The financial markets are generally steady today as traders are holding their bet ahead of FOMC announcement. US President Joe Biden is set to unveil a USD 1.8T package for family and education, but that’s unlikely to trigger much reaction. New Zealand Dollar and Canadian Dollar are currently the strongest ones for today, followed by Dollar. Australian Dollar remains the worst performing one after post CPI sell-off. Sterling is also weak together with Yen.

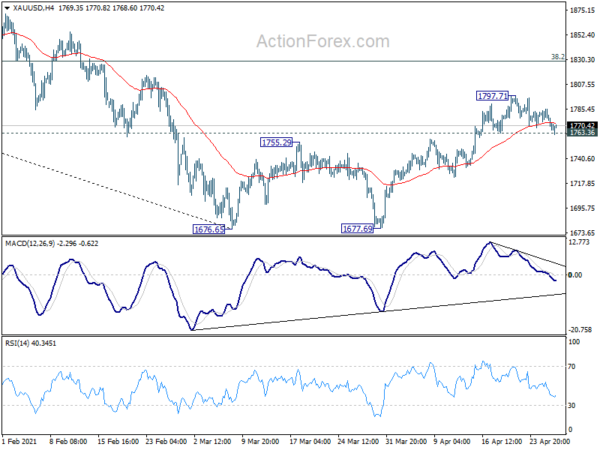

Technically, we’re staying near term bearish on Dollar, except versus Yen. This view will hold as long as 1.1992 minor support in EUR/USD, 0.7676 minor support in EUR/USD, 0.9121 minor resistance in USD/CHF and 1.2470 minor resistance in USD/CAD holds. Also, there is also prospect for Gold to rebound from current level to resume the rise from 1676.65 through 1797.71. However, Firm break of 1763.36 will be taken as an early indication of a stronger Dollar rebound.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 0.42%. CAC is up 0.63%. Germany 10-year yield is up 0.018 at -0.227. Earlier in Asia, Nikkei rose 0.21%. Hong Kong HSI rose 0.45%. China Shanghai SSE rose 0.42%. Singapore Strait Times rose 0.16%. Japan 10-year JGB yield rose 0.0098 to 0.095.

Here are some previews for FOMC:

US goods trade deficit widened to USD 90.6B in March

US goods exports rose USD 11.4B to USD 142B in March. Goods imports rose USD 14.9B to USD 232.6B. Trade deficit widened to USD -90.6B, from USD -87.1B, larger than expectation of USD -87.5B.

Wholesale inventories rose 1.4% mom to USD 693.4B. Retail inventories dropped -1.4% mom to USD 613.2B.

Canada retail sales rose 4.8% mom in Feb, up in 9 of 11 sectors

Canada retail sales rose 4.8% mom to CAD 55.1B in February, above expectation of 4.0% mom. Sales grew in 9 of 11 subsectors, higher sales at motor-vehicle and parts dealers and gasoline stations. Core retail sales, excluding gasoline stations and motor-vehicle and parts dealers, rose 3.8% mom.

Statistics Canada also estimated that retail sales would increase 2.3% mom in March. But owing to its preliminary nature, this figure will be revised.

German Gfk consumer sentiment dropped to -8.8, consumption not a pillar of the economy this year

German Gfk consumer sentiment for May dropped to -8.8, down from -6.2, missed expectation of -4.8. In April, economic expectations dropped from 17.7 to 7.3. Income expectations tumbled from 22.3 to 9.3. Though, propensity to buy rose from 12.3 to 17.3.

Rolf Bürkl, GfK consumer expert comments on the subject: “The recovery of the domestic economy will continue to lag due to the third wave. As in 2020, consumption will again not be a pillar of the economy this year. In the years before the pandemic, private consumer spending had still made an important contribution to the growth of the German economy.”

From Swiss, Credit Suisse Economic Expectations rose slightly to 68.3 in April, up from 66.7.

Australia CPI rose 0.6% qoq in Q1, missed expectations

Australia CPI rose 0.6% qoq in Q1, well below expectation of 0.9% qoq. Annually, CPI accelerated to 1.1% yoy, up from 0.9% yoy, but missed expectation of 1.4% yoy. At the all groups level, the CPI rose in all eight capital cities, ranging from 0.3% in Melbourne to 1.4% in Perth and 2.6% in Darwin.

Head of Prices Statistics at the ABS, Michelle Marquardt said: “Higher fuel prices, compared with the low prices seen in 2020, accounted for much of the rise in the March quarter CPI.”

Also released, goods exports rose 15% mom to AUD 36.2B in March. Goods imports rose 15% mom to AUD 27.8B. Goods trade surplus widened slightly to AUD 8.5B.

From Japan, retail sales rose 5.2% yoy in March, above expectation of 4.7% yoy.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2068; (P) 1.2080; (R1) 1.2103; More….

EUR/USD is staying in consolidation from 1.2116 temporary top and intraday bias remains neutral first. Further rise is expected with 1.1992 support intact. Break of 1.2116 will resume the rise from 1.1703 for retesting 1.2242/2348 resistance zone. On the downside, though, break of 1.1992, will turn bias to the downside for deeper pull back.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Mar | -1.30% | -2.40% | ||

| 23:50 | JPY | Retail Trade Y/Y Mar | 5.20% | 4.70% | -1.50% | |

| 01:30 | AUD | CPI Q/Q Q1 | 0.60% | 0.90% | 0.90% | |

| 01:30 | AUD | CPI Y/Y Q1 | 1.10% | 1.40% | 0.90% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q1 | 0.30% | 0.50% | 0.40% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q1 | 1.10% | 1.20% | 1.20% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence May | -8.8 | -6.2 | ||

| 08:00 | CHF | Credit Suisse Economic Expectations Apr | 68.3 | 66.7 | ||

| 12:30 | CAD | Retail Sales M/M Feb | 4.80% | 4.00% | -1.10% | 0.00% |

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | 4.80% | 3.50% | -1.20% | -0.10% |

| 12:30 | USD | Goods Trade Balance (USD) Mar P | -90.6B | -87.5B | -86.7B | -87.1B |

| 12:30 | USD | Wholesale Inventories Mar P | 1.40% | 0.10% | 0.60% | |

| 14:30 | USD | Crude Oil Inventories | -0.9M | 0.6M | ||

| 18:00 | USD | Fed Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals