The forex markets are engaging in sideway trading in very tight range in Asian session. Dollar and Yen remain the weaker ones for the week. But so far, there is not following selling to push them through near term support level yet. Overall risk sentiment is crucial in determining the next move. While US stocks staged a strong rebound overnight, Asian markets are just mixed, with softness seen in Hong Kong and China. The lack of committed risk buying also drags down Aussie and Kiwi a little bit.

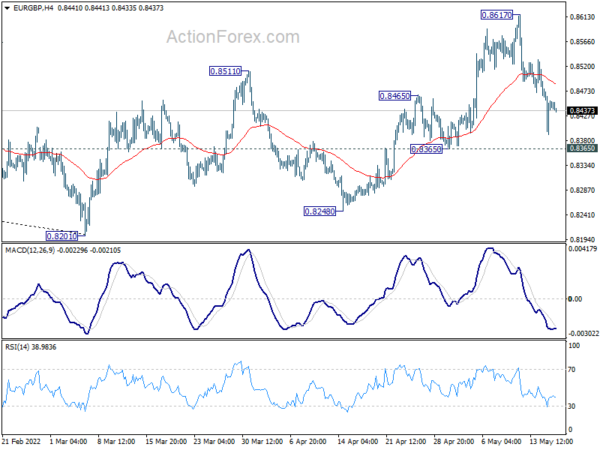

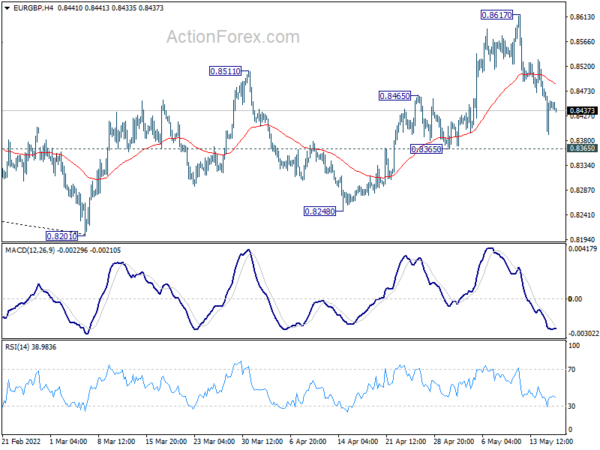

Technically, firstly, focus will stay on some near term levels in Dollar pairs, including 1.0641 resistance in EUR/USD, 1.2637 resistance in GBP/USD and 0.9871 support in USD/CHF. Firm break of these level will confirm short term topping in the greenback, and turn it into a “longer-lasting” near term correction phase. At the same time, attention will also be on some sterling pairs, including 0.8365 support in EUR/GBP and 162.16 resistance in GBP/JPY. Break of these two levels (in reaction to CPI data?) will push the Pound for a stronger near term rebound at least.

In Asia, at the time of writing, Nikkei is up 0.66%. Hong Kong HSI is down -0.32%. China Shanghai SSE is down -0.21%. Singapore Strait Times is up 0.89%. Japan 10-year JGB yield is up 0.0031 at 0.248. Overnight, DOW rose 1.34%. S&P 500 rose 2.02%. NASDAQ rose 2.76%. 10-year yield rose 0.091 to 2.968.

Fed Powell wont’ hesitate to move past neutral rate to tame inflation

Fed Chair Jerome Powell said yesterday, “this is a time for us to be tightly focused on the time ahead and getting inflation back down to 2%…. What we need to see is inflation coming down in a clear and convincing way… If we don’t see that, we will have to consider moving more aggressively”.

“If that involves moving past broadly understood levels of ‘neutral’ we won’t hesitate to do that,” he added. “We will go until we feel we are at a place where we can say ‘yes, financial conditions are at an appropriate place, we see inflation coming down.’”

“We’ll go to that point. There won’t be any hesitation about that,” he said.

Fed Kashkari: What I don’t know is how much are we going to need to do

Minneapolis Fed President Neel Kashkari said yesterday, “my colleagues and I are going to do what we need to do to bring the economy back into balance… What I don’t know is how much are we going to need to do … if we get some help on the supply side, then we won’t have to do as much; if we don’t get any help on the supply side, we are going to have to do more.”

But he also cautioned, “if the recession is effective in bringing inflation down, but then you’re pushing the unemployment rate way up, now all of a sudden you might be moving from one type of imbalance to the opposite type of imbalance. Like any kind of system, you want to avoid over-correcting if you can.”

Fed Evans expects completing any 50bps, plus some 25bps this year

Chicago Fed President Charles Evans said, “front-loading is important to speed up the necessary tightening of financial conditions, as well as for demonstrating our commitment to restrain inflation, thus helping to keep inflationary expectations in check.”

As for the pace of tightening, he said, “I’m expecting that before December, we will have completed in any 50s and have put in place at least a few 25s.”

“If we need to, we will be well positioned to respond more aggressively if inflation conditions do not improve sufficiently or, alternatively, to scale back planned adjustments if economic conditions soften in a way that threatens our employment mandate,” Evans explained.

BoE Cunliffe: There’s no intrinsic value around crypto assets

BoE Deputy Governor Jon Cunliffe said at a web event, “There’s a long tail of retail investors who have invested in cryptoassets. Do they all understand what they’ve invested in? I think not. For that long tail of retail investors, I’m not sure they do understand. They don’t really see this as a financial investment.”

“There’s no intrinsic value around crypto assets,” Cunliffe said. “They move with sentiment. They’re being moved mainly as a risky asset, and prices have been going down pretty consistently.”

“If you have that as a proportion of your portfolio, you have to realize it is highly speculative,” Cunliffe said. “You could lose all your money. You could make a sizable capital gain. It’s important for investors to understand the characteristics of this investment.”

Japan GDP contracted -0.2% qoq, -1.0% annualized in Q1

Japan GDP contracted -0.2% qoq in Q1, better than expectation of -0.4% qoq. In annualized term, GDP contracted -1.0%, first negative growth in two quarters, but better than expectation of -1.8%. GDP deflator dropped -0.4% yoy, also better than expectation of -1.2% yoy.

Economy minister Daishiro Yamagiwa said the economy has not returned to pre-pandemic levels but that further downside would likely be limited. He also expected the economy to pick up even though uncertainty remains due to Ukraine situation. Also, China’s zero-covid policy is having a significant impact on supply chains.

Australia Westpac leading index dropped to 0.88%, expects 40bps RBA hike in Jun

Australia Westpac-MI leading index dropped from 1.69% to 0.88% in April. Westpac recently revised down growth forecast for 2022 from 5.5% to 4.5%, reflecting the sharp increase in cost of living, and an earlier and more rapid RBA tightening policy.

As for RBA meeting on June 7, Westpac expects the central bank to hike by a further 40bps to 0.75%, even though most analysts favored a cautious move of 25bps. Westpac said, “It is also much more prudent to front load the increases where at a stage in the cycle when rates are clearly below what might be considered a ‘neutral’ level.

Looking ahead

Inflation data are the main focuses of the day. UK will release CPI and PPI. Eurozone will release CPI final. Canada will also release CPI. US will publish building permits and housing starts.

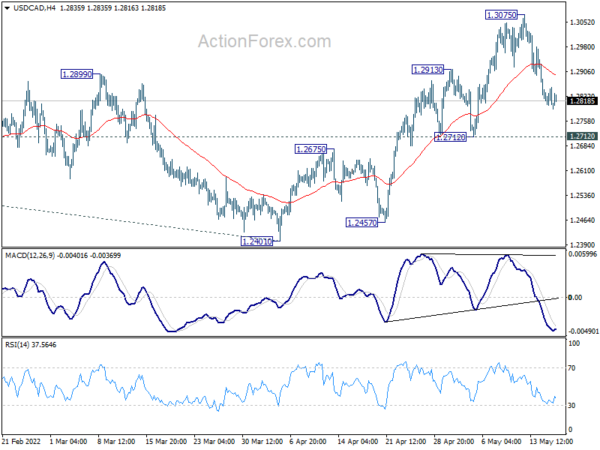

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2791; (P) 1.2825; (R1) 1.2843; More…

Intraday bias in USD/CAD stays neutral and outlook is unchanged. Pull back from 1.3075 could extend lower, but further rise is in favor with 1.2712 support intact. On the upside, break of 1.3075 will resume the rise from 1.2401. Sustained trading above 1.3022 fibonacci level will carry larger bullish implications. Next target will be 100% projection of 1.2005 to 1.2947 from 1.2401 at 1.3343. On the downside, however, break of 1.2712 support will indicate rejection by 1.3022 key fibonacci resistance, and bring deeper decline back to 1.2401 support.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend from 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q1 P | -0.20% | -0.40% | 1.10% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 P | -0.40% | -1.20% | -1.30% | 1.10% |

| 00:30 | AUD | Westpac Leading Index M/M Apr | -0.20% | 0.30% | ||

| 00:30 | AUD | Wage Price Index Q/Q Q1 | 0.70% | 0.80% | 0.70% | |

| 04:30 | JPY | Industrial Production M/M Mar F | 0.30% | 0.30% | 0.30% | |

| 06:00 | GBP | CPI M/M Apr | 2.60% | 1.10% | ||

| 06:00 | GBP | CPI Y/Y Apr | 9.10% | 7.00% | ||

| 06:00 | GBP | Core CPI Y/Y Apr | 6.20% | 5.70% | ||

| 06:00 | GBP | RPI M/M Apr | 0.90% | 1.00% | ||

| 06:00 | GBP | RPI Y/Y Apr | 11.10% | 9.00% | ||

| 06:00 | GBP | PPI Input M/M Apr | 2.60% | 5.20% | ||

| 06:00 | GBP | PPI Input Y/Y Apr | 20.70% | 19.20% | ||

| 06:00 | GBP | PPI Output M/M Apr | 1.60% | 2.00% | ||

| 06:00 | GBP | PPI Output Y/Y Apr | 12.50% | 11.90% | ||

| 06:00 | GBP | PPI Core Output M/M Apr | 1.60% | 2.00% | ||

| 06:00 | GBP | PPI Core Output Y/Y Apr | 12.70% | 12.00% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Apr F | 7.50% | 7.50% | ||

| 09:00 | EUR | Eurozone Core CPI Y/Y Apr F | 3.50% | 3.50% | ||

| 12:30 | CAD | CPI M/M Apr | 0.70% | 1.40% | ||

| 12:30 | CAD | CPI Y/Y Apr | 6.30% | 6.70% | ||

| 12:30 | CAD | CPI Common Y/Y Apr | 2.90% | 2.80% | ||

| 12:30 | CAD | CPI Median Y/Y Apr | 3.90% | 3.80% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Apr | 4.70% | 4.70% | ||

| 12:30 | USD | Building Permits Apr | 1.83M | 1.87M | ||

| 12:30 | USD | Housing Starts Apr | 1.77M | 1.79M | ||

| 14:30 | USD | Crude Oil Inventories | 2.1M | 8.5M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals