Moves in the markets are intensifying as another week starts, as Russia’s invasion on Ukraine continues. US and allies rejected Ukrainian President Volodymyr Zelenskyy’s plea for creating a no-fly zone over the country. But they’re now considering to step up sanctions on Russia by banning its oil exports. Asian stocks are trading in deep red while oil prices and gold surge. European majors are under heavy selling, and Aussie is leading other commodity currencies sharply higher.

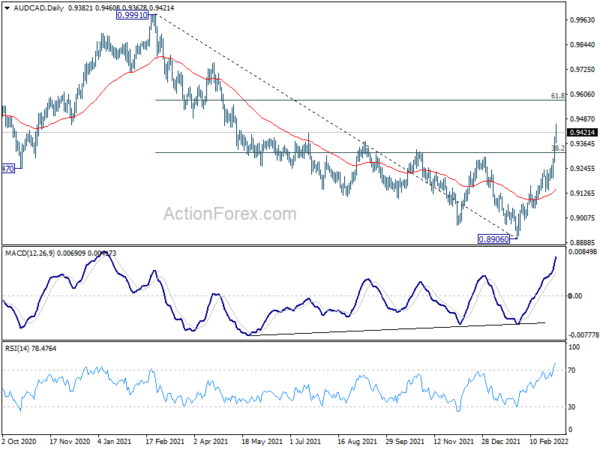

Technically, Aussie is having a clear advantage over Canadian as seen in AUD/CAD. With a strong break of 38.2% retracement of 0.9991 to 0.8906 at 0.9320, further rise should be seen to 61.8% projection at 0.9577. Sustained break there will raise the chance that AUD/CAD is indeed resuming the long term up trend from 0.8058 (2020 low). That is, there is prospect of Aussie continuing to outperform Canadian ahead.

In Asia, at the time of writing, Nikkei is down -2.95%. Hong Kong HSI is down -3.23%. China Shanghai SSE is down -1.81%. Singapore Strait Times is down -0.48%. Japan 10-year JGB yield is down -0.0066 at 0.146.

EUR/CAD and GBP/AUD extending free fall

Both Euro and Sterling are under heavy selling pressure today, against commodity currencies.

EUR/CAD dives to as low as 1.3773 so far and there is no sign of bottoming. Current fall from 1.4633 is part of the down trend from 1.5991 and should target 100% projection of 1.5096 to 1.4162 from 1.4633 at 1.3699.

Break of 1.3699, and sustained trading below medium term falling channel support, could prompt further downside acceleration to 161.8% projection at 1.3122, which is close to key long term support at 1.3019 (2015 low). Meanwhile, in any case, outlook will stay bearish as long as 1.4162 support turned resistances holds, in case of recovery.

GBP/AUD also dives to as low as 1.7729 so far as all from 1.9218 accelerates. Near term outlook will stay bearish as long as 1.8385 minor resistance holds. Next target is 1.7412 low.

Also, the corrective three-wave structure of the rise from 1.7412 to 1.9218 suggests that down trend from 2.0840 (2020 high) might be ready to resume. Break of 1.7412 will confirm and target 61.8% projection of 2.0840 to 1.7412 from 1.9218 at 1.7099 first. It’s a bit early to conclude. But firm break of 1.7099 could prompt further downside acceleration to 100% projection at 1.5790, which is close to long term support at 1.5693 (2016 low).

WTI oil hits 130, on track towards 147 record high

Oil prices surge gap up the week and surge to highest level since 2008. Both the US and its European allies are, responding to Ukrainian President Volodymyr Zelenskyy’s request, considering to ban Russian oil imports for its continuous assault and invasion of Ukraine. Meanwhile, the Iran nuclear deal continued to drag on.

WTI crude oil breached 130 level and hit as high as 131.82 so far. For now, break of 108.50 support is needed to indicate short term topping, even in case of deep retreat. Further rise is expected to 161.8% projection 33.50 to 85.92 from 62.90 at 147.71. That’s close to the historical high made in July 2008 at 147.27.

Gold gaps up and hits 2000, to target 2074 high first

Gold gaps up as the week open and hit as high as 2000.73 so far. The break of 1974.32 resistance confirms resumption of rally from 1682.60. Further rally is expected as long as 1923.09 minor support holds, to retest 2074.84 high.

With current upside acceleration, it’s getting more likely that Gold is resuming long term up trend. Break of 2074.84 will pave the way to 61.8% projection of 1160.17 to 2074.84 from 1682.60 at 2247.86.

Australia AiG services rose to 60 in Feb, grew strongly

Australia AiG Performance of Services Index rose 3.8 pts to 60.0 in February. Looking at some details, sales rose 9.7 pts to 68.6. Employment dropped -2.0 to 54.7. New orders rose 3.2 to 61.1. Supplier deliveries rose 7.6 to 59.0. Input prices dropped -0.1 to 66.0. Selling prices dropped -1.9 to 60.3. Average wages dropped -1.0 to 55.9.

Innes Willox, Chief Executive of Ai Group, said: “Australian service sector businesses grew strongly in February with sales, employment and new orders all adding to the gains in the December-January period. Prices of inputs and wages were up but not as dramatically as in the manufacturing and construction sectors. Selling prices remained at a level that suggests a capacity to recover a proportion of cost increases in the market.”

Lots of wild card elements in ECB meeting

ECB meeting will be a major focus this week. It’s on the path to normalize monetary policy without a doubt. But there are now more uncertainty then ever on the path, due to Russia’s invasion of Ukraine. There are a couple of wild cards which might trigger volatility in the markets, include any decision on an end date to APP purchases, the new economic projections, views of risk of stagflation and impact of war, the free fall in Euro and European stocks.

On the data front, US CPI will be the major focus. Some data to note including Eurozone Sentix, UK GDP, Canada employment, and China CPI and PPI. Here are some highlights for the week:

- Monday: Australia AiG services; China trade balance; Swiss unemployment rate, foreign currency reserves; Germany factory orders, retail sales; Eurozone Sentix investor confidence.

- Tuesday: Japan cash earnings, current account, leading indicators; Australia NAB business confidence; Germany industrial production; Italy retail sales; Eurozone GDP revision; Canada trade balance; US trade balance.

- Wednesday: New Zealand manufacturing sales; Australia Westpac consumer sentiment; Japan GDP final; China CPI, PPI; Italy industrial production.

- Thursday: Japan PPI; ECB rate decision; US CPI, jobless claims.

- Friday; Japan household spending, BIS manufacturing index; Germany CPI final; UK GDP , production, trade balance; Canada employment; US U of Michigan sentiment.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0855; (P) 1.0962; (R1) 1.1037; More…

EUR/USD’s decline continues today and intraday bias stays on the downside for 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786. Sustained break there will target 100% projection at 1.0349 next. On the upside, above 1.1007 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Index Feb | 60 | 56.2 | ||

| 02:00 | CNY | Trade Balance (USD) Jan | 115.95B | 95.5B | 94.5B | |

| 02:00 | CNY | Exports (USD) Y/Y Jan | 16.30% | 15.00% | 20.90% | |

| 02:00 | CNY | Imports (USD) Y/Y Jan | 15.50% | 16.50% | 19.50% | |

| 02:00 | CNY | Trade Balance (CNY) Jan | 738.8B | 450B | 605B | |

| 02:00 | CNY | Exports (CNY) Y/Y Jan | 13.60% | 19.10% | 17.30% | |

| 02:00 | CNY | Imports (CNY) Y/Y Jan | 12.90% | 21.30% | 16.00% | |

| 06:45 | CHF | Unemployment Rate Feb | 2.30% | 2.30% | ||

| 07:00 | EUR | Germany Retail Sales M/M Jan | 1.90% | -5.50% | ||

| 07:00 | EUR | Germany Factory Orders M/M Jan | 1.00% | 2.80% | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 947B | |||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Mar | 5.1 | 16.6 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals