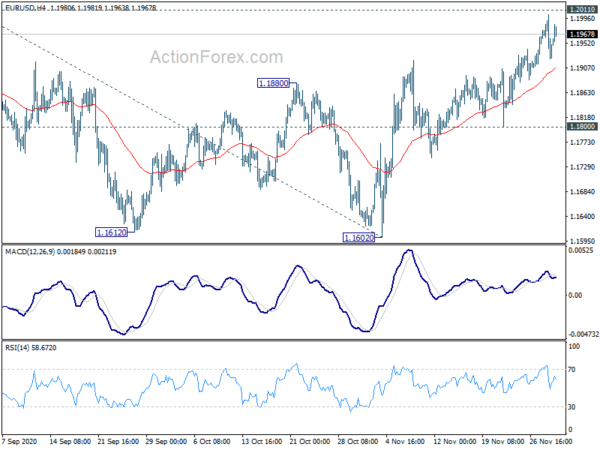

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1898; (P) 1.1951; (R1) 1.1977; More…..

EUR/USD retreats ahead of 1.2011 high and intraday bias is turned neutral first. On the upside, decisive break of 1.2011 will resume whole rally from 1.0635 low. Next target is 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452. On the downside, break of 1.1800 support will turn bias to the downside, to extend the consolidation pattern from 1.2011 with another falling leg.

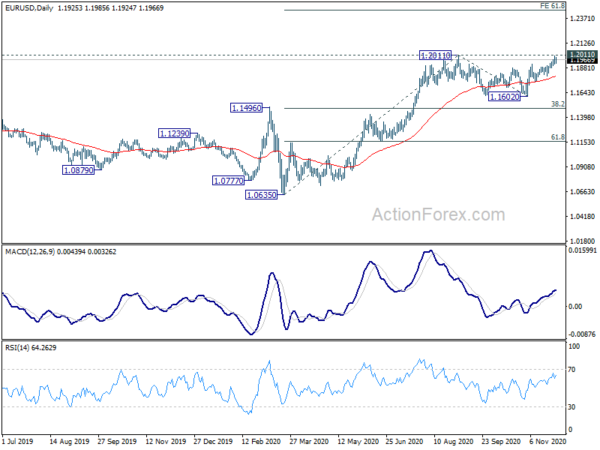

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Nov | 52.1 | 56.3 | ||

| 23:30 | JPY | Unemployment Rate Oct | 3.10% | 3.00% | 3.00% | |

| 23:50 | JPY | Capital Spending Q3 | -10.60% | -12.00% | -11.30% | |

| 0:30 | AUD | Current Account Balance (AUD) Q3 | 10.0B | 7.1B | 17.7B | 16.3B |

| 0:30 | AUD | Building Permits M/M Oct | 3.80% | -3.00% | 15.40% | 16.20% |

| 0:30 | JPY | Manufacturing PMI Nov F | 49 | 48.3 | 48.3 | |

| 1:45 | CNY | Caixin Manufacturing PMI Nov | 54.9 | 53.3 | 53.6 | |

| 3:30 | AUD | RBA Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 6:45 | CHF | GDP Q/Q Q3 | 7.20% | 5.90% | -7.30% | -7.00% |

| 8:30 | CHF | SVME PMI Nov | 55.2 | 51.5 | 52.3 | |

| 8:45 | EUR | Italy Manufacturing PMI Nov | 51.5 | 52 | 53.8 | |

| 8:50 | EUR | France Manufacturing PMI Nov F | 49.6 | 49.1 | 49.1 | |

| 8:55 | EUR | Germany Manufacturing PMI Nov F | 57.8 | 57.9 | 57.9 | |

| 8:55 | EUR | Germany Unemployment Change Nov | -39K | 10K | -35K | -38K |

| 8:55 | EUR | Germany Unemployment Rate Nov | 6.10% | 6.20% | 6.20% | |

| 9:00 | EUR | Eurozone Manufacturing PMI Nov F | 53.8 | 53.6 | 53.6 | |

| 9:30 | GBP | Manufacturing PMI Nov F | 53.8 | 55.2 | 55.2 | |

| 10:00 | EUR | Eurozone CPI Y/Y Nov P | -0.30% | -0.20% | -0.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov P | 0.20% | 0.20% | 0.20% | |

| 13:30 | CAD | GDP M/M Sep | 0.90% | 1.20% | ||

| 14:30 | CAD | Manufacturing PMI Nov | 55.5 | |||

| 14:45 | USD | Manufacturing PMI Nov F | 56.7 | 56.7 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 57.5 | 59.3 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 64.2 | 65.5 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 53.2 | |||

| 15:00 | USD | Construction Spending M/M Oct | 0.80% | 0.30% | ||

| 16:30 | USD | 52-Week Bill Auction | 0.14% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals