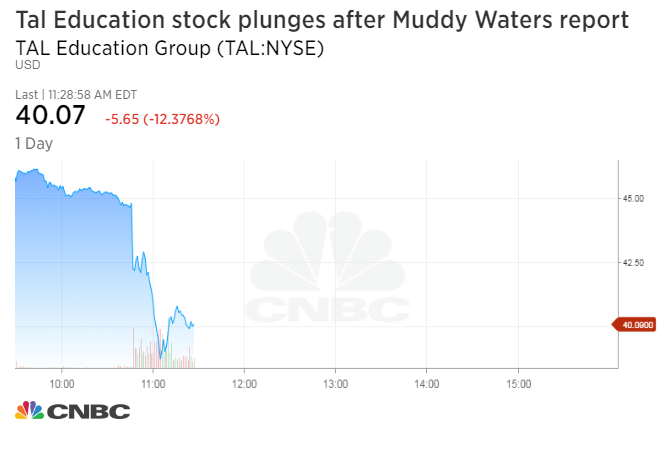

Shares of Chinese after-school operator Tal Education plunged Wednesday after short seller Carson Block compared practices at the company to the financial fraud at Enron.

The U.S.-listed shares of Tal briefly dropped more than 15 percent in morning trading. The stock remains more than 90 percent higher over the last 12 months.

Estimates indicate Tal has overstated net income by at least 43.6 percent for the last two fiscal years, Block’s firm Muddy Waters said in a release Wednesday.

“TAL combines the old school China fraud playbook of simply penciling in more favorable numbers with the more sophisticated asset parking fraud of Enron,” the short seller added in a report.

Muddy Waters cited its research into 1,000 pages of Chinese government files on various entities belonging to or associated with Tal, and third-party credit reports on many of those entities. Enron was a Houston energy company that collapsed in 2001 after an accounting scandal to hide financial losses sent the once-hot stock spiraling down.

Representatives for the Chinese company did not immediately respond to CNBC’s request for comment outside of Beijing business hours.

Block rose to prominence about seven years ago when Muddy Waters published a negative report on Chinese company Sino-Forest, which was ultimately delisted from the Toronto Stock Exchange.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals