Wall Street’s top activist investors are raising lots of cash and gearing up for battle over the next year, a new report shows. The group see more opportunity to disrupt the consumer discretionary sector, which includes retailers, than in any other industry, according to the study from from corporate law firm Schulte Roth & Zabel, Activist Insight and Okapi Partners.

Consumer products companies will continue to be in the crosshairs, the survey showed, amid multiple high-profile contests in the last year at household names like Procter & Gamble and Campbell Soup. But in order, activists believe consumer discretionary, financials, industrials and telecommunications represent the areas where management will see the most activity in the coming months.

The report, a result of an August 2018 survey of activist funds that have engaged almost 300 companies since 2013, found that 72 percent of respondents expect to raise “some” or “a lot” of new capital over the next year.

And more than half expect the size of assets allocated to activist strategies to grow over the next 12 months.

Source: Schulte Roth & Zabel, Activist Insight and Okapi Partners

“Activism remains an attractive asset class and, particularly with the increase in co-invest vehicles, more capital will be deployed in campaigns,” wrote Ele Klein, SRZ partner and co-chair of the firm’s global activism group.

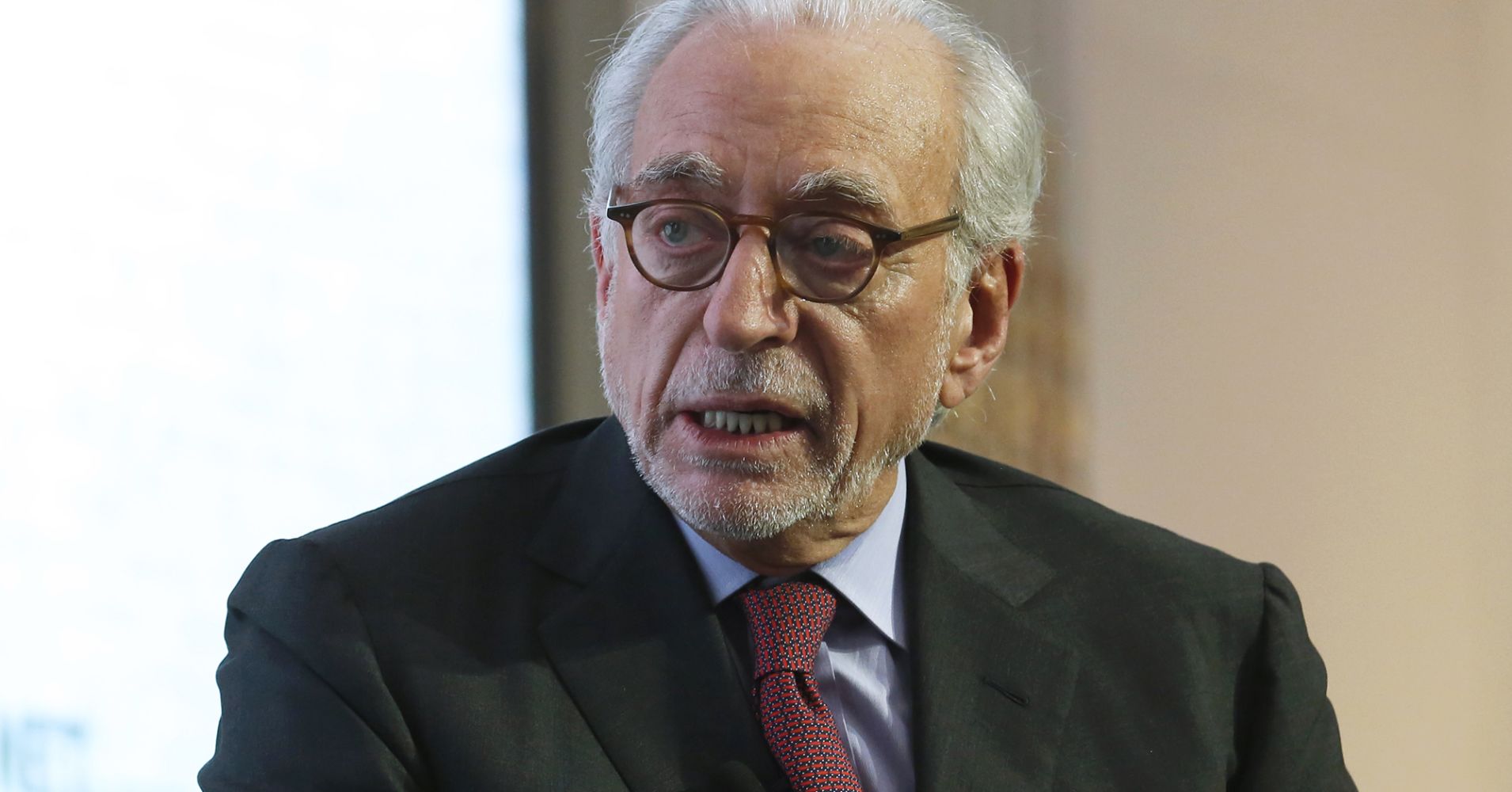

The latest findings come amid a resurgence in activist activity at some of the country’s largest consumer products titans. In one such battle, renowned activist investor Nelson Peltz took aim at Procter & Gamble, the largest U.S. company by market cap to have faced a proxy contest.

The two parties – which ultimately spent at least $60 million on the dispute – debated for weeks over the most effective business model before Peltz was ultimately elected to the board in one of the closest shareholder voters in the history of Wall Street.

Peltz, who took his seat on the board March 1, said the company needs to streamline it businesses into three global units and rekindle innovation to drive brand development.

Meanwhile, fellow activist investor Third Point is in the middle of its own crusade against a longtime consumer name. In a move reminiscent of Carl Icahn’s early career, manager Dan Loeb launched a campaign to replace the entire Campbell Soup board earlier this year after the company’s plans to sell assets failed to satisfy the investor.

Loeb joined forces with George Strawbridge – a descendant of the Campbell Soup founder – after the company announced it would sell its international and fresh food businesses despite CEO Denise Morrison’s efforts to establish footholds in healthier options.

Source: Schulte Roth & Zabel, Activist Insight and Okapi Partners

In a letter dated Sept. 28, Third Point called upon fellow shareholders to promote their new host of board candidates while also disparaging the company’s current leadership.

“The dismal stock performance is a report card on the Company’s leadership, which has made a series of blunders,” Third Point wrote at the time. “We believe the past year has been particularly disastrous. Campbell’s key brands are rapidly losing market share.”

But with activists circling the remaining consumer names, fund managers seeking to effect change at the board level are discovering it isn’t as easy as convincing a few institutional bigwigs like in other sectors.

In fact, retail investors may be the key if Messrs. Peltz and Loeb hope to have a chance in the space.

Of the 2 billion votes cast in the Procter & Gamble clash, the Trian founder had just over 40,000 more votes than a P&G director he ran against, or a margin of 0.0016 percent of the shares outstanding at the time.

And for Wall Street’s oldest and most complex companies like P&G – where retail investors own about 40 percent of floating shares – reaching hordes of individual investors will likely become crucial.

“As activists continue to gain a level of legitimacy in the market and design more effective ways to reach shareholders with their message, retail participation in the voting process should increase,” Bruce Goldfarb, CEO at Okapi Partners wrote in the report.

In the 2017 proxy season, retail shareholders voted just about 29 percent of their shares, while institutional investors voted about 91 percent of their shares, according to the Securities and Exchange Commission.

“Retail voter apathy is one of the most important challenges we have to overcome when working on a campaign. We find that many retail shareholders will vote their shares, but they require direct and indirect outreach, which takes time and resources,” Goldfarb added.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals