[Part 1 of our analysis dealt with group and CIB results; part 2 was about DCM, ECM and advisory]

FICC

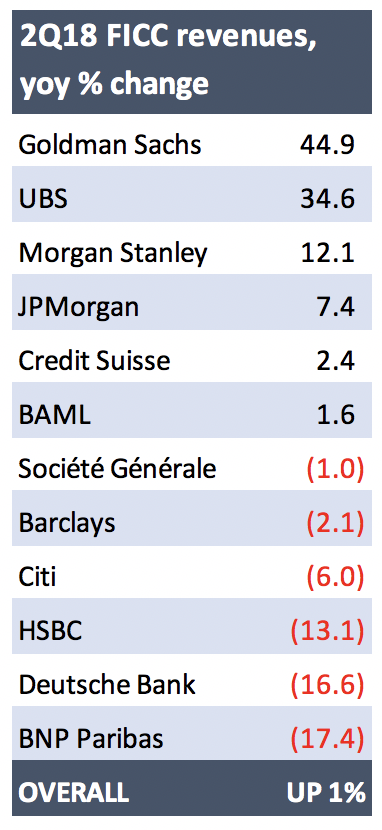

2Q18: UP 1%

Biggest rise: Goldman Sachs (45%)

Biggest fall: BNP Paribas (-17%)

TTM: DOWN 11%

Smallest fall: Credit Suisse (-2%)

Biggest fall: BNP Paribas (-26%)

What an odd quarter for fixed income businesses. It was one where the divergence in US and European conditions came to the fore, with the ability to make money in parts of European FICC severely constrained by continued quantitative easing. Commodities businesses generally rose but some firms have exited the business after past problems. Credit was often weak.

It was also a quarter where the aggregate result completely failed to reflect the industry. Revenues rose 1% to $18.7 billion at the 12 banks, but that apparent flatness concealed double-digit gains at three firms and double-digit falls at three others! Aggregate TTM is just below FY17 at the moment – and well down from FY16. But the first half of 2018 has matched the same period last year, so a better full year is certainly possible.

2Q18: The story of the quarter was of course Goldman Sachs, which has engineered a recovery from its terrible 2017 in FICC in some style. It says that this is partly down to the franchise-diversifying revenue generation efforts it announced last year, but it has also been helped by a return of volatility at the right time. In some ways more striking though is UBS’s 35% uptick, well above any other firm’s increase and admittedly off a base that is the smallest of the 12.

JPMorgan remains the biggest business. Its 7% rise was a surprise to some, after an update that had suggested things might be flattish. One analyst was brave enough to ask Jamie Dimon what had changed in the last month of the quarter. Predictable answer: “It got better.”

At the other end of the scale, some of the Europeans – HSBC, Deutsche, BNP Paribas – had a torrid time. FX movements hurt them, as did European conditions. Citi being down 6% looks disappointing, but the previous year’s period had been boosted by strong performances in G10 rates and securitised products. (Note that BNPP reports its non-corporate DCM business inside FICC.)

TTM: If there was a split in the quarterly results, there certainly wasn’t in the last 12 months. Every firm is down – the only one of these business lines where that is the case – from 2% at Credit Suisse to 26% at BNPP. The universe is down 11%, to $72 billion.

EQUITIES

2Q18: UP 11%

Biggest rise: Barclays (32%)

Biggest fall: HSBC (-18%)

TTM: UP 9%

Biggest rise: Bank of America Merrill Lynch (15%)

Biggest fall: Deutsche Bank (-14%)

Equities was an altogether more even business in 2Q18 than fixed income, with strength in cash, prime service and flow derivatives (note that UBS reports corporate equity derivatives in ECM and SG reports ECM in equities). Revenues were up at almost all firms, with the group as a whole rising 11% year-on-year to $13.6 billion.

The quarter was down on 1Q18, but was otherwise the best since 1Q15 and banks reported strong investor client activity and higher volatility all round. And after a lacklustre FY17, we could be on track for a better year. Deutsche is the only firm where TTM revenues are below FY17, and aggregate TTM revenues for the 12 banks are above 2015, 2016 and 2017.

2Q18: The biggest mover was Barclays, with a 32% jump that reflected its US exposure in comparison with some European peers. The biggest faller was HSBC, which duly suffered from having a smaller US franchise, as well as more exposure to a weaker Asia and emerging markets in general. HSBC was also coming off a good second quarter in 2017, when it had posted a year-on-year rise of 25%, so this year’s number needs to be seen in that light.

And in any case, HSBC’s is the smallest business of the lot. Market leader Morgan Stanley is nine times bigger – and explicitly cited European equities as an area of strength, which was in contrast to some European firms’ apparent experiences. Deutsche was down, but there are a few encouraging signs in places: it has cut leverage exposure in prime finance, for instance, but without losing revenue – which it says is down to repricing and moving into higher margin exposure.

TTM: 12-month revenues were up 9% to just under $50 billion, with just three firms falling. Goldman’s low growth of 4% and flat quarterly number suggest it’s missing out on something. That’s unusual for Goldman, but it remains the second biggest. BAML’s equities business is finding more consistent growth than in primary ECM – and its markets businesses in general tend to operate on lower VaR than peers.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals