One of the market’s oldest inflation hedges appears to be in the early stages of a comeback: gold.

As a decade of extraordinary policy unwinds at the Federal Reserve, the yellow metal may appear as an attractive option for investors looking to protect themselves from the eroding effects of inflation.

“We think that it is a good time to own the precious metals,” said Chris Gaffney, president of EverBank World Markets. “We are seeing a burgeoning middle class and more disposable income in India and China, which should lead to more physical demand.”

“At the same time, the volatility on the equity markets really has people looking at alternative assets that can hold their value in times of market turmoil,” he added.

Gold tends to perform best during periods of rising inflation, as investors look to precious metals as a store of value. With a strong economic outlook, market volatility and nascent signs of inflation, the Fed is likely to bump rates multiple times in 2018.

Spot gold held at $1,352.36 an ounce Thursday afternoon, a day after it climbed 1.6 percent in its largest one-day gain since May 2017, while U.S. gold futures traded at $1,355 an ounce, within $30 of a nearly four-year high.

The iShares Gold Trust exchange-traded fund jumped 1.5 percent after a Wednesday report from the Labor Department showed consumer prices rising at a stronger pace.

The consumer price index — which tracks prices in a variety of common consumer goods — rose 0.5 percent last month against projections of a 0.3 percent increase, the Labor Department reported Wednesday. Excluding volatile food and energy prices, the index was up 0.349 percent, it’s largest monthly increase since 2005.

But “key” wage data also has investors on edge, added EverBank’s Gaffney, who highlighted a recent Labor Department report that showed a surprising rise in wages. That jobs report sparked a widespread equity sell-off, sending the Dow Jones industrial average into correction territory as the yield on the 10-year Treasury note clinched four-year highs.

That, in turn, egged on gold.

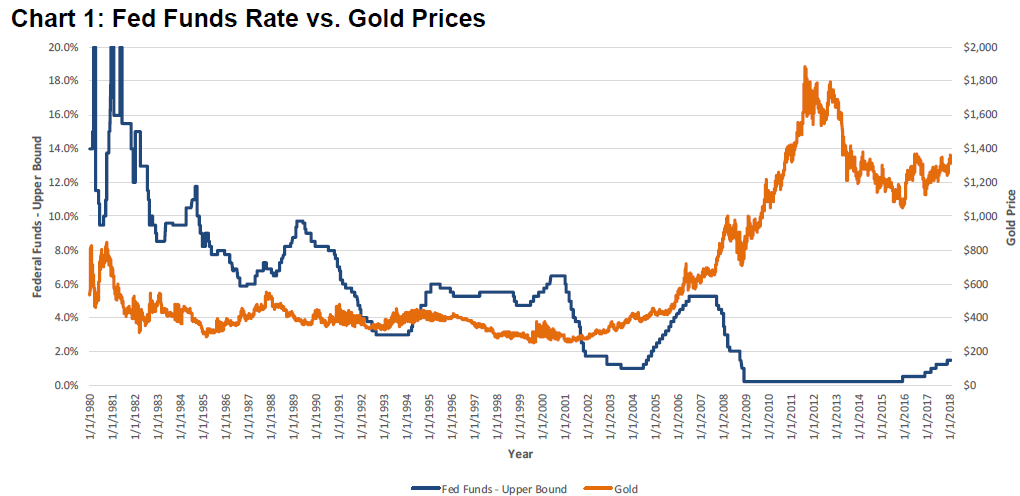

Source: CFRA

“Ultimately, the Fed has reason to be measured with interest rate increases, which will work in gold’s favor,” wrote CFRA strategist Lindsey Bell. “We see gold as a smart and defensive way to diversify a portfolio in the later innings of a bull market and ahead of what has historically been a volatile year as mid-term elections approach.”

To be sure, some portfolio managers aren’t as keen on precious metals just yet. Since its peak in 2011 – and despite aggressive quantitative easing by central banks – gold has hemorrhaged value as prices refused to budge. Gold futures remain more than 26 percent below those peak levels.

A common criticism levelled at gold bugs is that gold, unlike other safe assets like Treasurys, don’t provide a regular stream of coupon payments or dividends. Gold, in terms of trading, is strictly a play on capital appreciation.

“The problem with gold is it really trades off real interest rates. When real interest rates are low or negative, people like gold. When financial assets have a high real yield, then gold is disadvantaged,” said Jack Ablin, chief investment officer at Cresset Wealth Advisors. “If you’re concerned about volatility and interest rates are too low, I think gold could be a good diversifier near-term.”

“Gold works well for unexpected inflation,” he added. “And this is the most widely anticipated inflation I’ve ever seen.”

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals