One of the biggest obstacles traders face is staying focused on the process of trading and acting in accordance to their game-plan. By implementing a systematic way of making sure you are ‘doing the right thing’ you can take a big step towards keeping yourself on track. This is where utilizing a pre-trade checklist can be a powerful tool.

Check out this guide which goes hand-in-hand with this webinar series – Building Confidence in Trading

What is the purpose of having a pre-trade checklist?

A checklist will help keep you focused on the process of trading and maintain objectivity. It can keep you acting in accordance to your game-plan (the starting foundation). If you don’t have one already, check out this prior webinar on creating a trading plan. Objectively identifying opportunities in this manner not only helps build confidence in good trade ideas, but also steers you clear of those less-than-ideal set-ups, which is a pretty big deal as side-stepping bad opportunities is a large part of profitable trading.

There are several key questions a trader must ask themselves and be able to answer confidently before entering into a trade. The following are broad stroke questions identified as being most important in my book, but you might find some other pertinent questions which you want to add. A checklist can be created in an application such as Excel or on a piece of paper, and more advanced traders can use a mental checklist once familiarized with the process.

Does the set-up fit criteria according to my game-plan?

You should know what types of set-ups work best for you, and it varies from one trader to the next as each has their own unique style. For beginning traders this will understandably be less clear, but as you grow you will gravitate towards one style of trading or another.

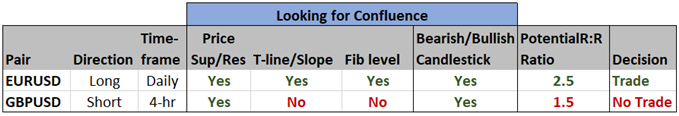

The criteria which qualify a set-up as high quality should be met and a box next to each factor checked off. If you can confidently check off the proper boxes, you should have a feeling of conviction, an element of excitement about the opportunity in front of you (this is an example of using emotions to your benefit – not all emotions in trading are bad!) However, if you can’t check off the proper boxes, then you will likely lack conviction and it’s time to move on.

Example of a Checklist Set-up

Where will I place my stop, my target; does it provide a good risk/reward ratio?

Based on your analysis you should have a good idea where the trade will be proven wrong and a target where you think within reason the market in question could end up. The distance from the entry price to the stop and the distance from entry to target should be skewed asymmetrically in your favor to give you a good risk/reward profile. As a general rule, your risk/reward ratio should be close to 1:2 or better.

You might have a good entry on a set-up, but if you can’t reasonably expect the market to move by a sufficient amount then over time low risk/reward trades will come back to hurt you. For example, you might identify a long set-up at support, but strong resistance sits not far ahead, in this case your risk/reward might not be very good.

Good vs Bad Risk/Reward

How much am I willing to risk on the trade?

Risk management is paramount and your risk-per-trade should be determined long before a set-up even develops (determined in your game-plan). It varies from trader to trader, but make sure you can accept the amount at risk without it negatively impacting your psyche.

Will I be able to look myself in the mirror if the trade triggers my stop-loss?

Ask yourself, based on the set-up at hand and the amount I am wiling to risk; if this trade doesn’t work (and many won’t), can I accept the loss? You must be able to answer this question with a definitive “YES”. You want to be able to look yourself in the mirror and say you took the right trade according to plan and stuck to your rules.

If certain questions can be answered appropriately, then it’s time to act…

Checking off all the boxes, having proper risk/reward, and feeling confident about a trade certainly doesn’t guarantee a profitable outcome. But it does mean you acted consistently with your game-plan and that is what good execution is all about.

Remember: Winners can be bad trades and losers can be good trades. Don’t just evaluate the outcome based on P&L alone. You could take a trade outside the plan and ‘get lucky’ while taking a high-quality set-up and have it hit your stop-loss (part of trading). Over time, though, ill-conceived trades will catch up to a trader. The only way to give yourself a chance in the long-run is to stick to a proper plan with consistency. Using a checklist is a great way to do just that – create consistency.

For the full conversation and examples, please see the video above…

Past recordings you might be interested in:Creating a Trading Plan; Handling Drawdowns; Risk Management; Analysis, keeping it simple; 6 Mistakes Traders Make; Focusing on the Process; Building Consistency; Classic Chart Patterns, Part I;Classic Chart Patterns, Part II

—Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email – SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX

Link to the source of information: www.dailyfx.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals