President Donald Trump is more than 19 months into an administration engulfed in so much controversy that it may overshadow a tremendous achievement, namely an economic boom uniquely his.

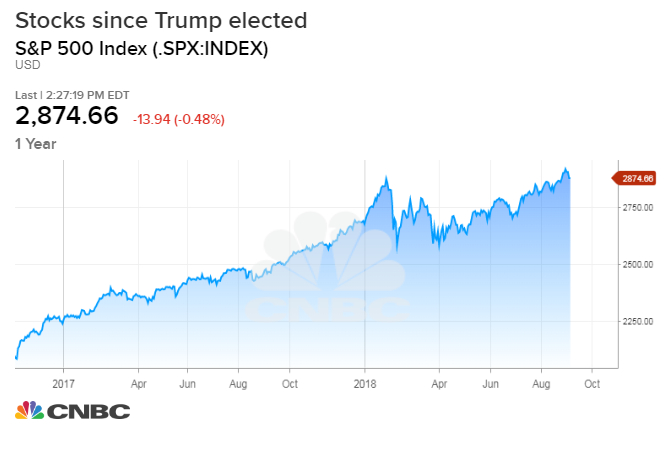

During his time in office, the economy has achieved feats most experts thought impossible. GDP is growing at a 3 percent-plus rate. The unemployment rate is near a 50-year low. Meanwhile, the stock market has jumped 27 percent amid a surge in corporate profits.

Friday brought another round of good news: Nonfarm payrolls rose by a better-than-expected 201,000 and wages, the last missing piece of the economic recovery, increased by 2.9 percent year over year to the highest level since April 2009. That made it the best gain since the recession ended in June 2009.

His critics, a group that includes a legion of Wall Street economists, most Democrats and even some in his own Republican Party, don’t believe it will last. They figure the current boom will begin petering out as soon as mid-2019 and possibly end in recession in 2020.

But even they acknowledge that the current numbers are a uniquely Trumpian achievement and not owed to policies already set in motion when he took office.

“I still believe the big story this year is an economic boom that most folks thought impossible,” Larry Kudlow, director of the National Economic Council and a chief advisor to Trump, said in a recent interview with CNBC.com. “I understand that he’s been in for a year and a half, but when you look at those numbers, this is not going away.”

Indeed, the economy does seem to be on fire, and it’s fairly easy to draw a straight line from Trump’s policies to the current trends.

Business confidence is soaring, in part thanks to a softer regulatory environment. Consumer sentiment by one measure is at its highest level in 18 years. Corporate profits, owed in good part to last year’s tax cuts, are coming close to setting records.

Each of those accomplishments can be tied either directly to new policies or at least indirectly through a brimming sense of hope from businesses that the White House is back on their side.

“When you look at those confidence indexes, they’re telling you something,” Kudlow said. “His attitude is, we’re not punishing business, we’re not punishing success, we want to make things easier to do business and to hire, and I think it’s had a very positive effect and a very palpable effect.”

GDP most recently gained 4.2 percent in the second quarter, the best performance in nearly four years.

At the same time, the unemployment rate is 3.9 percent, just one-tenth of a percentage point above the lowest level since 1969.

But there are some more telling figures about just how much progress has been made under Trump.

At a time when most economists had been using the term “full employment” to describe the economy, 3.9 million more Americans have joined the ranks of the working during the Trump term. During the same period under former President Barack Obama, employment had fallen by 2.6 million. The economy in total, while still not in breakout mode, has grown by $1.4 trillion through the second quarter under Trump; the same time period for Obama saw a gain of just $481 billion, or a third of Trump’s total.

Businesses are investing, consumers are spending and innovation is on the rise as well.

Trump pledged that he would pare down regulations that were choking business activity. While the actual moves toward deregulation haven’t been quite as ambitious as planned, the approach has won him converts in the business community.

The most recent reading from the National Federation of Independent Business was the second highest in history dating back 45 years. Small business owners reported aggressive hiring plans, the only obstacle to which has been a dearth of labor supply. The end of June saw 6.7 million job openings and just 6.6 million Americans classified as unemployed, an unprecedented imbalance.

“Expansion continues to be a priority for small businesses who show no signs of slowing as they anticipate more sales and better business conditions.” NFIB President and CEO Juanita Duggan said in a statement.

Trump’s economic program was very simple: an attack on taxes and regulations with an extra dose of spending on infrastructure and the military that would create a supply shock to a moribund economy.

On the tax side, the White House pushed through a massive $1.5 trillion reform plan that sliced the highest-in-the-world corporate tax from 35 percent to 21 percent and lowered rates for millions of taxpayers, though the cuts for individuals will expire in 2025.

On deregulation, Trump ordered that rules be pared back or eliminated across the board. During his time in office, Congress has cut back on the Dodd-Frank banking reforms, particularly in areas affecting regional and community institutions, rolled back a multitude of environmental protections that he said were killing jobs and took a hatchet to dozens of other rules. (The left-leaning Brookings Institution think tank has a rolling deregulation tracker that can be viewed here.)

During the first year of his administration, “significant regulatory activity” had declined 74 percent from where it was in the same period of the Obama administration, according to data collected by Bridget Dooling, research professor at GW’s Regulatory Studies Center.

The Dodd-Frank rollbacks have been particularly helpful to community banks, whose share prices collectively are up more than 25 percent over the past year. Small-cap stocks in general have strongly outperformed the broader market, gaining 23 percent over the past 12 months at a time when the S&P 500 is up 17 percent.

The Federal Register, where business rules are stored and thus serves as a proxy for regulatory activity, was 19.2 percent smaller from Inauguration Day until Aug. 16 under Trump than during the same period for Obama.

“You can think of that as turning off the spigot of new regulations,” Dooling said in an interview. She said more aggressive movement appears to be on the way.

Dooling said recent regulatory changes from the Environmental Protection Agency and the departments of Education and Labor will advance deregulation in an even “more meaningful way.”

In addition to expected deregulation benefits, there’s also anticipation that the true benefits of tax cuts have yet to kick in. Mick Mulvaney, head of the Office of Management and Budget, recently told CNBC that he attributes the bulk of new economic growth to deregulation rather than the tax cuts, whose benefits he expects to come later.

“It’s still too early to tell. We haven’t seen any of the multipliers yet from tax reform,” said Jacob Oubina, senior U.S. economist at RBC Capital Markets. “We have enough in terms of ammunition to put in 3 percent growth for the rest of this year and even all of 2019, but we haven’t seen sort of this spike in activity yet.”

There’s been another interesting trend that is peculiar to the Trump economy: a drifting of benefits from urban centers to nonmetropolitan areas, which are seeing their first collective population growth since 2010.

Trump’s tax cuts “should deliver greater tax relief to rural areas where there is a higher rate of small business owners who will benefit from the favorable pass-through tax rates,” Joseph Song, U.S. economist at Bank of America Merrill Lynch, said in a recent note to clients.

His critics don’t believe it will last. They figure the current boom will begin petering out as soon as mid-2019 and possibly end in recession in 2020.

“This is temporary. In fact it’s raising the odds of recession on the other side,” said Mark Zandi, chief economist at Moody’s Analytics. “The economy is now more cyclical because of the stimulus. You’re doing a lot of near-term growth, but you’re setting up for a tough time on the other side of it. That’s why most economists think we have a recession in 2020, because of these policies.”

There is plenty to worry about: A ballooning debt that will only get worse if Trump’s growth predictions don’t materialize, the increasing likelihood of a trade war that sparks inflation and punishes U.S. companies that depend on exports, and a suddenly slowing real estate market that could be pointing to larger issues at the heart of the economy.

Indeed, while Trump has preached fiscal discipline, he has not practiced it. The U.S. economy is carrying a $45 trillion debt load that continues to grow under Trump. Government debt has swollen by $1.46 trillion in Trump’s 19 months, an increase of 7.3 percent, to $21.4 trillion. The public owes $15.7 trillion of that debt, an increase of 9 percent.

Government debt since 2009

There also are some pockets of the economy that remain mired in slowness, most notably wage gains. Average hourly earnings have risen just 4.1 percent since January 2017 when Trump took office, barely keeping pace with inflation. (Still, during the same period wages rose just 3 percent under Obama.)

Then there’s the Federal Reserve, which cut rates and flooded the financial system with cash during the Obama years. Now it is reversing course and tightening, or raising rates.

“The short answer is the honest answer: Nobody knows,” Joe LaVorgna, chief economist for the Americas at Natixis, said in assessing the duration of the Trump bump. “If we generate 3.5 percent this year and generate 3.5 percent next year, that could happen provided the Fed doesn’t kill it. Then you’re going to say it looks like some of it was Trump. It has to be.”

With midterm elections fast approaching, Trump’s economic record will be front and center. The strong performance could bolster Republicans’ hopes as the GOP tries to hold onto control of both the House and the Senate.

So far, though, the experts have gotten it wrong about Trump.

LaVorgna said the final verdict in assessing the Trump performance is yet to come.

When Obama took criticism for the performance during his years, he often blamed obstructionist Republicans.

If the economy falters now, Trump will have no one to blame but himself.

“It’s very hard to disentangle all these effects,” he said. “If we do get 3 percent growth, which we haven’t had since 2005, you have to give credit where it’s due. Whether it lasts, who knows?”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals