Yen remains the weakest one for the week, following the extended rebound in US stocks overnight, and persistent strength in treasury yields. Swiss Franc and Dollar are also soft as distant second and third. Meanwhile, Euro is currently the best week performer, followed by Aussie and then Kiwi. Sterling’s rally attempt was capped by the dovish BoE hike and is mixed for now.

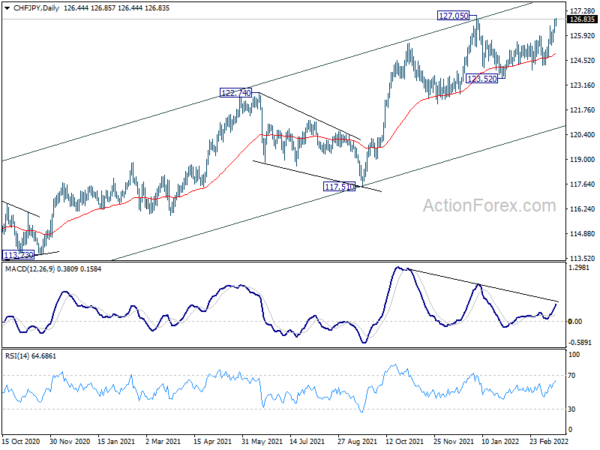

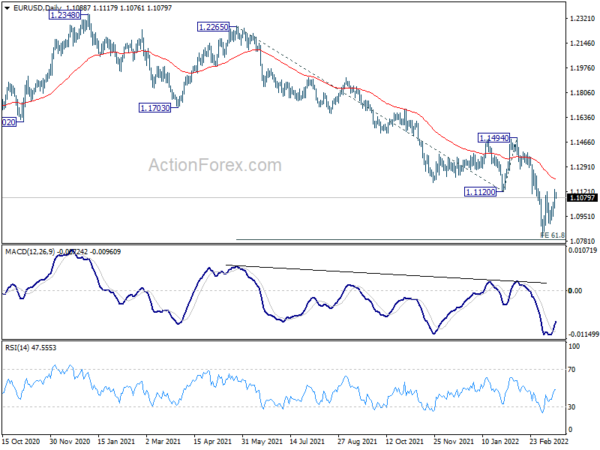

Technically, there are two pairs to watch before the week ends. EUR/USD is back pressing 1.1120 resistance. Strong break there will but a sign of more sustainable rebound in the common currency for the near term. CHF/JPY is now heading back to 127.05 high, after drawing support from 55 day EMA multiple times. Break of 127.05 will resume larger up trend from 106.71, and would give Yen extra pressure ahead.

In Asia, at the time of writing, Nikkei is up 0.33%. Hong Kong HSI is down -2.38%. China Shanghai SSE is down -0.22%. Singapore Strait Times is up 0.13%. Japan 10-year JGB yield is up 0.0074 at 0.211. Overnight, DOW rose 1.23%. S&P 500 rose 1.23%. NASDAQ rose 1.33%. 10-year yield rose 0.004 to 2.192.

BoJ stands pat, extremely high uncertainties surrounding impact from Ukraine

BoJ kept monetary policy unchanged as widely expected today. Under the yield curve control frame work, short-term policy interest rate is held at -0.10%. As for long-term interest rate, BoJ will continue to purchases JGBs, without upper limit, to maintain 10-year JGB yield at around 0%. The decision was made by 8-1 vote, with Goushi Kataoka dissented again, preferring to strength monetary easing.

In the accompany statement, BoJ said the “economy has picked up as a trend, although some weakness has been seen in part”. Exports and industrial production “have continued to increase as a trend, despite the remaining effects of supply-side constraints.”

Core inflation is “likely to increase clearly in positive territory for the time being due to a significant rise in energy prices, a pass-through of raw material cost increases, and dissipation of the effects of the reduction in mobile phone charges”.

BoJ also said, “there are extremely high uncertainties over how the situation surrounding Ukraine will affect Japan’s economic activity and prices, mainly through developments in global financial and capital markets, commodity prices, and overseas economies.”

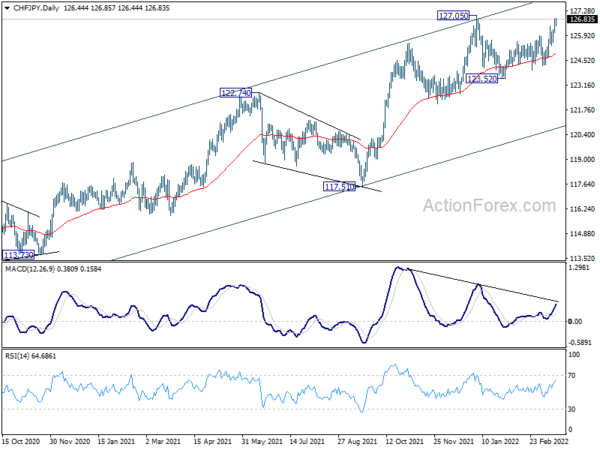

DOW breaks near term resistance, correction finished?

DOW’s strong break of 34179.07 resistance overnight was a clear near term bullish signal. The development suggests that correction from 36952.65 has completed with three waves down to 32272.64. A weekly close above near term falling channel resistance (now at around 34700) will solidify this case, and bring further rally to 35824.28 resistance next week.

At the same time, break of corresponding resistance of 4416.78 in S&P 500, and 13837.58 resistance in NASDQ, will also solidify overall near term bullish reversal in US stock markets.

WTI crude oil back above 106, first leg of correction finished

WTI crude oil is back at 106 as rebound from 93.98 extends. Russia is showing no sign of stopping its invasion of Ukraine despite waves of sanctions and rounds of negotiations. Earlier this week, the International Energy Agency warned that 3 million barrels per day of Russia oil and products could be shut in from as early as six months.

Technically, a short term bottom should be formed at 93.98 in WTI. The fall from 131.82, as the first leg of a corrective pattern should have completed. Further rise should be seen to 38.2% retracement of 131.82 to 93.98 at 108.43 first. Firm break there will target 61.8% retracement at 117.36 and above.

Also, with notable support seen from 55 day EMA, the medium term outlook stays bullish. That is, larger up trend is still in favor to extend through 131.82 high. However, it would take a while, most likely with at least one more falling leg, before the corrective pattern from 131.82 completes.

Looking ahead

Italy and Eurozone trade balance will be released in European session. Later in the day, Canada will release retail sales and new housing price index. US will release existing home sales.

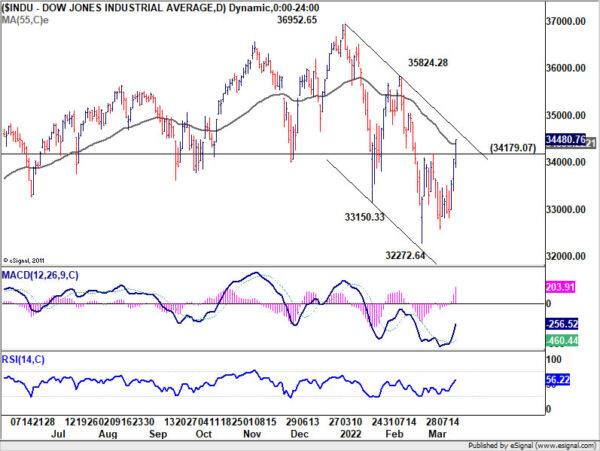

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1022; (P) 1.1079; (R1) 1.1150; More…

Intraday bias in EUR/USD remains neutral with focus on 1.1120 support turned resistance. Firm break there will confirm short term bottoming at 1.0805. Bias will be back on the upside for 55 day EMA (now at 1.1206). Sustained break there will raise the chance of medium term bottoming and target 1.1494 resistance. However, rejection by 1.1120 will maintain near term bearishness. Break of 1.0899 minor support should resume larger down trend from 1.2348 through 1.0805.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Feb | 0.60% | 0.60% | 0.20% | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jan | -1.00% | 0.40% | ||

| 09:00 | EUR | Italy Trade Balance (EUR) Jan | 3.05B | 1.10B | ||

| 10:00 | EUR | Eurozone Trade Balance(EUR) Jan | -4.6B | -9.7B | ||

| 12:30 | CAD | Retail Sales M/M Jan | 2.40% | -1.80% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | 2.30% | -2.50% | ||

| 13:30 | CAD | New Housing Price Index M/M Feb | 0.60% | 0.90% | ||

| 15:00 | USD | Existing Home Sales Feb | 6.18M | 6.50M | ||

| 15:00 | USD | Existing Home Sales Change M/M Feb | -1.00% | 6.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals