Italy political turmoil and trade tensions are weighing on market sentiments on two fronts. Italy will now likely go into a snap election soon. And the eurosceptic parties will frame that as referendum on Euro membership. US President Donald Trump reignites trade spat with China while NAFTA negotiation is going nowhere. More importantly, probably no one knows what’s coming next when temporary exemption on US steel tariffs expire on June 1, this Friday.

DOW closed sharply lower by -391.61pts or -1.58% at 24361.45 overnight. And, it’s having its sight on 24000 handle next. Asian market follow with Nikkei losing -1.5% at the time of writing. HK HSI is down -1.2%. The bond markets are even more volatile. US 10 year closed the regular session down -0.163 at 2.768. It hit as high as 3.115 just two weeks ago. German 10 year bund yield closed at 0.255 yesterday after hitting as low as 0.187. It’s less than half of May’s high at 0.651. On the other hand, Italian 10 year yield closed at 3.10 after hitting as high as 3.313, comparing to May’s low at 1.736. German-Italian spread broke 300 handle yesterday and could revisit it again today.

One more thing to point out is that markets are fast in paring back Fed rate hike expectations. Fed fund futures are now pricing in less than 80% chance of a June hike to 1.75-2.00%. And it was 100% just a week ago. For another hike to 2.00-2.25% in September, fed fund futures are pricing in only 40% chance. And it was over 80% a week ago.

– advertisement –

In the currency markets, Yen remains the strongest one for the week and is trading firmly in Asian session. Another safe haven currency Swiss Franc was uncertain and is mixed for the week. Dollar is the second strongest one for the week, thanks to flight for safety this time. Euro, naturally, trades as the weakest one for the week, followed by Aussie and then Canadian Dollar.

Technically, Yen crosses remains in near term down trend in general. USD/JPY’s strong break of 108.82 now opens up the case for deeper fall to 107.20 fibonacci level. USD/CHF recovers after touching near term trend line support and could be heading back up. EUR/CHF broke a key support level at 1.1445 and could be heading to 1.12 handle. The contrasting outlook in USD/CHF and EUR/CHF is worth some attention.

Cottarelli didn’t present cabinet to president Mattarella, possibly going to straight to snap election

Italian Prime Minister designate Carlo Cottarelli didn’t present his cabinet to President Sergio Mattarella at the meeting yesterday. The president’s spokesman Giovanni Grasso said that “the prime minister-designate met with the president and told him about the current situation. The two will meet again tomorrow morning.”

It’s obvious that the caretaker government won’t have enough confidence vote. Whether Cottarelli make up a list of ministers or not, an early election is the most likely outcome. It’s possible that Mattarella could dissolve the parliament in the coming days. With that, a snap election could be held as soon as July 29 or in early August. The anti-establishment parties could frame the election as a referendum on staying or leaving Euro.

Trump’s White House issued strong statement on China, unexpected yet expected

The White House issued strong worded statement regarding trade relationship with China yesterday.

From a fact sheet titled “President Donald J. Trump is Confronting China’s Unfair Trade Policies“, it’s said that “China has consistently taken advantage of the American economy with practices that undermine fair and reciprocal trade.” And it accused that “China has aggressively sought to obtain technology from American companies and undermine American innovation and creativity.”

The statement noted that “President Trump has taken long overdue action to finally address the source of the problem, China’s unfair trade practices that hurt America’s workers and our innovative industries.” And, “President Trump has worked to defend America’s intellectual property and proprietary technology from theft and other threats.”

Simultaneously, there’s another statement outlining the Steps to Protect Domestic Technology and Intellectual Property from China’s Discriminatory and Burdensome Trade Practices.

The Chinese Ministry of Commerce responded in a statement that the US statements were unexpected yet expected. It said the today’s statement contradict the consensus reached in Washington not long ago. And the MOFCOM pledged that “China has confidence, ability, and experience to safeguard the interests of the Chinese people and the country’s core interests. China urges the United States to act in accordance with the spirit of the joint statement.”

Canada PM Trudeau: No Nafta is better than a bad deal

Canadian Prime Minister Justin Trudeau dismissed the threat of auto tariffs of the US as “negotiating tactic” for NAFTA. And emphasized that won’t push Canada to accept a bad deal. He added that “quite frankly that’s simply not something we’re going to do.” Trudeau also reiterated that “no Nafta is better than a bad deal” and “we are not going to move ahead just for the sake of moving ahead.”

He also talked down the collapse of NAFTA negotiation and said “the interconnectedness between the Canadian and U.S. economies is not going to change any time soon” and “you can’t get around geography”. And, “we are their (the Americans’) number one customer and there is no question that any disruption of that flow of goods, yes, would be terrible for the Canadian economy but would also be pretty terrible for a lot of U.S. jobs.”

Canadian Foreign Minister Chrystia Freeland is in Washington meeting with US Trade Representative Robert Lighthizer. She said there were “very productive discussions” but declined to give any details. Asked about the temporary exemption on steel tariffs that’s going to expire this week, Freeland said “our government always is very ready and very prepared to respond appropriately to every action. We are always prepared and ready to defend our workers and our industries.”

Trump brought up the issue of border wall again yesterday and said Mexico “do absolutely nothing to stop people from going through Mexico, from Honduras and all these other countries … They do nothing to help us.” And he said “in the end, Mexico is going to pay for the wall.” Mexican President Enrique Pena Nieto responded in his tweet saying that “President @realDonaldTrump: NO. Mexico will NEVER pay for a wall. Not now, not ever. Sincerely, Mexico.”

To recap, there are a few deadlines for NAFTA negotiations to complete. Firstly, the temporary exemption on US steel and aluminum tariffs will expire on June 1 and it’s uncertain what will happen. Mexico Presidential election is upcoming on July 1. Timing is running out, or has already run out, for the current Congress to approve the new NAFTA deal within this year. And less pressing, the US has started national security investigation on automobile imports that could lead to new tariffs.

In the calendar – BoC to stand pat and offer no hint on hike

New Zealand building permits dropped -3.7% mom in April. Australia building approvals dropped -5.0% mom in April. Japan retail sales rose 1.6% yoy in April. UK BRC shop price dropped -1.1% yoy in May.

The calendar is extremely busy today. In European session, German retail sales, import price, unemployment and CPI will be featured. Swiss will release KOF leading indicator. France will release GDP revision. Eurozone will release confidence indications.

BoC is widely expected to keep interest rate unchanged at 1.25% today. Given the uncertainty around NAFTA, steel tariffs and the upcoming auto tariffs, the central is unlikely to give any hint on the timing of the next hike. Governor Stephen Poloz possibly doesn’t have a clue himself too. Canada will also release IPPI and RMPI as well as current account.

From US, Q1 GDP revision, trade balance, and ADP employment will be featured. Fed will also release Beige Book economic report.

EUR/JPY Daily Outlook

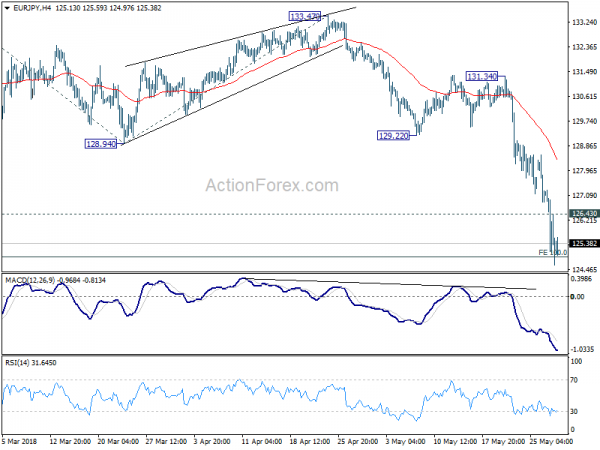

Daily Pivots: (S1) 124.30; (P) 125.80; (R1) 126.99; More….

EUR/JPY reached as low as 124.61 so far and breached 100% projection of 137.49 to 128.94 from 133.47 at 124.92. There is no sign of bottoming yet despite oversold condition in both 4 hour and daily RSI. Intraday bias remains on the downside. Sustained trading below 124.92 will pave the way to 161.8% projection at 119.63 next. On the upside, above 126.83 minor resistance will turn intraday bias neutral and bring consolidation first. But near term outlook will remain bearish as long as 128.94 support turned resistance holds.

In the bigger picture, the case of medium term trend reversal continues to build up. That is rise from 109.03 (2016 low) could have completed at 137.49 already. This is supported by bearish divergence in daily MACD current downside acceleration, as well as the break of 38.2% retracement of 109.03 to 137.49 at 126.61. Deeper decline should be seen to 61.8% retracement at 119.90 and below. This will be the preferred case as long as 128.94 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Financial Stability Report | ||||

| 22:45 | NZD | Building Permits M/M Apr | -3.70% | 14.70% | 13.00% | |

| 23:01 | GBP | BRC Shop Price Index Y/Y May | -1.10% | -1.00% | ||

| 23:50 | JPY | Retail Trade Y/Y Apr | 1.60% | 0.90% | 1.00% | |

| 1:30 | AUD | Building Approvals M/M Apr | -5.00% | -3.00% | 2.60% | 3.50% |

| 5:00 | JPY | Consumer Confidence May | 43.9 | 43.6 | ||

| 6:00 | EUR | German Retail Sales M/M Apr | 0.50% | -0.60% | ||

| 6:00 | EUR | German Import Price Index M/M Apr | 0.70% | 0.00% | ||

| 6:45 | EUR | French GDP Q/Q Q1 P | 0.30% | 0.30% | ||

| 7:00 | CHF | KOF Leading Indicator May | 104.7 | 105.3 | ||

| 7:55 | EUR | German Unemployment Change May | -10K | -7K | ||

| 7:55 | EUR | German Unemployment Claims Rate May | 5.30% | 5.30% | ||

| 9:00 | EUR | Eurozone Business Climate Indicator May | 1.3 | 1.35 | ||

| 9:00 | EUR | Eurozone Economic Confidence May | 112 | 112.7 | ||

| 9:00 | EUR | Eurozone Industrial Confidence May | 6.8 | 7.1 | ||

| 9:00 | EUR | Eurozone Services Confidence May | 14.3 | 14.9 | ||

| 9:00 | EUR | Eurozone Consumer Confidence May F | 0.2 | 0.2 | ||

| 12:00 | EUR | German CPI M/M May P | 0.30% | 0.00% | ||

| 12:00 | EUR | German CPI Y/Y May P | 1.90% | 1.60% | ||

| 12:15 | USD | ADP Employment Change May | 190k | 204k | ||

| 12:30 | CAD | Current Account Balance Q1 | -$18.15b | -$16.35b | ||

| 12:30 | CAD | Industrial Product Price M/M Apr | 0.60% | 0.80% | ||

| 12:30 | CAD | Raw Materials Price Index M/M Apr | 2.10% | |||

| 12:30 | USD | Wholesale Inventories M/M Apr P | 0.50% | 0.30% | ||

| 12:30 | USD | GDP Annualized Q/Q Q1 S | 2.30% | 2.30% | ||

| 12:30 | USD | GDP Price Index Q1 S | 2.00% | 2% | ||

| 12:30 | USD | Advance Goods Trade Balance Apr | -71.2B | -68.3B | ||

| 14:00 | CAD | BoC Rate Decision | 1.25% | 1.25% | ||

| 18:00 | USD | Federal Reserve Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals