Economic data and improving sentiments are the main drivers in the markets. Australian Dollar and New Zealand Dollar are so far the strongest ones today as European stocks rally. At this time of writing, FTSE is up 1.33%, DAX up 0.42% and CAC is up 0.97%. US futures also point to higher open. However, as the rebound in stocks is … just a rebound. Major global indices are still on track to close the week lower. Aussie and Kiwi are the second and third weakest ones for the week too. We won’t call that a “risk-on” market. Investors are squaring their positions, taking profits, ahead of the weekend. In particular, there are reports on White House split over the hardline response to trade war with China. Based on the erratic nature of Trump and his administration, we’ll neve know if there will be some surprises before next week.

Meanwhile, Canadian dollar suffers steep selling today after weaker than expected retail sales and CPI data. It’s also trading as the weakest one for the week. There are reports that OPEC is reaching an agreement in principle to raise output by 600k barrels a day, much lower than the worst case of 1-1.5m barrels a day. That could give oil prices a lift, but may not help the Loonie too much. Euro rises broadly today, except versus Aussie and Kiwi. PMIs show strong rebound in services which offset the slowdown in manufacturing.

Yen is trading broadly lower today, but it will still likely end the week as two of the strongest, along with Swiss Franc. Sterling, despite the BoE boost, is still down against Dollar, Euro, Yen and Swiss for the week.

Euro surges as PMIs point to solid 0.5% GDP growth, price pressures on the rise

Eurozone PMI manufacturing dropped to 55.0 in June, down from 55.5 and met expectation. PMI services rose to 55.0, up from 53.8 and beat expectation of 53.7. PMI composite rose to 54.8, up from 54.1 and beat expectation of 53.9. PMI composite is at a 2 month high while PMI services is at at 4-month high. However, PMI manufacturing is at an 18-month low. Overall, the data point to 0.5% GDP growth in Q2.

Markit Chief Business Economist Chris Williamson noted in the release that “an improved service sector performance helped offset an increasing drag from the manufacturing sector in June, lifting Eurozone growth off the 18- month low seen in May. With growth kicking higher in June, the surveys are commensurate with GDP rising 0.5% in the second quarter.” In addition, “price pressures are also on the rise again, running close to seven-year highs. Increased oil and raw material prices are driving up costs, but wages are also lifting higher, in part reflecting tighter labour markets in some parts of the region.”

Though, he also warned that “manufacturing is looking especially prone to a further slowdown in coming months, with companies citing trade worries and political uncertainty as their biggest concerns.” And, “risks remained tilted towards a further slowdown in the second half of the year.”

Also released, Germany PMI manufacturing dropped to 55.9 in June, down from 56.9 and missed expectation of 56.3. PMI services rose to 53.9, up from 52.1 and beat expectation of 52.2. PMI composite rose to 54.2, up from 53.4, and hit a 2-month high.

French PMI manufacturing dropped to 53.1 in June, down from 54.4 and missed expectation of 54.0. But PMI services rose to 56.4, up from 54.3 and beat expectation of 54.3. PMI composite rose to 55.6, up from 54.2, and hit a 2 month high.

Canada retail sales dropped -1.2%, ex-auto sales dropped -0.1%, core CPI moderated

Canadian Dollar drops sharply after very weak retail sales data. Headline sales dropped -1.2% mom in April versus expectation of 0.0% mom. Ex-auto sales dropped -0.1% mom versus expectation of 0.2% mom.

Inflation data is not helping neither. CPI rose 0.1% mom, 2.2% yoy in May, below expectation of 0.4% mom, 2.6% yoy. CPI core common was unchanged at 1.9% yoy. CPI core median dropped to 1.9% yoy, down from 2.1% yoy. CPI core Trim dropped to 1.9% yoy, down from 2.1% yoy.

Japan CPI Core unchanged, PMI manufacturing improved

Released from Japan, all items CPI rose to 0.7% yoy in May, up from 0.6% yoy. Core CPI, less fresh food, was unchanged at 0.7% yoy. Core core CPI, less fresh food and energy even slowed to 0.3% yoy, down from 0.4% yoy. The data highlighted BoJ’s inability to lift inflation and inflation expectation even with the ultra-loose monetary policy. And the central bank is still a long way from stimulus exit.

PMI manufacturing rose to 53.1 in June, up from 52.8, beat expectation of 52.6. Joe Hayes, Economist at IHS Markit note in the release that “the final PMI reading of the second quarter revealed a quickened pace of growth across the Japanese manufacturing economy. “The sector has sustained a relatively solid upward trend across 2018,” and “there appears to be further legs in the manufacturing growth cycle.”

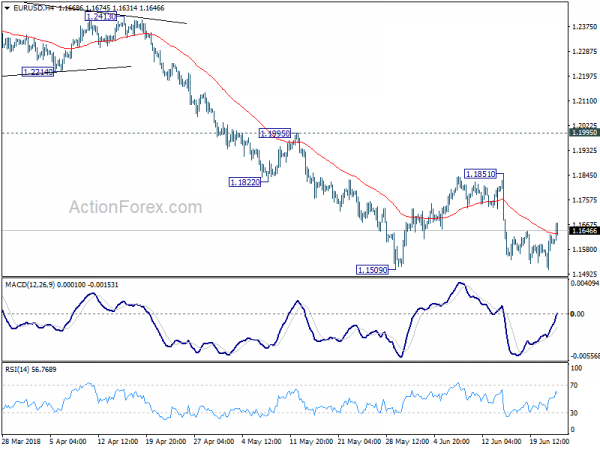

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1531; (P) 1.1582 (R1) 1.1655; More…..

EUR/USD rebounds to as high as 1.1674 so far today but outlook is unchanged. While further rise cannot be ruled out, upside should be limited below 1.1851 resistance to bring fall resumption. Firm break of 1.1509 low will resume larger decline from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186.

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y May | 0.70% | 0.70% | 0.70% | |

| 00:30 | JPY | Flash Manufacturing PMI Jun | 53.1 | 52.6 | 52.8 | |

| 04:30 | JPY | All Industry Activity Index M/M Apr | 1.00% | 0.90% | 0.00% | |

| 07:00 | EUR | France Manufacturing PMI Jun P | 53.1 | 54 | 54.4 | |

| 07:00 | EUR | France Services PMI Jun P | 56.4 | 54.3 | 54.3 | |

| 07:30 | EUR | Germany Manufacturing PMI Jun P | 55.9 | 56.3 | 56.9 | |

| 07:30 | EUR | Germany Services PMI Jun P | 53.9 | 52.2 | 52.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jun P | 55 | 55 | 55.5 | |

| 08:00 | EUR | Eurozone Services PMI Jun P | 55 | 53.7 | 53.8 | |

| 08:00 | EUR | Eurozone Composite PMI Jun P | 54.8 | 53.9 | 54.1 | |

| 12:30 | CAD | Retail Sales M/M Apr | -1.20% | 0.00% | 0.60% | 0.80% |

| 12:30 | CAD | Retail Sales Ex Auto M/M Apr | -0.10% | 0.20% | -0.20% | 0.00% |

| 12:30 | CAD | CPI M/M May | 0.10% | 0.40% | 0.30% | |

| 12:30 | CAD | CPI Y/Y May | 2.20% | 2.60% | 2.20% | |

| 12:30 | CAD | CPI Core – Common Y/Y May | 1.90% | 1.90% | ||

| 12:30 | CAD | CPI Core- Median Y/Y May | 1.90% | 2.10% | ||

| 12:30 | CAD | CPI Core- Trim Y/Y May | 1.90% | 2.10% | ||

| 13:45 | USD | US Manufacturing PMI Jun P | 56.2 | 56.4 | ||

| 13:45 | USD | US Services PMI Jun P | 54.9 | 56.8 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals