ECB Reduces PEPP Purchases, Upgrades Inflation forecasts

The ECB meeting came largely in line with expectations. While leaving the policy rates unchanged, the members confirmed that the PEPP program would end in March 2022. Meanwhile, they have extended the reinvestment process and topped up the APP program,...

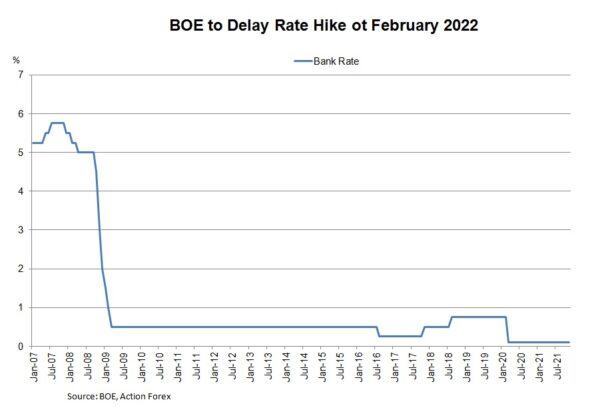

BOE Hikes Bank Rate, Surprising the Market Two Months in a Row

The BOE surprised the market in two consecutive months. After failing to deliver rate hike in November, the members surprisingly increased the Bank rate by +15 bps to 0.25% in December. Concerns over elevated trumped Omicron variant uncertainty. British pound...

Hawkish monetary policy. Fed Anticipates Rate Hikes Next Year

Hawkish monetary policy FOMC delivered a hawkish outlook at the December meeting. Besides doubling the size of tapering as we had anticipated, more than two-third of the members have projected at least 3 rate hikes next year. The latest economic...

ECB Preview – Phase-Out of PEPP by March as Scheduled

The focus of this week’s ECB meeting is whether the PEPP would extend beyond March 2020 in light of the new Omicron variant and rapid increase the number of coronavirus cases across Europe since the November meeting. Recent comments from...

BOE Preview – Delaying Rate Hike to February 2022

We expect the BOE to stand pat at this week’s meeting. October’s GDP came in weaker than expected, and the renewed restrictive measures to curb spread of the new Omicron variant could affect household consumption and put a brake on...

FOMC Preview – Fed to Double Size of QE Tapering

The Fed this week will announce acceleration of QE tapering. With inflation approaching 7%, policymakers would likely revise its view on inflation outlook and “retire” the word “transitory”. The updated economic projections and median dot plots showing members’ interest rate...

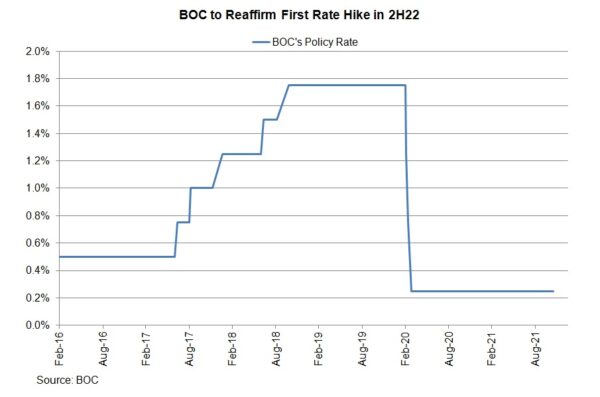

BOC Preview – Reiterating Rate Hike in First Half 2022 amidst Strong Economic Data

Following a hawkish move in October, we expect the BOC to keep the powder dry this week. Policymakers should acknowledge the strong GDP growth and job market data, while cautioning over the uncertainty of the Omicron variant. They are also...

RBA Stayed Put, Cautiously Optimistic Over Domestic Economy

The RBA left the cash rate unchanged at 0.1% and the asset purchase program at AUD 4B/week. Policymakers maintained a cautiously optimistic outlook over economic recovery despite Omicron uncertainty. Again, policymakers reiterated that the next meeting (February) would be the...

RBA Preview – Keeping Powder Dry on Mixed Data and Omicron Uncertainty

The RBA is widely expected to leave the cash rate unchanged at 0.1%. Given the mixed economic data flow since the last meeting, the uncertainty of the Omicron variant and the scheduled discussion about asset purchases in February, policymakers would...

Hawkish Powell Expects Fed to End QE Tapering a Few Months Earlier than Previously Anticipated

Despite concerns over the new coronavirus variant Omicron, Fed Chair Jay Powell’s testimony before the Senate was hawkish. He suggested that the Fed could accelerate the tapering of asset purchases in order to curb strong inflation. US dollar extended rally...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals