Sterling recovers mildly today as there was finally a piece of better than expected key data from the UK. Nonetheless, Swiss Franc outshines Sterling as the strongest one for today. And the Pound is still the weakest one for the week, followed by Euro. Canadian Dollar, on the other hand, is the weakest one for today, followed by Dollar and other commodity currencies. WTI crude oil dips back below 71 handle is a factor dragging the Loonie down. US’s intention to impose auto tariffs also create additional uncertainty for NAFTA negotiations.

Trade war and protectionism back as the main theme in the markets today. US President Donald Trump has ordered Commerce Secretary Wilbur Ross to start a Section 232 national security investigation on auto imports. And he’s considering to impose as much as 25% tariffs on import cars. Mexico, Canada, Japan, South Korea and Germany are major car importers to the US. Mexico and Canada combined export 4.2m cars to US in 2017. Hence, some saw the tariff as a move to force concessions in NAFTA talks.

It could also be a target to Germany which exported 0.5m cars to the US last year and is persistently having a trade surplus with US. South Korea will likely be alright as it was the first one to get permanent exemption from the steel tariffs, demonstrating it’s strategic relationship with the US. Japan, however, could be a casualty again. It’s the only close ally and top steel importer to the US who’s not even given a temporary exemption on steel tariffs. And Japan, who sold 1.7m cars to the US in 2017, rely on vehicle exports for growth.

– advertisement –

On the fundamental front, trade tensions, North Korea, Italy government will also remain on radar. But technical developments in bonds could drive some volatility in the markets again today. It now looks like US 10 year yield is kissing 3% handle goodbye. German 10 year bund yield also cannot get hold of 0.5%. Deeper fall in yield would drag down Yen pairs again.

Released from US, initial jobless claims rose 11k to 234k in the week ended May 19, above expectation of 220k. Four-week moving average of initial claims rose 6.25k to 219.75k. Continuing claims rose 29k to 1.741m in the week ended May 12. Four-week moving average of continuing claims dropped 23.25k to 1.752m, hitting the lowest since 1973. House price index rose 0.1% mom in March, below expectation of 0.5% mom.

UK retail sales bear market expectations, rose 1.6% mom in April

UK headline retail sales jumped 1.6% mom in April, much higher than expectation of 0.7%. Excluding auto and fuel, retail sales also jumped solidly by 1.3% mom, versus expectation of 0.4% mom.

The ONS noted that “the effects of the adverse weather on sales introduces further volatility to the monthly growth rate in April 2018.” And, “combining March and April to compare the two months with the same two months a year earlier provides a more stable picture of the year-on-year growth”.

Combining both March and April, sales grew 1.3% in 2018, much lower than 2.9% back in 2017.

ECB: Risks from protectionism had become more prominent

In the April meeting accounts, ECB offered not nothing new to the markets, but just a little more cautiousness. Despite recent moderation in activity, data remained consistent with “solid and broad-based expansion”. And underlying economic strength added to the Governing Council’s “confidence” that inflation will “gradually” move back to 2% target over medium term. But since underlying inflation remain subdued, without signs of sustained upward trend, “patience, persistence and prudence with regard to monetary policy remained warranted.”

Risks to outlook remain “broadly balanced”. But ECB pointed to “risks related to global factors, including the threat of increased protectionism”. ECB noted that those risks “had become more prominent and warranted monitoring with regard to their implications for the medium-term outlook for growth and prices.

ECB Praet: There are some clouds despite good economic conditions

ECB Chief Economist Peter Praet said in in an event in Brussels today that economic conditions in Eurozone remain good. Recent data softness was partly due to temporary factors and “supply constraints” only. But he noted “there are some clouds and we should be watchful because that can go into confidence in a more fundamental way.” Those clouds include the loose fiscal policy of Italy’s new eurosceptic government, as well as international trade tensions.

ECB Governing Council member Vitas Vasiliauskas also noted that geopolitical factors would be analyzed before the central bank make a decision on its asset purchase program. In particular, Vasiliauskas noted the markets have already reacted to the Italian government change. And he said ECB has to take that into account.

EU Katainen: US auto tariffs probe very difficult to understand

European Commission Vice President Jyrki Katainen respond to the Trump’s intention to impose new tariffs on automobile imports. Katainen criticized that would be “against the WTO” and “it’s very difficult to imagine it to create any sort of threat to national security. He reiterated that “it’s very difficult to understand”.

But he also noted that “we have now just heard what has been said and there is a long journey to the practice … We don’t expect this to further complicate the issue. We just have to find a solution that is fair.”

German Merkel welcomed in her visit to China

German Chancellor Angela Merkel is having a fruitful visit to China. Chinese Premier Li Keqiang said, in joint appearance with Merkel, that “China’s door is open” and welcome German vehicle makes to invest there. Li also pledged that “if they come across any problems during their investment, especially when it comes to legal protections, I can clearly tell you that China is striding forward to being a country with rule of law.”Li also said China has always supported a unified and prosperous Europe and that China and Germany uphold free trade.

Besides, Li also noted “the euro is an important choice in our foreign currency reserves, and so we are continuing to buy European debt.” And, “even when certain European countries had sovereign debt crises, China kept the broader picture in mind.”

In addition, Merkel also secured the support from China on the current Iran nuclear deal, despite US withdrawal.

GBP/USD Mid-Day Outlook

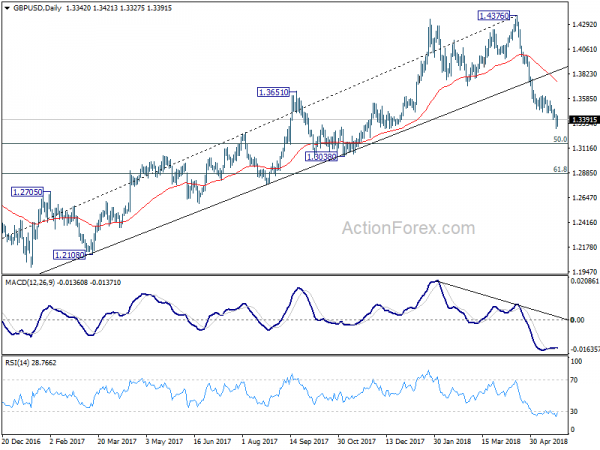

Daily Pivots: (S1) 1.3289; (P) 1.3366; (R1) 1.3427; More…

A temporary low is in place at 1.3303 in GBP/USD with today’s recovery. Intraday bias is turned neutral for consolidations first. Upside should be limited by 1.3617 resistance to bring fall resumption. On the downside, below 1.3303 will extend the decline fro 1.4376 to 50% retracement of 1.1946 to 1.4376 at 1.3161. Break will target 61.8% retracement at 1.2874. Nonetheless, firm break of 1.3617 will confirm short term bottoming and bring stronger rebound.

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4249). 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 should now be firmly taken out. Next target will be 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3761) holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance Apr | 253M | 198M | -86M | -156M |

| 06:00 | EUR | German GDP Q/Q Q1 F | 0.30% | 0.30% | 0.30% | |

| 06:00 | EUR | German GfK Consumer Confidence Jun | 10.7 | 10.8 | 10.8 | |

| 08:30 | GBP | Retail Sales M/M Apr | 1.60% | 0.80% | -1.20% | -1.10% |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (MAY 19) | 234K | 220K | 222K | 223 |

| 13:00 | USD | House Price Index M/M Mar | 0.10% | 0.50% | 0.60% | |

| 14:00 | USD | Existing Home Sales Apr | 5.55M | 5.60M | ||

| 14:30 | USD | Natural Gas Storage | 92B | 106B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals