Digital banking: Moven app may be a nudge too far

There are now so many digital lenders being launched that it can be hard to differentiate one from the next. Most offer better interest rates than traditional banks, low foreign exchange fees and cashback protected by regulators and conveniently accessed...

Commerzbank is far from fixed

Much better than expected third quarter results at Commerzbank don’t change the harsh truth: Germany’s second biggest bank is going nowhere. Chief executive Martin Zielke’s new three-year strategy falls well short of what is necessary to revive it. Martin Zielke,Commerzbank...

Asset management: Moreau’s arrival underscores need for action at HSBC GAM

Nicolas Moreau’s arrival as chief executive of HSBC Global Asset Management (GAM) comes just days after Europe’s biggest bank removed its group chief executive, John Flint. Nicolas Moreau,HSBC It is further evidence that chairman Mark Tucker wants outsiders to bring...

Libor: Sonia and Sofr need term rates too

JPMorgan was in the market in late July with a $2.25 billion preferred stock deal. The non-call five notes pay a fixed rate of 5% until August 1, 2024, and then switch to a floating rate of three-month term secured overnight...

NAB chairman and CEO quit in Royal Commission fallout

Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry claimed its latest scalp on Thursday, when National Australia Bank’s chairman and chief executive both quit. CEO Andrew Thorburn will finish on February 28; chairman Ken Henry...

Romania’s misguided bank tax risks derailing economic recovery

Over the past decade, bank taxes have been gradually spreading across emerging Europe. Hungary led the way in 2010, when Viktor Orban’s new Fidesz government implemented a swingeing levy on sector assets. Slovakia followed suit two years later and Poland...

Turkish risk is heightened in fresh market jitters

Experts taking part in Euromoney’s Country Risk Survey took a dim view of Turkish prospects in 2018, resulting in a downgraded total risk score and lower investment ranking. The pessimism was justified in August when the lira took a tumble...

Why Moody’s is wrong to keep Cyprus on junk status

Cyprus is now into its fifth year of vigorous economic growth, after three years (2012-2015) of steep decline caused by the banking crisis, with little indication the trade-risk vulnerabilities affecting other eurozone markets will become a limiting factor. GDP has...

It is time to pick up the pace on Libor transition

There are many things to worry about in the capital markets, but the sluggish pace of the transition to new risk-free rates (RFRs) must be pretty high on everyone’s agenda at this stage. It is certainly high on the agenda...

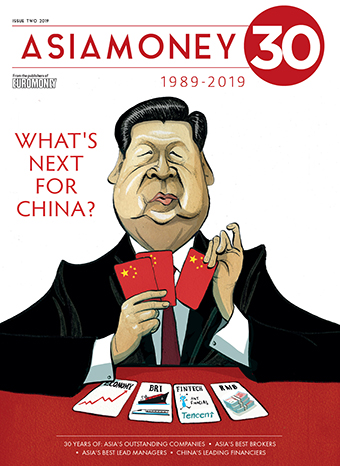

Finance: China goes from student to teacher

When Goldman Sachs asked Hank Paulson to be its man in charge of Asia in 1990, it was for a simple reason: he was based in Chicago, which meant he was slightly closer to the region than his investment banking...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals