Risk aversion is the general theme in European and Asian markets today while US futures point to lower open. But that’s not quite reflected in the currency markets. New Zealand Dollar is trading as the strongest one so far. Canadian Dollar also recovered some ground as markets await BoC rate decision. The central bank will most likely stand pat today and save the anticipated H2 rate hike for October. US-Canada trade talk will also restart but expectation is rather low. Dollar follows as the third strongest one.

Sterling is so far the worst performing one as this week’s selloff, on Brexit, extends. Stronger than expected PMI services couldn’t save the pound. Yen and Swiss Franc follow as the next weakest despite risk aversion. Easing worries over Italy is seen by us as a major factor. Italian 10 year bond yield drops sharply by -0.1351 so far today 2.896. Also, German 10 year bund yield is up 0.009 to 0.368. Now, spread at 300 is rather far away again. And recovery in German yield helps support Euro against Yen and the Franc.

Quick update: Sterling rebounds strongly as Bloomberg reports that both Germany and UK have dropped key Brexit demands, citing unnamed source. Additionally, there are signs of progress on the key sticky issue of Irish border. Also, even though there are oppositions to the Chequers plan, Bloomberg’s source said that such opposition isn’t necessarily an obstacle for the agreement.

Quick update 2: BoC kept overnight cash rate target unchanged at 1.50% as widely expected. Full statement here.

In the stock markets, at the time of writing, FTSE is down -0.37%, DAX down -0.68% and CAC down -0.98%. Earlier today, Hong Kong HSI closed down -2.61%, China Shanghai SSE down -1.68%, Nikkei down -0.51% while Singapore Strait Times fell -1.69%. WTI crude oil once again failed to stay above 70 handle and is now back below 69. Gold is now defending 1190 as near term consolidation extends.

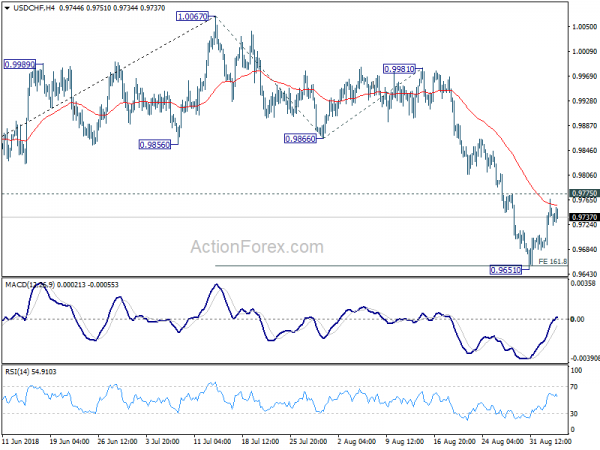

Technically, while Yen weakens today, the recoveries in both EUR/JPY and GBP/JPY are rather weak and corrective looking. From that, we’d expect Yen buying to resume not soon after. 1.1529 support in EUR/USD and 0.9775 resistance in USD/CHF will remain the levels to watch for confirming whether Dollar has the momentum to complete recent correction.

Released in the US session, Canada trade deficit narrowed to CAD -0.1B in July, smaller than expectation of CAD -0.8B. Labor productivity rose 0.7% qoq in Q2 versus expectation of 0.2% qoq. US trade deficit widened to USD -50.1B in July, worse than expectation of USD -47.6B.

Italian yield tumbles after Salvini pledged not to blow up public account

Italian 10 year bond yield drops sharply today as, Deputy Prime Minister Matteo Salvini reiterated the pledge not to blow up public accounts/ Salvini, leader of the far right League, said in a newspaper interview that “clearly we will not do everything in one shot, not even Italians expect that from us… If we want to run the country for a long period we cannot blow up its public accounts.” Additionally, another Deputy Prime Minister and Five-Star Movement leader, Luigi Di Maio also said “the budget law will be courageous and will keep accounts in order.”

Eurozone PMI composite finalized at 54.4, expansion looking increasingly uneven

Eurozone PMI services was finalized at 54.4 in August, unrevised, up from July’s 54.2. PMI composite was revised up to 54.5, up from July’s 54.3. Among the countries, Ireland PMI composite hit 7-month high of 58.4. German PMI composite hit 6-month high at 55.6. However, Italy PMI composite hit 22-month low at 51.7. Chris Williamson, Chief Business Economist at IHS Markit said that “recent run of robust growth of business activity, new orders and employment extending into August.” However, “expansion is looking increasingly uneven”. The survey data suggested that Eurozone GDP will at least match 0.4% as in Q2. But “downturn in optimism raises questions over whether this pace of growth can be sustained into the fourth quarter.”

Also from Eurozone, retail sales dropped -0.2% mom in July, below expectation of -0.1% mom.

UK PMI services rose to 54.3, but risk tilted to the downside

UK PMI services rose to 54.3 in August, up from 53.5, and beat expectation of 53.9. Markit noted in the released that there were stronger rises in business activity and new work. At the same time, input cost inflation accelerated, led by fuel prices and wage pressures. However, optimism towards the year-ahead business outlook was at lowest level since March.

Chris Williamson, Chief Business Economist at IHS Markit said that the survey data pointed to 0.4% growth in Q3. And, that’s “a relatively robust and resilient rate of expansion that will no doubt draw some sighs of relief at the Bank of England after the rate hike earlier in the month.” However, “business expectations for the year ahead meanwhile sank markedly lower… reflecting increased anxiety over Brexit negotiations.” And, “given the increasingly unbalanced nature of growth and the darkening business mood, risks to the immediate outlook seem tilted to the downside.”

Australia GDP grew 0.9% qoq, 3.4% yoy, Aussie lifted briefly

Australian Dollar was lifted notably by better than expected GDP data in Asian session. Q2 GDP rose 0.9% qoq, 3.4% yoy, comparing to expectation of 0.8% qoq, 2.8% yoy. That’s marked the 27th year without recession, and it’s the strongest in almost six years. Chief Economist for the ABS, Bruce Hockman, said: “Growth in domestic demand accounts for over half the growth in GDP, and reflected strength in household expenditure.”

Looking at the details, domestic demand rose 0.6% qoq, government expenditure rose 1.0% qoq, new dwelling investments rose 3.6% qoq. However, employee compensation grew only 0.7% qoq “due to a rises in the number of wage and salary earners and wage rates.”

The lift to Aussie is relatively brief however. While the GDP figure was strong, it’s not enough to trigger even a rethink of interest path of RBA. Policymakers are looking for sign of pick up of wage growth.

Also released, Australia AiG performance of services index dropped -1.4 to 52.2 in August. New Zealand ANZ commodity price dropped -1.1% in August. China PMI services dropped to 51.5 in August, down from 52.8.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9696; (P) 0.9732; (R1) 0.9778; More…..

USD/CHF is still staying in range below 0.9775 minor resistance and intraday bias remains neutral. With 0.9775 intact, another decline is mildly in favor. On the downside, break of 0.9651 will target 200% projection of 1.0067 to 0.9866 from 0.9981 at 0.8579 next. However, Firm break of 0.9775 will be an early sign of near term reversal. That is, fall from 1.0067 could have completed. In this case, further rally would be seen back to 0.9866 support turned resistance for confirmation.

In the bigger picture, current development suggests that rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggests that fall from 1.0067 has completed and rise from 0.9186 is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Aug | 52.2 | 53.6 | ||

| 01:00 | NZD | ANZ Commodity Price Aug | -1.10% | -3.20% | -3.30% | |

| 01:30 | AUD | GDP Q/Q Q2 | 0.90% | 0.80% | 1.00% | 1.10% |

| 01:30 | AUD | GDP Y/Y Q2 | 3.40% | 2.80% | 3.10% | |

| 01:45 | CNY | China PMI Services Aug | 51.5 | 52.7 | 52.8 | |

| 07:45 | EUR | Italy Services PMI Aug | 52.6 | 53.2 | 54 | |

| 07:50 | EUR | France Services PMI Aug F | 55.4 | 55.7 | 55.7 | |

| 07:55 | EUR | Germany Services PMI Aug F | 55 | 55.2 | 55.2 | |

| 08:00 | EUR | Eurozone Services PMI Aug F | 54.4 | 54.4 | 54.4 | |

| 08:30 | GBP | Services PMI Aug | 54.3 | 53.9 | 53.5 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jul | -0.20% | -0.10% | 0.30% | |

| 12:30 | CAD | Trade Balance (CAD) Jul | -0.1B | -0.8B | -0.6B | -0.7B |

| 12:30 | CAD | Labor Productivity Q/Q Q2 | 0.70% | 0.20% | -0.30% | -0.30% |

| 12:30 | USD | Trade Balance (USD) Jul | -50.1B | -47.6B | -46.3B | -45.7B |

| 14:00 | CAD | BoC Rate Decision | 1.50% | 1.50% | 1.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals