A tug-of-war between student borrowers hoping to get tens of thousands of dollars in loans they took out for their education discharged and the government may be a step closer to resolution.

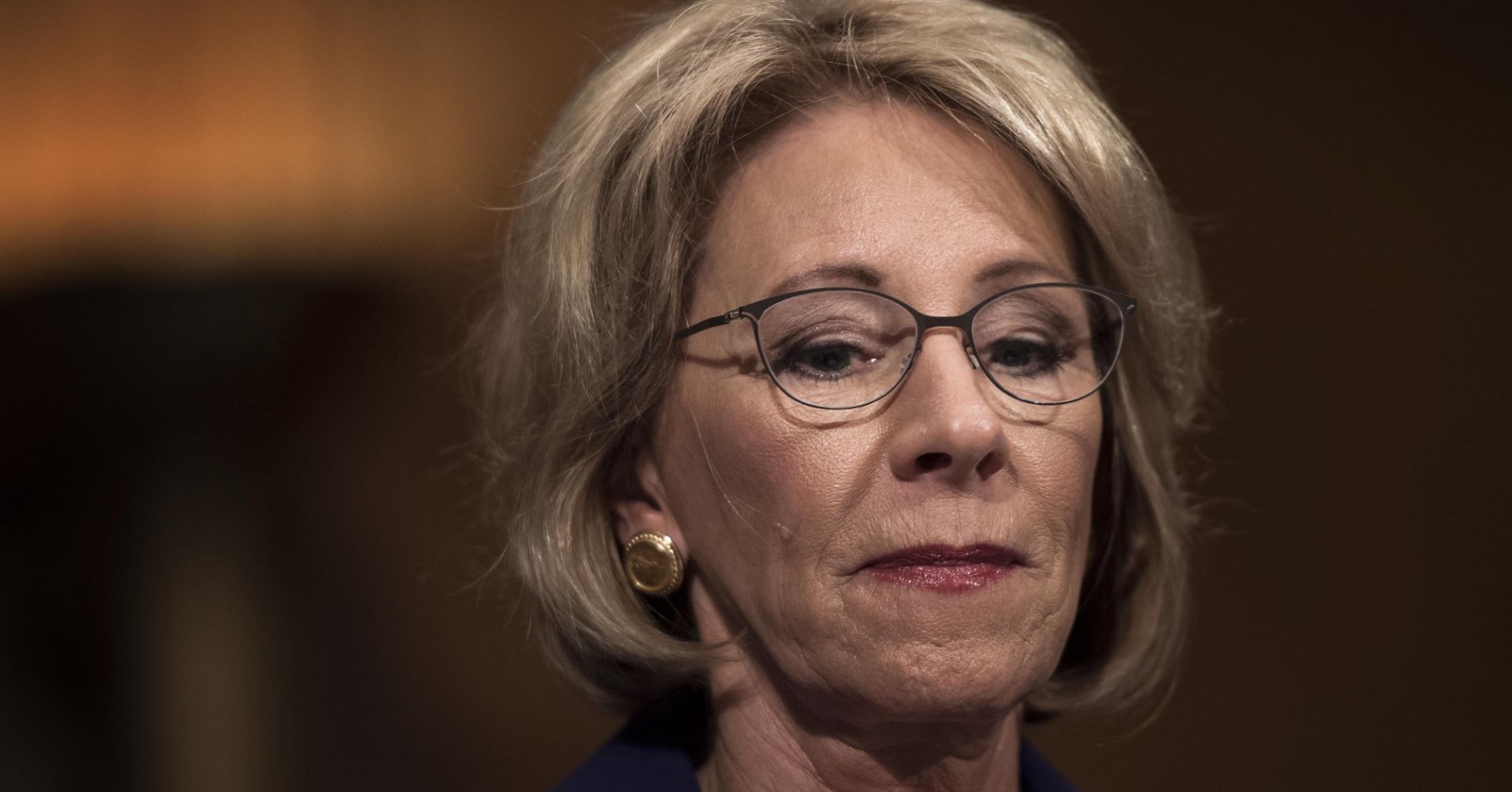

A federal judge ruled this week that repeated delays by Education Secretary Betsy DeVos of an Obama administration plan to provide debt relief to defrauded borrowers was unlawful.

Judge Randolph D. Moss, a federal judge in Washington, D.C., said on Wednesday the Department’s action was arbitrary and capricious.

“We think this is an incredibly important ruling both for cheated student loan borrowers and anyone who cares about the government under the rule of law instead of under the thumb of a predatory, for-profit college industry,” said Toby Merrill, director of the Harvard Law School’s Project on Predatory Student Lending.

More from Personal Finance:

Strong economy could be your ticket to a new job

If you’re tired of Medicare Advantage, now is the time to ditch

Retire in paradise: 5 countries where you can live the dream

More than 160,000 people have claimed to the government that their school defrauded them, and new applications continue to pour in. Almost all of these complaints come from for-profit schools, of which there are some 7,000 around the country. Together, they take in around 15 percent of the government’s financial aid.

Many of these borrowers have found themselves waiting without answers.

The Obama administration announced a regulation in 2016, known as borrower defense, aimed at canceling the debt of those with degrees from schools that misled or deceived them.

Before the regulation could go into effect in July 2017, an industry group of the for-profit college sector, the California Association of Private Postsecondary Schools, filed a lawsuit with the Education Department, arguing the regulation was outside the government’s authority.

Soon after, the Department announced it was postponing certain provisions of the regulation. Speaking at a conference, DeVos said that under the current rule, “all one had to do was raise his or her hands to be entitled to so-called free money.”

In a hearing on Friday, the California Association of Private Postsecondary Schools continued to challenge the Obama-era regulation. Judge Moss said he would consider the merits of their lawsuit. “The industry is still trying to challenge the regulation,” Merrill said.

Despite the resistance, borrowers and advocates were hopeful from the ruling earlier in the week that DeVos’s repeated delays of the Obama-era plan were unlawful.

The end of that delay could release thousands of people from their debt, said Clare McCann, a federal policy expert at the New America Foundation. Some borrowers could find their loans automatically discharged, she said, if their school had shut down while they were enrolled. That happened to thousands of students from Corinthian College.

Ashley Goodman, a former student of the Art Institute, another one of the for-profit schools under scrutiny, was thrilled by the ruling.

She said the school took out loans in her name without her knowing, and that she owes more than $150,000 today.

“It’s destroyed my life,” Goodman, 34, said. “I can’t have a credit card. I can’t do anything at all.”

(Previous requests for comment from the Education Management Corporation, the Art Institute’s parent company, went unanswered. “There is no current representative of the debtors available to comment,” said Jay Jaffe, one of the company’s bankruptcy lawyers.)

If the Obama-era regulation were to go into effect, it would only apply to borrowers before a certain time.

Those who took out federal student loans for schools that turn out to be predatory after July 2019 could fall under the Trump administration’s new borrower defense rule. That rendition of the regulation, first proposed in July, would make loan cancellation less likely. While the Obama-era regulation was projected to cost the government around $15 billion in debt forgiveness, this one would cost it just around $2 billion.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals