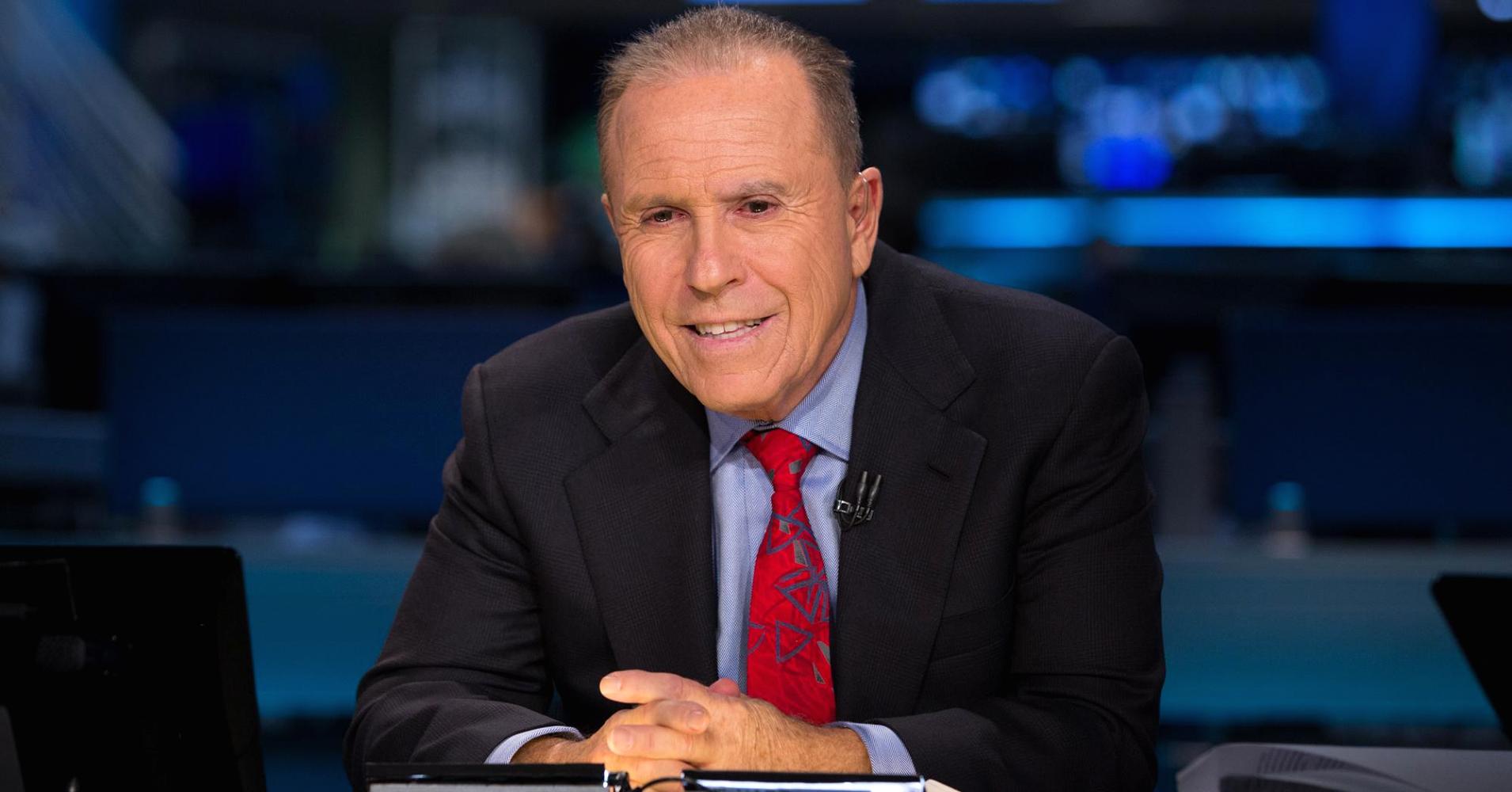

Noted value investor Bob Olstein is 100 percent behind the call by Warren Buffett and Jamie Dimon to end quarterly earnings guidance by companies.

“They should make it illegal to make specific quarterly earnings estimates. It leads to nothing that is good. They manipulate earnings to reach it. They take their eye off the football,” the chairman and chief investment officer at The Olstein Funds said Thursday on “Closing Bell.”

Buffett, chairman and CEO of Berkshire Hathaway, and Dimon, chairman and CEO of J.P. Morgan Chase, teamed up in a rare joint interview that aired on CNBC earlier in the day to explain their stance.

Executives often feel pressure to make quarterly forecasts, but “it can often put a company in a position where management from the CEO down feels obligated to deliver earnings and therefore may do things that they wouldn’t otherwise have done,” Dimon said.

Companies forecast sales and profit numbers to Wall Street analysts, who use them to produce research and stock recommendations for investors. Missing “the number” can often result in big, short-term stock moves. Making a forecast, and then hitting the target, are seen as a way to manage expectations and eliminate volatility.

However, Olstein has a different way to evaluate businesses.

“You value companies on a company’s ability to generate long-term free cash flow,” he said.

However, Romit Shah, a senior analyst at Nomura Instinet, said he is a big believer in corporate quarterly guidance.

That is what “gives us the opportunity to go through a checklist of items and actually see if these companies are executing the plans,” he told “Closing Bell.”

“In my mind it’s a question of transparency. More transparency is better than less transparency,” added Shah, who has been an analyst for 20 years.

Olstein believes it is the analyst’s job to come up with their own estimates.

— CNBC’s Liz Moyer contributed to this report.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals