Dollar and Euro are both trading mildly lower in a relatively subdued, consolidative markets today. Yen and Kiwi are, on the other the stronger ones. There is no clear sing of range breakout yet. Pfizer provided another piece of upbeat news on coronavirus vaccines. The final results from late-stage trial has completed with 95% effectiveness. The company is ready to apply for emergency US authorization within day. Yet, investors are showing cold shoulders for now.

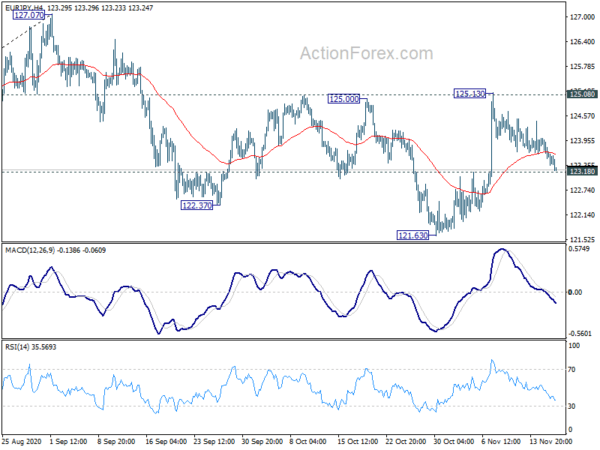

Technically, EUR/JPY is now eye 123.18 minor support and break will indicate completion of rebound form 121.63, after rejection by 125.08 resistance. That will also keep the cross inside the corrective pattern from 127.07, with risk of another falling leg to 121.63 and below. The move could be accompanied by deeper fall in USD/JPY to 103.17 support and even below. But that question is, EUR/USD also appears to be losing momentum ahead of 1.1920 temporary top. It remains to be seen if EUR/JPY for head south alone, or with USD/JPY.

In Europe, currently, FTSE is up 0.37%. DAX is up 0.28%. CAC is up 0.51%. German 10-year yield is down -0.0061 at -0.563. Earlier in Asia, Nikkei dropped -1.10%. Hong Kong HSI rose 0.49%. China Shanghai SSE rose 0.22%. Singapore Strait Times rose 0.36%. Japan 10-year JGB yield dropped -0.0020 to 0.021.

Canada CPI rose to 0.7% yoy in Oct, mainly due to food component

Canada CPI accelerated to 0.70% yoy in October, up from 0.50% yoy, above expectation of 0.4% yoy. CPI common rose to 1.6% yoy, up from 1.5% yoy, above expectation of 1.50% yoy. CPI median was unchanged at 1.9% yoy while CPI trimmed was unchanged at 1.8% yoy, both match expectations.

StatCan noted: “Prices rose in five of the eight major components on a year-over-year basis in October. While the shelter component contributed the most to the year-over-year increase, the all-items index rose at a faster pace in October compared with September, mainly due to the food component. ”

From US, housing starts rose to 1.53m annualized rate in October, above expectation of 1.45m. Building permits dropped slightly to 1.545m.

BoE Haldane: Digital priority becomes digital necessity with Covid

BoE Chief Economist Andy Haldane said in a speech that Covid is “not a traditional cyclical shock” whose effects would eventually wash-out. It’s instead a “structural shock” with lasting implications for individuals behaviors and business model. The pandemic crisis “already flicked a digital switch”, on how we spend, work and save. The crisis has could has accelerated the changes and could “serve as a catalyst for faster innovation in the future”, he added. “What was a digital priority pre-Covid has, for many, now become a digital necessity.”.

On monetary policy, Haldane said one of the “most pressing issues” is the “zero (or close to zero) lower bound (ZLB) on interest rates.” ZLB arrives from a “technological constraint on the ability to pay or receive interest on physical cash, whether positive or negative. In principle, a widely-used digital currency could mitigate, if not eliminate, that technological constraint by enabling interest rates to be levied on retail monetary assets.” And, “the potential macro-economic benefits of easing the ZLB constraint appear to be significant.”

UK CPI rose to 0.7% yoy in Oct, core CPI up to 1.5% yoy

UK CPI accelerated to 0.7% yoy in October, up from 0.5% yoy, above expectation of 0.5% yoy. Core CPI also rose to 1.5% yoy, up from 1.3% yoy, beat expectation of 1.3% yoy. Largest contribution came from recreation and culture. RPI rose to 1.3% yoy, up from 1.1% yoy, matched expectations.

PPI input was at 0.0% mom, -1.3% yoy, versus expectation of 0.0% mom, -2.6% yoy. PPI output was at 0.0% mom, -1.4% yoy, versus expectation of 0.1% mom, -0.7% yoy. PPI output core was at -0.2% mom, 1.1% yoy, versus expectation of 0.1% mom, 0.4% yoy.

Eurozone CPI finalized at -0.3% yoy in Oct, core CPI at 0.2% yoy

Eurozone CPI was finalized at -0.3% yoy in October, unchanged to September’s figure. Core CPI was finalized at 0.2% yoy. The highest contribution came from food, alcohol & tobacco (+0.38%), followed by services (+0.19%), non-energy industrial goods (-0.03%) and energy (-0.81%).

EU CPI was finalized at 0.3% yoy, also stable compared to September. The lowest annual rates were registered in Greece (-2.0%), Estonia (-1.7%) and Ireland (-1.5%). The highest annual rates were recorded in Poland (3.8%), Hungary (3.0%) and Czechia (2.9%). Compared with September, annual inflation fell in fifteen Member States, remained stable in two and rose in ten.

BoJ Kuroda: Premature to exit from massive stimulus program

BoJ Governor Haruhiko Kuroda, said “the economy likely hit bottom around April-June and is expected to continue improving as a trend. That will help price growth turn positive and gradually accelerate toward our 2% inflation target.”

“If inflation hits our 2% target and an exit from our massive stimulus programme comes into sight, there will certainly be debate on how to end our ETF buying. But it’s premature to do so at this stage,” he added.

From Japan, trade surplus narrowed to JPY 0.31T in October, above expectation of JPY 0.11T.

RBA Lowe sees tremendous opportunities to broaden out markets from China

RBA Governor Philip Lowe said it’s “incredibly mutually advantageous” for Australia and China to keep the strong trading relationship in place. But he also emphasized “over time there is tremendous opportunities to broaden out our markets”.

“Australia is in a fantastic location on the globe,” he added. “We are close to the fastest growing region in the world, we have good relationships with Indonesia and India.”

Lowe also noted, “digitalization is not only helping Australians deal with the pandemic, but it will also boost productivity and can help drive future economic growth.”

From Australia, wage price index rose 0.1% qoq in Q3, versus expectation of 0.2% qoq. New Zealand PPI input rose 0.6% qoq in Q3, above expectation of -0.1% qoq. PPI output dropped -0.3% qoq, versus expectation of 0.0% qoq.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.97; (P) 104.29; (R1) 104.50; More…

Intraday bias in USD/JPY stay son the downside at this point, and further fall should be seen to retest 103.17 low. Decisive break there will resume larger decline from 111.71. On the upside, above 104.56 minor resistance will turn intraday bias neutral first. But further break of 105.67 resistance is needed to indicate bullish reversal. Otherwise, outlook will stay bearish in case of another rebound.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q3 | 0.60% | -0.10% | -1.00% | -0.90% |

| 21:45 | NZD | PPI Output Q/Q Q3 | -0.30% | 0.00% | -0.30% | -0.20% |

| 23:50 | JPY | Trade Balance (JPY) Oct | 0.31T | 0.11T | 0.48T | 0.44T |

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 0.10% | 0.20% | 0.20% | |

| 07:00 | GBP | CPI M/M Oct | 0.00% | -0.10% | 0.40% | |

| 07:00 | GBP | CPI Y/Y Oct | 0.70% | 0.60% | 0.50% | |

| 07:00 | GBP | Core CPI Y/Y Oct | 1.50% | 1.30% | 1.30% | |

| 07:00 | GBP | RPI M/M Oct | 0.00% | -0.10% | 0.30% | |

| 07:00 | GBP | RPI Y/Y Oct | 1.30% | 1.30% | 1.10% | |

| 07:00 | GBP | PPI Input M/M Oct | 0.20% | 0.00% | 1.10% | |

| 07:00 | GBP | PPI Input Y/Y Oct | -1.30% | -2.60% | -3.70% | |

| 07:00 | GBP | PPI Output M/M Oct | 0.00% | 0.10% | -0.10% | |

| 07:00 | GBP | PPI Output Y/Y Oct | -1.40% | -0.70% | -0.90% | |

| 07:00 | GBP | PPI Core Output M/M Oct | -0.20% | 0.10% | 0.20% | |

| 07:00 | GBP | PPI Core Output Y/Y Oct | 1.10% | 0.40% | 0.30% | |

| 10:00 | EUR | Eurozone CPI Y/Y Oct F | -0.30% | -0.30% | -0.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct F | 0.20% | 0.20% | 0.20% | |

| 13:30 | USD | Housing Starts Oct | 1.53M | 1.45M | 1.42M | 1.46M |

| 13:30 | USD | Building Permits Oct | 1.545M | 1.57M | 1.55M | |

| 13:30 | CAD | CPI M/M Oct | 0.40% | 0.20% | -0.10% | |

| 13:30 | CAD | CPI Y/Y Oct | 0.70% | 0.40% | 0.50% | |

| 13:30 | CAD | CPI Common Y/Y Oct | 1.60% | 1.50% | 1.50% | |

| 13:30 | CAD | CPI Median Y/Y Oct | 1.90% | 1.90% | 1.90% | |

| 13:30 | CAD | CPI Trimmed Y/Y Oct | 1.80% | 1.80% | 1.80% | |

| 15:30 | USD | Crude Oil Inventories | 1.7M | 4.3M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals