Simple candlestick patterns can be an excellent way to identify key inflection points in the market by visual representation of areas of important supply (sellers) and demand (buyers). These formations can be used as a signal for taking a trade (or avoiding one), as well as guide for stop placement and improving the overall risk profile of a trade. In addition to explaining the basics we also went through numerous examples.

Whether you are a new trader building a foundation or an experienced trader struggling (happens to the best), here are 4 ideas to help you Build Confidence in Trading

Why use candlesticks charts?

Candlestick analysis is an excellent way to identify important price action dynamics on any time-frame. These get at the heart of the price action portion of technical analysis. While there are many different types and configurations, we focused on the simplest reversal candlestick types. Reversal candles are excellent in showing where there are important power struggles between buyers and sellers. Of course, as is the case with any form of analysis, these should be used in conjunction with other tools and methodologies. Reversal candles can also be used to assess risk (stop placement) and for determining when to exit a trade.

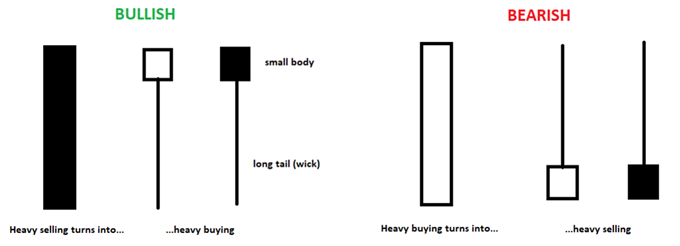

Two basic reversal types

The two basic types of candlesticks we focused on were key-reversals (also know as pin bars, hammers – bullish, and shooting stars – bearish) and dojis (regular and long-legged). A key reversal is identified as a candle with a long tail or wick relative to the body. As a rule of thumb the body should account for approximately 25% or less of the range of the candlestick. The range of the candlestick should be above average, longer wicks indicate a more powerful reversal. The close of the candle can be greater or less than the open, preferably closer to the top of the candlestick for bullish formations and the bottom for the bearish variation.

We understand the difficulties of trading, which is why we’ve put together a variety of guides designed to help traders of all experience levels.

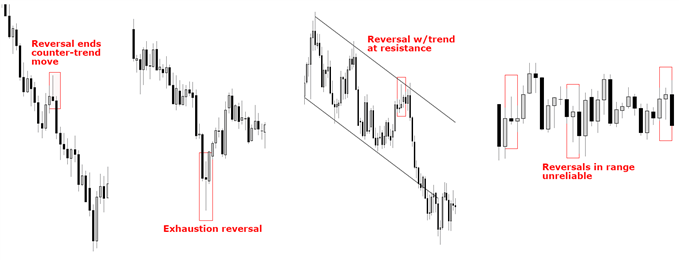

Context is important

Where on the chart a candlestick forms is very important. Trend needs to be taken into consideration; is it forming after an extended move (overbought/oversold), with or against the trend on a countertrend move, or in the middle of trading range? Those that form in the middle of a choppy range are to be avoided. Is there support or resistance in the area of the candle? As said earlier, candlesticks shouldn’t be traded just because it’s a high-quality formation, other factors need to be considered. We also looked at a few unique sequences using more than one time-frame (i.e. reversal on weekly followed up by a formation on the daily). Also discussed was the power of more than one reversal event in very close proximity to one another (See video for examples.)

Examples of Candlesticks in different circumstances

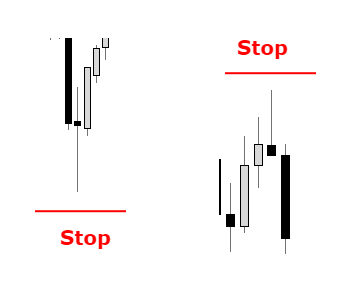

Execution and risk management

As per usual, we cannot go on talking strategy without discussing the topic of risk management. Candlesticks are a good way to identify where stops should be placed. For example, if you buy a bullish key-reversal off support it would make sense that if the bullish price action is negated (price trades sufficiently through the low of the candlestick) that you exit the trade. Vice versa for a short (stop placed above the high of a candle).

Stop-loss placement (Long & Short)

For the full conversation and examples, please see the video above…

Enjoy the video? Join Paul or any of the team’s analysts live each week for webinars covering analysis, fundamental events, and education.

Past webinars you might be interested in: Handling Drawdowns; Risk Management; Analysis, keeping it simple; 6 Mistakes Traders Make; Focusing on the Process; Building Consistency; Classic Chart Patterns, Part I; Classic Chart Patterns, Part II; Trading Breakouts; Trading Pullbacks; Combining Breakouts & Pullbacks

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals