The week open relatively quietly again with Swiss Franc leading the way down, followed by Aussie and Kiwi. Dollar strengthens broadly but it’s again out shone by Japanese Yen. Asian markets are mixed with Nikkei trading down -0.8% at the time of writing. But HK HSI, China SSE are mildly up. The economic calendar is quite light today but volatility ahead is ensured with central bank meetings, important economic data and political events. In particular, Jerome Powell will announce the first Fed hike as chairman. US President Donald Trump could ignore all the objections and announce his tariffs on Chinese goods.

45 trade groups warn Trump: Don’t do something commercially meaningless and penalize Americans

45 trade groups wrote an open letter to Trump trying to stop him from starting a trade war with China. In a joint open letter, the group urged Trump’s administration to take “measured, commercially meaningful actions consistent with international obligations” and warned Trump not to “penalize the American consumer and jeopardize recent gains in American competitiveness.” It’s clear to the group of businesses what Trump is trying to do regarding tariff on China is not commercially meaningful.

The group also warned of the “chain reaction of negative consequences” of trade war with China by “provoking” retaliation. And Trump should not respond to unfair Chinese practices and policies by measures that will “harm U.S. companies, workers, farmers, ranchers, consumers, and investors.”

In particular, it’s listed out in the letter that

- Tariffs on consumer goods would raise price for consumers and business and “negating gains for American workers from U.S. tax reform.”

- Tariffs will also harm American companies that “sell component pieces of final products exported from China.”

- Also, tariffs would harm community services provides including “health care, education, and emergency responders.

- Tariffs on product components would “disrupting existing supply chains” and have “negative impact on American jobs”.

- Tariffs will also depress financial markets.

Additionally, the group warned that “imposition of unilateral tariffs by the Administration would only serve to split the United States from its allies”.

Here is a copy of the letter. And here is quick glance on the list of trade groups.

German economic minister Altmaier: Americans are “still” our allies”

German Economy Minister Peter Altmaier will meet with US Commerce Secretary Wilbur Ross this week, and “anyone in Washington who is willing to talk.” US steel and aluminum tariffs is the main focus on the trip for Altmaier. He warned that “what’s dangerous about the current situation is that it threatens a spiral of one-sided measures that contradict the idea of free trade.” And, “that would counter what we’ve done for the past 60 years. Altmaier also emphasized that “Americans are still our allies” and he’d want to prevent a trade war.

German Finance Minister Olaf Scholz will meet US Treasurer Steven Mnuchin at G20 finance head meeting in Buenos Aires. Scholz told the press that “we must think about how we can ensure growth for the future and of course also how we can keep one of the most important resources for future wealth — the possibility to trade freely — stable.” And, that’s why it would be difficult if protectionism played a bigger role now again.”

EU published retaliation list, up to EUR 6.4b of US imports

EU published a list of products for retaliation over US steel and trade tariffs last Friday. The total value of US imports to EU could add up to EUR 6.4b in total. There are two parts in the list. Part A includes goods that are worth EUR 2.8b and EU aim to impose 25% tariff. Part B include products that could be tariffed after three years. It’s believed that EU will notify the WTO as soon as possible within a 90-day deadline. For the time being, according to WTO rules, EU can only retaliate up to the amount of EU’s steel exports to the US, and thus that EUR 2.8b amount. But EU is making itself ready for further action, playing by the WTO book. Here is the list of products in case you’re interested.

Weidmann: Good economic developments allows quick end to QE

Bundesbank President Jens Weidmann said in a German newspaper interview that “I personally think that the good economic developments and the inflation forecast would allow a rapid end to the bond purchases.” Weidmann is always felt like the lone hawk in ECB board. Recent comments from other ECB officials generally remained cautious. For example, ECB President Mario Draghi just repeated last week that he still need to see further evidence of prices picking up towards target. And repeated that “monetary policy will remain patient, persistent and prudent.” Chief economist Peter Praet said last week that he didn’t even prefer to revise the ECB’s forward guidance too early.

BoJ: Needs to explain the difference between normalization and tightening

BoJ summary of opinions at March 8-9 policy meeting showed no change in the board’s stance on monetary policy. Generally speaking “powerful monetary easing” will be maintained as it’s “still a long way” to meet 2% inflation target. There were concerns of Yen’s appreciation and stocks’ decline as they would “constrain wages and prices” and risk delaying of meeting price target. CPI is expected to “continue on an uptrend” towards 2%, “mainly on the back of an improvement in the output gap and a rise in medium- to long-term inflation expectations.” The board also saw the need to explain the difference between “normalization” and “tightening” even though it’s not in the phase to consider normalization. That is, normalization is “gradually reducing the degree of monetary accommodation”. On the other hand, tightening ” aims at reducing the positive output gap.” So we’ll likely hear more rhetorics from BoJ Governor Haruhiko Kuroda ahead regarding exit. Yet he’ll repeat and repeat that it’s not there for exit yet.

Released from Japan, trade balance showed JPY -0.2% deficit in February, versus expectation of JPY -0.1T.

Busy week ahead with central banks, data and politics

The week ahead will likely be an exciting one with central banks, economic data and politics featured.

Three central banks will meet this week. Jerome Powell’s first FOMC meeting as Fed chair is the major focus. Fed is widely expected to raise federal funds rate by 25bps to 1.75%. Fed fund futures are pricing in 94.4% chance for that and there shouldn’t be any surprise. Focus will be on voting and new economic projections. In particular, known dove Chicago Fed Charles Evans might vote against the hike. The famous dot-plot could also reveal whether Fed officials have shifted their base case from three hikes to four hikes this year. BoE and RBNZ rate decision will likely be none events. In addition to that RBA will release meeting minutes while ECB will release monthly bulletin.

In the politics front, G20 meeting will start today with trade war and protectionism as a hot topic. Trump would possibly announce the tariffs on Chinese goods. Tariff talks between EU and US will likely generate some noises. EU is expected to approve the Brexit transition deal with the UK, with conditions attached.

Here are some highlights for the week ahead:

- Tuesday: RBA minutes, Australia house price index; Swiss trade balance, SECO economic forecasts; UK CPI, PPI; German ZEW; Canada wholesale sales

- Wednesday: UK employment; US current account, existing home sales; FOMC rate decision

- Thursday: RBNZ rate decision; Australia employment; Japan PMI manufacturing, all industry index; Eurozone PMIs, ECB bulletin; German Ifo; UK retail sales, BoE rate decision; US jobless claims, PMIs, house price index

- Friday: BoE quarterly bulletin; Canada CPI, retail sales; US durable goods, new home sales

AUD/USD Daily Outlook

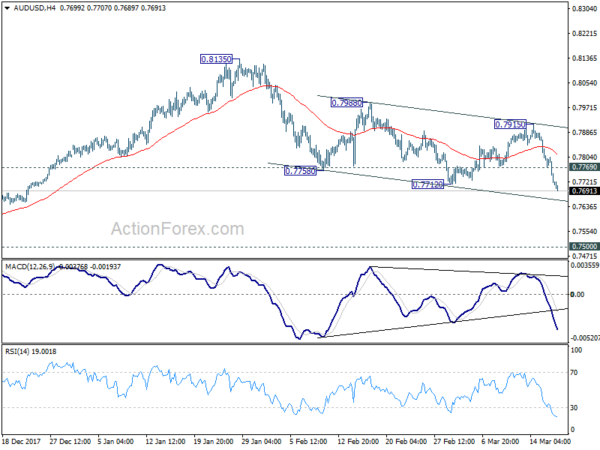

Daily Pivots: (S1) 0.7678; (P) 0.7740; (R1) 0.7773; More…

AUD/USD’s decline continues today and reaches as low as 0.7689 so far. Intraday bias remains on the downside for a test on 0.7500 key support next. We’ll keep an eye on sign of downside acceleration to gauge the chance of breaking 0.7500. On the upside, above 0.7769 minor resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 0.7915 resistance holds.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Trade Balance (JPY) Feb | -0.20T | -0.10T | 0.37T | 0.35T |

| 00:01 | GBP | Rightmove House Prices M/M Mar | 1.50% | 0.80% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 22.6B | 23.8B |

Link to the source of information: www.actionforex.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals