Dollar falls broadly in early US session after much worse than expected jobless claims data, confirming the impact of the current wave of coronavirus pandemic. Yen is not far behind for now as second weakest. But Sterling is also facing some selling pressure on Brexit impasse. Commodity currencies are currently the strongest ones, as led by Australian Dollar. Euro is also firm after ECB delivered the expansion and extension of PEPP as markets expected.

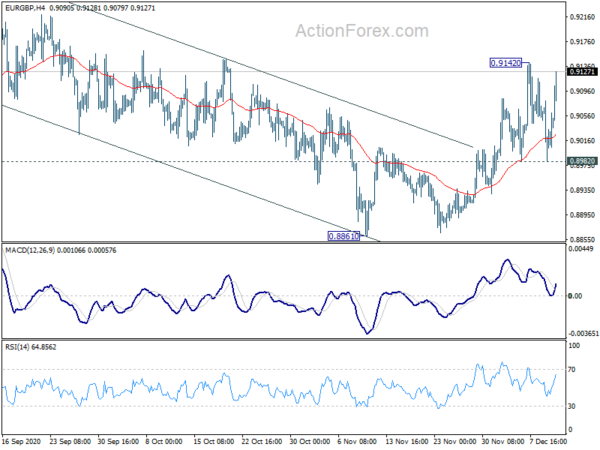

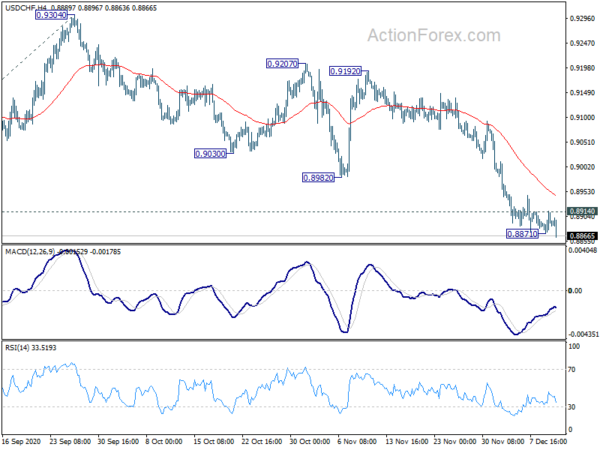

Technically, Dollar’s weakness is generally felt with break of 1.2768 temporary low in USD/CAD and 0.8871 temporary low in USD/CHF. A focus is now on whether EUR/USD could break through 1.2177 temporary top to resume recent up trend. Also, eyes will be on 126.68 temporary top in EUR/JPY and 0.9142 temporary top in EUR/GBP, for indication of resumption of near term rise. If happens, strength in these pairs could help keep EUR/AUD above 1.6122 temporary low.

In Europe, FTSE is up 0.62%. DAX is down -0.09%. CAC is up 0.22%. Germany 10-year yield is up 0.006 at -0.596. Earlier in Asia, Nikkei dropped -0.23%. Hong Kong HSI dropped -0.35%. China Shanghai SSE rose 0.04%. Singapore Strait Times dropped -0.64%. Japan 10-year JGB yield dropped -0.0052 to 0.015.

US initial jobless claims surged to 853k, continuing claims rose to 5.8m

US initial jobless claims rose 137k to 853k in the week ending December 5, well above expectation of 723k. Four-week moving average of initial claims rose 35.5k to 776.0k. Continuing claims rose 230k to 5757k in the week ending November 28. Four-week moving average of continuing claims dropped -260k to 5936k.

CPI came in at 0.2% mom, 1.2% yoy in November. CPI was core at 0.2% mom, 1.6% yoy.

ECB raises PEPP envelop by EUR 500B, extends to March 2022

ECB announced a package of measures today, including expanding and extending the pandemic emergency purchase programme (PEPP). The measures are “to preserving favourable financing conditions over the pandemic period, thereby supporting the flow of credit to all sectors of the economy, underpinning economic activity and safeguarding medium-term price stability.” ECB also stands ready to ” stand ready to adjust all of its instruments, as appropriate”

The central bank left main refinancing rate unchanged at 0.00% as widely expected. Marginal lending rate and deposit rate are held at 0.25% and -0.50% respectively. The asset purchase programme (APP) purchase will continue at a monthly pace of EUR 20B.

The envelop of the pandemic emergency purchase programme (PEPP) is raised by EUR 500B to a total of EUR 1850B. The program will also be extended to “at least the end of March 2022”. The third series of targeted longer-term refinancing operations (TLTRO III).is extended by 12 months to June 2022, with three additional operations to be conducted between June and December 2021. The total amount that counterparties will be entitled to borrow in TLTRO III operations from 50 per cent to 55 per cent of their stock of eligible loans. ECB also decided to extend the collateral easing measures to June 2022. Four additional pandemic emergency longer-term refinancing operations (PELTROs) will be offered in 2021.

EU announces targeted contingency measures in case of no-deal Brexit

The European Commission announced today a set of “targeted contingency measures” in case of no-deal Brexit on January 1, 2021. The measures aim at ” ensuring basic reciprocal air and road connectivity between the EU and the UK, as well as allowing for the possibility of reciprocal fishing access by EU and UK vessels to each other’s waters.”

President von der Leyen said: “Negotiations are still ongoing. However, given that the end of the transition is very near, there is no guarantee that if and when an agreement is found, it can enter into force on time. Our responsibility is to be prepared for all eventualities, including not having a deal in place with the UK on 1 January 2021. That is why we are coming forward with these measures today”.

UK GDP grew 0.4% mom in Oct, still -7.9% below Feb’s level

UK GDP grew 0.4% mom in October, slightly below expectation of 0.5% mom. That’s, nonetheless, the sixth consecutive monthly increase. GDP was 23.4% higher than the trough in April, but -7.9% below the level in pre-pandemic February.

Services grew 0.2% mom, but remains -8.6% below February’s level. Production grew 1.3% mom, but was -4.4% below February’s level. Construction rose 1.0% mom, but remains -6.4% below February’s level.

Also released, goods trade deficit widened to GBP -12.0B, wider than expectation of GBP -9.6B.

France industrial output rose 1.6% mom in October, well above expectation of 0.4% mom. Manufacturing output rose 0.5% mom. However, output remained significantly lower in the manufacturing industry (−5.0%), as well as in the whole industry (−3.6%).

Released in Asian session, Japan BSI large manufacturing index rose to 21.6 in Q4. PPI dropped -2.2% in November. Australia consumer inflation expectations was unchanged at 3.5% for December.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8872; (P) 0.8893; (R1) 0.8916; More….

USD/CHF’s break of 0.8871 temporary low should indicate down trend resumption. Intraday bias is back on the downside for t 61.8% projection of 0.9901 to 0.8998 from 0.9304 at 0.8746 next. On the upside, though, break of 0.8914 minor resistance will turn intraday bias neutral again and bring more consolidations first.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9304 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Index Q/Q Q4 | 21.6 | 0.1 | ||

| 23:50 | JPY | PPI Y/Y Nov | -2.20% | -2.10% | -2.10% | |

| 00:00 | AUD | Consumer Inflation Expectations Dec | 3.50% | 3.50% | ||

| 00:01 | GBP | RICS Housing Price Balance Nov | 66% | 55% | 68% | 67% |

| 00:30 | AUD | RBA Bulletin | ||||

| 07:00 | GBP | GDP M/M Oct | 0.40% | 0.50% | 1.10% | |

| 07:00 | GBP | Manufacturing Production M/M Oct | 1.70% | 1.00% | 0.20% | |

| 07:00 | GBP | Manufacturing Production Y/Y Oct | -7.10% | -7.40% | -7.90% | |

| 07:00 | GBP | Industrial Production M/M Oct | 1.30% | 0.30% | 0.50% | |

| 07:00 | GBP | Index of Services 3M/3M Oct | 9.70% | 14.20% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Oct | -12.0B | -9.6B | -9.3B | |

| 07:45 | EUR | France Industrial Output M/M Oct | 1.60% | 0.40% | 1.40% | 1.60% |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | Initial Jobless Claims (Dec 4) | 853K | 723K | 712K | 716K |

| 13:30 | USD | CPI M/M Nov | 0.20% | 0.20% | 0.00% | |

| 13:30 | USD | CPI Y/Y Nov | 1.20% | 1.30% | 1.20% | |

| 13:30 | USD | CPI Core M/M Nov | 0.20% | 0.10% | 0.00% | |

| 13:30 | USD | CPI Core Y/Y Nov | 1.60% | 1.80% | 1.60% | |

| 15:00 | GBP | NIESR GDP Estimate Nov | 1.50% | 10.20% | 10.30% | |

| 15:30 | USD | Natural Gas Storage | -85B | -1B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals