Morgan Stanley’s chief U.S. equity strategist believes the stock market is in the midst of a cyclical bear market that could last through the end of next year.

“I think we’re in a rolling bear market. Every sector has gone down at least 11 or 12 percent at least once this year. Some were down 18, 19, 20 percent,” Mike Wilson, Morgan Stanley’s chief U.S. equity strategist, said on CNBC’s “Halftime Report” on Thursday. “It’s fooling everybody at the index level, but there’s a lot of pain out there: Staples, homebuilders, some of these semiconductor stocks that are more cyclical are having problems.”

The strategist’s comment came as the major market indexes added to their weekly losses, with the S&P 500 down 0.3 percent and the Dow Jones industrial average down nearly 1.2 percent since Tuesday. Markets were closed Monday for the Memorial Day holiday.

But while stocks were poised for a positive return for the month of May, volatility has plagued markets since the beginning of the year, with the Dow and S&P 500 both falling more than 10 percent from their highs at one point. In turn, the bumpy trading has signaled to many market gurus that aged bull market could finally be taking a breather.

While stocks remain above their lows notched earlier this year, Wilson explained his definition of a bear market varies from traditional Wall Street wisdom.

“A bear market to me doesn’t [necessarily] mean the market has to go down 20 percent,” he said. “A bear market is a tougher environment, it’s hard to make money. Volatility is a lot higher, so I don’t care what kind of portfolio you’re running, you can’t run as much risk anymore, you just can’t do it.”

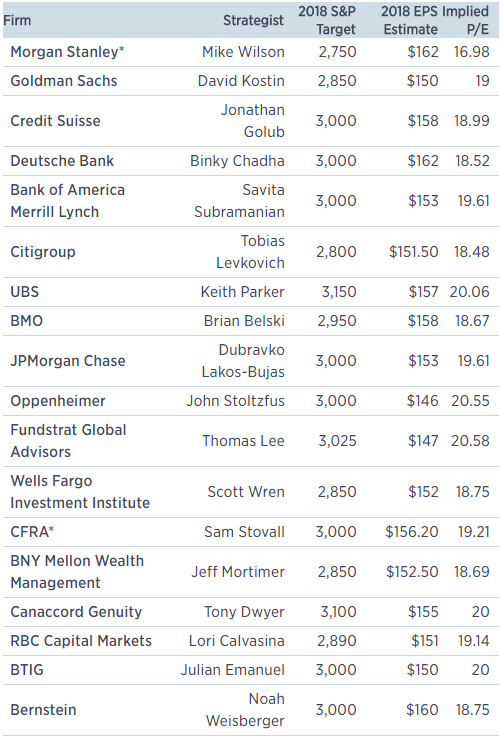

The most bearish strategist tracked by CNBC, Wilson has consistently forecasted that the S&P 500 will finish the year at 2,750, implying less than 1 percent upside for the broad market index over the remaining seven months. But the sluggish returns aren’t likely to abate anytime soon, Wilson warned, telling CNBC that the cyclical bear market “could last through the end of 2019.”

Many of Wilson’s comments Thursday echoed Morgan Stanley analysis earlier this month, when the bank told clients in a note that the “end of easy” investing was over.

“We think it’s pretty obvious that the market had discounted the news on tax cuts, global growth and still supportive financial conditions,” Wilson wrote. “In many ways a correction or consolidation was overdue and makes perfect sense. The question is whether or not this turns into something more sinister.”

Chief among Morgan Stanley worries have been a return of inflation, uncertain political outlook and tightening monetary policy, the lack of which helped fuel the unprecedented run in the U.S. stock market over the past nine years.

The firm lowered its global equity allocation from overweight to equal weight in the note.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals