Dollar recovers broadly today as markets turn into consolidative mode. The greenback pars back some of f the previous selloffs. but remains the worst performing one for the week. Canadian Dollar and Swiss Franc follow as the next weakest. On the other hand, Sterling and Aussie turn a bit softer, but remain the best weekly performers. Trading could turn more subdued for the rest of the day, unless the still ongoing Brexit trade negotiations give us something new.

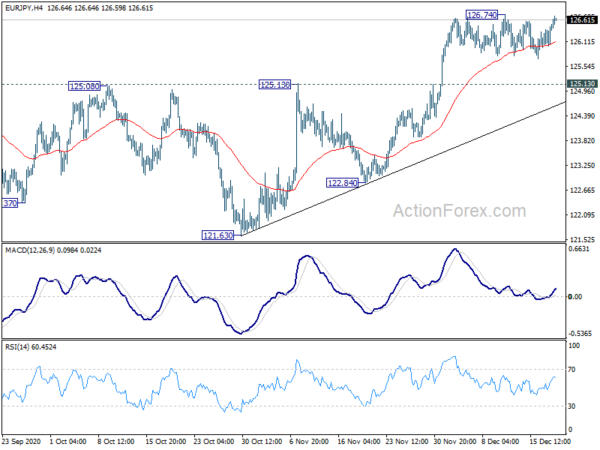

Technically, Yen has apparently turned weaker today and there is some prospect of more upside in Yen crosses. In particular, USD/JPY’s decline had been very unconvincing and failed to sustain below 103.71 low. A break above 126.75 resistance in EUR/JPY will be the first sign of rally resumption. GBP/JPY might take on corresponding resistance at 140.70 too. If both resistance levels are taken out, there is prospect for USD/JPY to follow higher too.

In Asia, Nikkei closed down -0.16%. Hong Kong HSI is down -0.95%. China Shanghai SSE is down -0.30%. Singapore Strait Times is down -0.32%. Japan 10-year JGB yield is up 0.0008 at 0.009. Overnight, DOW rose 0.49%. S&P 500 rose 0.58%. NASDAQ rose 0.84%. 10-year yield rose 0.010 to 0.930.

BoJ stands pat, to conduct assessment on monetary easing

BoJ announced to extend the during of the Special Program to Support Financing in Response to the Novel Coronavirus (COVID-19) by 6 months. Other than that, monetary policy was kept unchanged. Under the yield curve control framework, short term interest rate target was held at -0.1%. 10-year JGB yield target is held at around 0%, with unlimited purchase of government bonds.

Also, BoJ will “conduct an assessment for further effective and sustainable monetary easing, with a view to supporting the economy and thereby achieving the price stability target of 2 percent”. Nevertheless, the framework of QQE with YCC has been “working well to date” and thus there is “no need to change it. The results of the review will likely be be published in March.

The central bank said Japan’s economy is “likely to follow an improving trend” with gradual waning of COVID-19 impact. But pace of improvement is expected to be “only moderate”. Year-on-year rate of core CPI is “likely to be negative for the time being”. But it’s expected to turn positive and then increase gradually.

Released from Japan, nation CPI core dropped to -0.0% yoy in November, matched expectations. That’s the worst reading since September 2010.

Japan government upgrades fiscal 2021 GDP growth forecast to record 4%

Japan’s government upgraded fiscal 2021 (starting in April) GDP growth forecast to 4.0%, up form July estimate of 3.4%. If realized, that would be the largest expansion since data became comparable in 1995. Also, real GDP in March quarter of 2022 would be around the pre-pandemic level in December quarter of 2019.

The government’s newly approved JPY 74 trillion policy package would “underpin the economy and boost private demand such as capital expenditures”, said a Cabinet official.

Policymakers need to keep a close watch “on downside risks to the economy in Japan and overseas from the pandemic and impacts from moves in financial capital markets,” he added.

New Zealand ANZ business confidence rose to 9.4, first positive since 2017

New Zealand ANZ Business Confidence jumped to 9.4 in December, up form -6.9. That’s the first positive reading since August 2017. Own Activity index rose to 21.7, up from 9.1, highest since March 2018.

ANZ added, “the New Zealand economy is showing impressive resilience. After a 14% bounceback in the September quarter, the economy is the same size it was pre-COVID.” Nevertheless, “it’s not the same shape” with “some real stresses and strains, in both overheated sectors like construction, and chilled ones like tourism.” Also, “we expect a technical recession in Q4 and Q1 as the policy-fuelled bounce fades and the tourism hole hurts”.

New Zealand imports tumbled -17% in Nov, exports dropped -0.2%

New Zealand goods exports dropped -0.2% yoy to NZD 5.2B in November. Goods imports dropped -17% yoy in NZD 5.0B. Monthly trade balance was a surplus of NZD 252m, slightly above expectation of NZD 250m. That’s the first November surplus since 2013.

There were contrasting movements in exports to top destinations. Exports to China, US and EU were up. Exports to Australia and Japan were down. Imports were down from all top trading partners, including China, EU, Australia, US and Japan.

Looking ahead

UK retail sales, Germany PPI and Ifo, Eurozone current account will be released in European session. Canada new housing price index and retail sales, US current account will be featured later in the day.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 126.17; (P) 126.34; (R1) 126.67; More….

Intraday bias in EUR/JPY remains neutral for the moment as consolidation from 126.74 continues. Break of 126.74 will put focus on 127.07 resistance. Decisive break there will resume whole rise from 114.42. Next target will be 128.67 medium term fibonacci level. In any case, outlook will remain cautiously bullish as long as 125.13 resistance turned support holds, in case of another retreat.

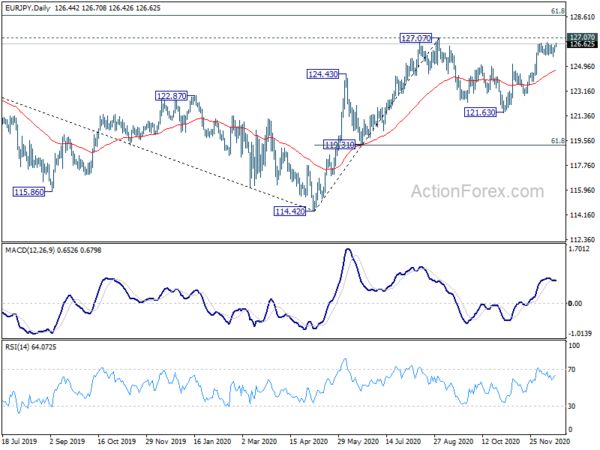

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 119.31 support holds. Break of 127.07 will target 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67 next. Sustained trading above there will target 137.49 next. However, firm break of 119.31 will argue that the rise from 114.42 has completed and turn focus back to this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | 252M | 250M | -501M | -427M |

| 23:30 | JPY | National CPI Core Y/Y Nov | -0.90% | -0.90% | -0.70% | |

| 0:01 | GBP | GfK Consumer Confidence Dec | -26 | -30 | -33 | |

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 7:00 | GBP | Retail Sales M/M Nov | -3.30% | 1.20% | ||

| 7:00 | GBP | Retail Sales Y/Y Nov | 2.80% | 5.80% | ||

| 7:00 | GBP | Retail Sales ex-Fuel M/M Nov | -2.30% | 1.30% | ||

| 7:00 | GBP | Retail Sales ex-Fuel Y/Y Nov | 6.20% | 7.80% | ||

| 7:00 | EUR | Germany PPI M/M Nov | 0.10% | 0.10% | ||

| 7:00 | EUR | Germany PPI Y/Y Nov | -0.60% | -0.70% | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Oct | 25.2B | |||

| 9:00 | EUR | Germany IFO Business Climate Dec | 90.5 | 90.7 | ||

| 9:00 | EUR | Germany IFO Current Assessment Dec | 89.3 | 90 | ||

| 9:00 | EUR | Germany IFO Expectations Dec | 92.8 | 91.5 | ||

| 13:30 | CAD | New Housing Price Index M/M Nov | 0.80% | |||

| 13:30 | CAD | Retail Sales M/M Oct | 1.10% | |||

| 13:30 | CAD | Retail Sales ex Autos M/M Oct | 1.00% | |||

| 13:30 | USD | Current Account (USD) Q3 | -190B | -171B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals