Yen opened the week mildly higher as Asian markets are generally soft on risk aversion, after Trump warned of tariffs on additional USD 267B in Chinese imports on Friday. However, Nikkei is rather immured from trade threats for today, despite Japan being named the next target. But after all, with the exception of selloff in New Zealand Dollar, the forex markets are generally in range. The fact that Australian Dollar follows Yen as the second strongest says it all. Traders are waiting for the markets to come back to life in European session, when some important UK data are scheduled to release.

At the time of writing, Nikkei is trading up 0.13% and is set to end the day with slight gain. On the other hand, China Shanghai SSE is down -0.73%, Hong Kong HSI is down -1.09% and Singapore Strait Times is down -0.58%. In particular, SSE, now at 2683, is very close to August low at 2683 and key support level at 2638 (2016 low). Break of these levels will certainly spill over to other Asian markets. Gold is trading at 1193 as recent consolidation extends. But 1182.90 near term support neve is safe and more upside is still expected through 1214.30 at a later stage.

Technically, EUR/USD will is facing 1.1529 near term support again. Break there will indicate completion of recent rebound from 1.1300 and deeper decline would be seen back to retest this low. However, how the forex markets would reaction elsewhere is uncertain. EUR/USD’s fall could be triggered by another selloff in EUR/GBP, which is reversing recent rally. Or, it could be triggered by selloff in EUR/CHF which is extending the decline from 1.2004 and took our 1.1200 already. Meanwhile, GBP/USD and GBP/JPY are staying in tight range last week. Today’s UK data may finally prompt a breakout.

Boston Fed Rosengren: There’s an argument to normalize policy, and probably be mildly restrictive

Boston Fed President Eric Rosengren reiterated on Saturday that it’s time to bring interest rate back to “normal” level. He told reporters after an economic conference that “here is upward pressure on inflation, and given that we are already at 2 percent, labor markets are already tight … that is going to be a situation where we start persistently having inflation above what our target is.” And he noted, “there is an argument to normalize policy and probably be mildly restrictive.”

Rosengren also added that recent job and growth data were increasingly “inconsistent” with the estimates of a low neutral rate. And, “it would not surprise me at all if the committee estimates (on neutral rate) … go up over time.” And, if those estimates rise, “you would expect the path to move as well.”

US Agriculture Secretary Perdue: Class 7 has to go for a NAFTA deal

As White House economic advisor Larry Kudlow repeated many times, “milk” is the key word in NAFTA renegotiation. This was echoed by US Agriculture Secretary Sonny Perdue in a TV interview aired on Sunday. Perdue said “our farmers don’t have access to the Canadian markets the way that they have access to us. Class 7 has to go. It can’t be renamed something or called something else.”

Class 7 is a new milk class created by Canada to price milk ingredients such as protein concentrates, skim milk and whole milk powder. Perdue added the class “allowed them to export milk solids on the world market and below prices that cut into our opportunity for our dairy people to have access to that world market.”

Canadian Foreign Minister Chrystia Freeland insisted over the weekend that to reach a deal, “it’s going to take flexibility on all sides.” She didn’t respond to Kudlow’s comments by pointed out that he is “not at the negotiating table”.

Italian EM Tria: Makes no sense to borrow more on higher yields

Italian Economy Minister Giovanni Tria pledged on Sunday that the coalition will respect EU fiscal rules. And, more progressive budget plans would only be introduced gradually. The programs include both a new welfare tool advocated by the Five Star Movement and tax cuts promoted by the League. But he emphasized that “almost all reforms will start to be implemented gradually.” And, “we are looking into Italy’s big state balance sheet to find financial resources to be shifted toward these measures.”

Also, he acknowledge the need to bring down the 130% debt to output ratio, which is the second highest in Eurozone. And such reduction “may bring about a strengthening and consolidation of Italy’s presence on financial markets, which will free up resources and attract investments.”He added “it makes no sense to seek two or three billion euros of extra deficit if we then have to pay three or four billion more due to higher yields”. Further, “as the government puts words into actions, the (bond yield) spread will return to more normal levels.”

Italian 10 year yield dipped notably from August high at 3.281 after the coalition government pledged not to break the bank. But, currently above 3%, it’s still notably higher than 1.75-2.00% range before the coalition took office.

Japan PM Abe: Trade fights no benefit anyone, will proceed with sale tax hike

Facing trade threats from the US, Japanese Prime Minister Shinzo Abe kept his cool today and note that trade fights do not benefit any country. Japan is clearly the next trade target of Trump, who pull out of the Trans Pacific Partnership as the first “achievement” after taking office. Japan has been clear in insisting on promoting multilateral frameworks despite requests from the US on bilateral trade deals. Trump warned on Friday that “if we don’t make a deal with Japan, Japan knows it’s a big problem.”

Additionally, Abe would proceed with the planned sales tax hike in October 2019 and carry out fiscal reforms. He said that “we will carry out fiscal consolidation and want to raise the sales tax as planned” to 10 percent, in a kick off news conference for his LDP leadership campaign. Abe added that he’s learned a lesson from the 2014 sales tax hike and pledge with measures to ease consumptions.

Released from Japan today, Q2 GDP was finalized at 0.7% qoq, revised up from 0.5% qoq. GDP deflator rose 0.1% yoy, unrevised. Current account surplus narrowed to JPY 1.48T in July.

China bought more from others, but export growth to US steady

Trade data released on Saturday from China showed that with Trump’s trade threats, it’s quickly moving to other regions like EU and Australia for imports. At the same time, exports growth to the US maintained similar pace. It’s still early to tell. But t Trump’s trade policy failed for another month.

China increased imports from other regions in August like EU (10.6% yoy) and AU (34.0% yoy). Import from US slowed drastically to 2.7% yoy. On the other hand, exports to the US still grew steadily at 13.2% yoy comparing to EU (8.3% yoy) and AU (23.3% yoy). In the end, trade surplus with the US grew 18.4% yoy. And, trade surplus with EU just rose 4.0% yoy. Trade deficit with AU has indeed jumped 45.7% yoy. More details found in this quick note.

Also from China, CPI accelerated 0.1% to 2.2% yoy in August PPI slowed by 0.5% to 4.1% yoy.

ECB and BoE to highlight the week ahead

ECB and BoE meeting will catch most attention today. In particular, ECB is expected to reiterate that the monthly asset purchase will be tapered from EUR 30B to EUR 15B starting November. It’s on track to stop asset purchases after December. But interest rates will stay at present level through the summer of 2019. The more interesting part could be the new economic projections. More in ECB to Affirm QE Reduction from October and Downgrade Inflation Forecasts. BoE, will very likely be a non-event.

In addition, there are some data to look into, including UK GDP, productions and employment, US inflation and retail sales, German ZEW, Australia employment. There will also be a bunch of Chinese data featured. Here are some highlights for the week:

- Monday: Eurozone Sentix investor confidence; UK GDP, productions, construction output

- Tuesday: Japan tertiary industry index, machine tool orders; UK employment; German ZEW economic sentiment; Eurozone employment change; Canada housing starts

- Wednesday: Japan BSI manufacturing; Australia Westpac consumer sentiment; Eurozone industrial production; US PPI; Fed’s Beige Book report

- Thursday: Japan machine orders, Japan PPI; Australia employment; German CPI final; Swiss CPI; BoE rate decision; ECB rate decision; US CPI, jobless claims

- Friday: New Zealand Business NZ manufacturing index; China fixed asset investment, industrial production, retail sales, unemployment rate; Eurozone trade balance; US retail sales, import prices, industrial production, business inventories and U of Michigan sentiment

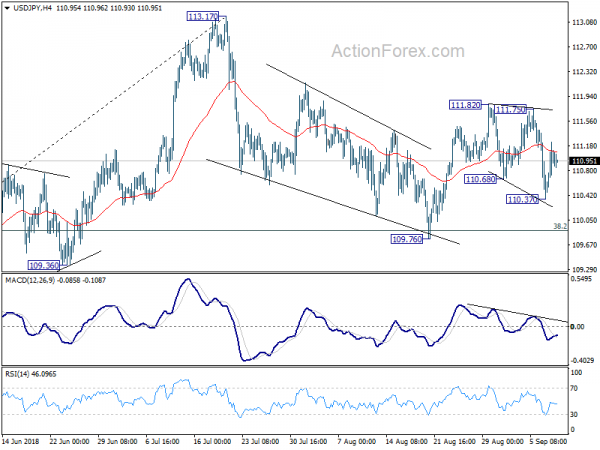

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.56; (P) 110.90; (R1) 111.43; More…

Intraday bias in USD/JPY remains neutral at this point. On the upside, break of 111.73 minor resistance will resume the rebound from 109.76 to retest 113.17 high. Break there will resume larger rise from 104.62. On the downside, below 110.37 will bring deeper fall. But still, we’d expect strong support from 38.2% retracement of 104.62 to 113.17 at 109.90 to contain downside and bring rebound.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Activity Q2 | 1.80% | 0.60% | 0.70% | |

| 23:50 | JPY | GDP Q/Q Q2 F | 0.70% | 0.70% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | 0.10% | 0.10% | 0.10% | |

| 23:50 | JPY | Current Account (JPY) Jul | 1.48T | 1.56T | 1.76T | |

| 1:30 | CNY | CPI Y/Y Aug | 2.20% | 2.10% | 2.10% | |

| 1:30 | CNY | PPI Y/Y Aug | 4.10% | 4.10% | 4.60% | |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Sep | 13.8 | 14.7 | ||

| 8:30 | GBP | Visible Trade Balance (GBP) Jul | -11.7B | -11.4B | ||

| 8:30 | GBP | Industrial Production M/M Jul | 0.40% | 0.40% | ||

| 8:30 | GBP | Industrial Production Y/Y Jul | 1.00% | 1.10% | ||

| 8:30 | GBP | Manufacturing Production M/M Jul | 0.30% | 0.40% | ||

| 8:30 | GBP | Manufacturing Production Y/Y Jul | 1.50% | |||

| 8:30 | GBP | Construction Output M/M Jul | -0.40% | 1.40% | ||

| 8:30 | GBP | GDP M/M Jul | 0.20% | 0.10% | ||

| 8:30 | GBP | Monthly GDP 3M/3M Change Jul | 0.60% | 0.40% | ||

| 8:30 | GBP | Index of Services 3M/3M Jul | 0.50% | 0.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals