Dollar and Yen recover mildly as the week starts, paring some of last week’s losses. Buying momentum in both currencies is rather weak so far, and they don’t look like bottoming yet. New Zealand Dollar spiked higher earlier today after much stronger than expected consumer inflation data. But the rally in Kiwi faded quickly. Overall, the markets are in consolidative mode, and we’d look for more downside in Dollar and Yen later in the week.

Technically, however, the rather weak recovery in EUR/USD is casting some doubts on Dollar’s weakness. The recovery from 1.1523 is limited comfortably below 1.1639 minor resistance so far. Larger fall from 1.2265 is still mildly in favor to resume at a later stage. Nevertheless, firm break of 1.1639 should confirm short term bottoming and bring stronger rebound. We’d keep an eye on the development as hint on overall direction in Dollar.

In Asia, Nikkei closed up 0.15%. Hong Kong HSI is down -0.45%. China Shanghai SSE is down -0.25%. Singapore Strait Times is down -0.03%. Japan 10-year JGB yield is up 0.012 at 0.092.

New Zealand CPI rose 2.2% qoq, 4.9% in Q3, highest in over a decade

New Zealand CPI rose 2.2% qoq in Q3, well above expectation of 1.4% qoq. That’s the largest quarterly increase in over a decade since 2010. For the 12-month period, CPI accelerated to 4.9% yoy, up from Q2’s 3.3% yoy, well above expectation of 4.1% yoy too. The annual rise is also the highest since 2011. The strong inflation reading prompted more expectations of more RBNZ rate hikes ahead, following the 25bps increase earlier this month.

China GDP growth slowed to 0.2% qoq, 4.9% yoy in Q3

China GDP grew 4.9% yoy in Q3, below expectation of 5.2% yoy. On a quarterly basis, GDP grew only 0.2% qoq, slowed from Q2’s 1.2% qoq, and missed expectation of 0.5% qoq. In September, retail sales rose 4.4% yoy, above expectation of 3.3% yoy. Industrial production rose 3.1% yoy, below expectation of 4.5% yoy. Fixed asset investment rose 7.3% ytd yoy, below expectation of 7.9%.

“The overall national economy maintained the recovery momentum in the first three quarters … however, we must note that the current uncertainties in the international environment are mounting and the domestic economic recovery is still unstable and uneven,” said NBS spokesman Fu Linghui.

ECB Lagarde: Inflation is largely transitory

ECB President Christine Lagarde repeated on Saturday that “inflation is largely transitory”. “Monetary policy will continue supporting the economy in order to durably stabilize inflation at our 2% inflation target over the medium term,” she said. “The ECB is committed to preserving favorable financing conditions for all sectors of the economy over the pandemic period.”

“Once the pandemic emergency comes to an end — which is drawing closer — our forward guidance on rates as well as asset purchases will ensure that monetary policy remains supportive of the timely attainment of our target,” Lagarde said.

Separately, Governing Council member Klaas Knot also said the current inflation is “mostly temporary”. “It is highly relevant to determine whether this is a temporary phenomenon and goes away or not, and whether this becomes a risk and has secondary effects through higher wages and costs, and that is not the case now,” Knot said. “At this moment, we see it as mostly temporary as our economy is reopening after the corona shock and the supply of products is not keeping up with demand.”

BoE Bailey sent another signal that “we have to act”

BoE Governor Andrew Bailey warned that rising energy prices means inflation will “last longer” and “get into the annual numbers for longer as a consequence.” The development raised the “fear and concern of embedded expectations.”

“Monetary policy cannot solve supply-side problems,” he noted. “But it will have to act and must do so if we see a risk, particularly to medium-term inflation and to medium-term inflation expectations”

“That’s why we, at the Bank of England have signaled, and this is another signal, that we will have to act”, he said. “But of course that action comes in our monetary policy meetings.”

More inflation data and PMIs to highlight the week

PMI data from Australia, Japan, UK, Eurozone and UK will be the major focuses this week, for insights on growth, employment as well as inflation. Additionally, UK, Canada and Japan will release inflation data. BoC business outlook survey, RBA minutes and Fed’s Beige Book report will also be watched. Additionally, China will release a set of latest economic data, which could shake the Asian markets.

Here are some highlights for the week:

- Monday: New Zealand CPI; China GDP, retail sales, industrial production, fixed asset investment; Canada housing starts, foreign securities purchase, BoC business outlook survey; US industrial production, NAHB housing index.

- Tuesday: RBA minutes; Swiss trade balance; US housing starts and building permits.

- Wednesday: Japan trade balance; Germany PPI; UK CPI, PPI; Eurozone current account, CPI final; Canada CPI; Fed’s Beige Book report.

- Thursday: Australia NAB business confidence; UK public sector net borrowing; Canada new housing price index; US Philly Fed survey, jobless claim, existing home sales.

- Friday: Australia PMIs; Japan PMI manufacturing, CPI core; UK retail sales PMIs; Eurozone PMIs; Canada retail sales; US PMIs.

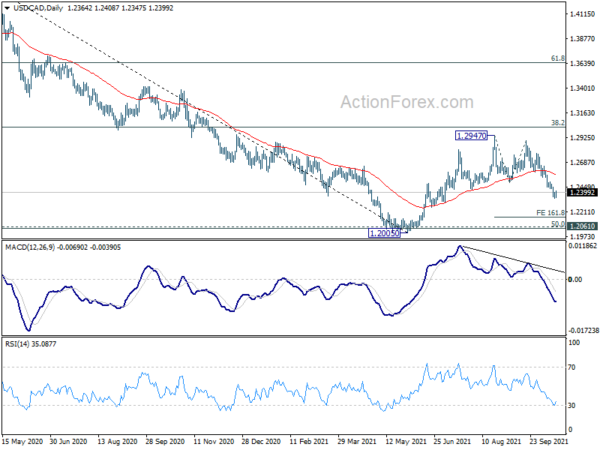

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2334; (P) 1.2366; (R1) 1.2394; More…

Intraday bias in USD/CAD is turned neutral with current recovery, and some consolidations should be seen first. Upside of recovery should be limited below 1.2592 support turned resistance to bring another fall. As noted before, rebound from 1.2005 should be finished at 1.2947. Below 1.2335 temporary low will target 161.8% projection of 1.2947 to 1.2492 from 1.2894 at 1.2158 next.

In the bigger picture, the rejection by 38.2% retracement of 1.4667 to 1.2005 at 1.3022 argues that rebound from 1.2005 is merely a corrective rise, which is complete. More importantly, the down trend from 1.4667 (2020 high). is not over yet. Sustained break of 1.2005 will extend the down trend to next long term fibonacci level at 61.8% retracement of 0.9406 to 1.4689 at 1.1424. In any case, outlook will not turn bullish as long as 1.2947 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 2.20% | 1.40% | 1.30% | |

| 21:45 | NZD | CPI Y/Y Q3 | 4.90% | 4.10% | 3.30% | |

| 23:01 | GBP | Rightmove House Price Index M/M Oct | 1.80% | 0.30% | ||

| 02:00 | CNY | GDP Y/Y Q3 | 4.90% | 5.20% | 7.90% | |

| 02:00 | CNY | Retail Sales Y/Y Sep | 4.40% | 3.30% | 2.50% | |

| 02:00 | CNY | Industrial Production Y/Y Sep | 3.10% | 4.50% | 5.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Sep | 7.30% | 7.90% | 8.90% | |

| 12:15 | CAD | Housing Starts Y/Y Sep | 265K | 260K | ||

| 12:30 | CAD | Foreign Securities Purchases (CAD) Aug | 14.19B | |||

| 13:15 | USD | Industrial Production M/M Sep | 0.20% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Sep | 76.50% | 76.40% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 75 | 76 | ||

| 14:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals