After suffering yesterday’s deeper selloff, there’s hope for some stabilization and recovery in US stocks. Investors are cheering US CPI miss as DOW futures pare back some of earlier losses. The greenback, on the other hand, is suffering refreshed selling after the release. Japanese yen follow as the second weakest one as it could take advantage on global risk aversion. As for today, Australian Dollar and New Zealand Dollar are the strongest ones.

The US CPI miss might add some bullets for Trump to harass the Federal reserve for rate hikes. But it should be reminded that even with a strong economy and record low unemployment, core inflation is kept close to target. Fed, the committee of seasoned central bankers, and the hundreds of economists and staff working in all the branches, have done a marvellous job. Anyone with a little bit of decency will just let these professionals continue with their work.

European stocks stay weak though. At the time of writing, DAX is down -0.66%, CAC down -1.43%, FTSE down -1.31%. Italian 10 year yield is rising 0.055 at 3.559. German 10 year yield is down -0.035 at 0.522. German-Italian spread is hovering slightly above 300 handle. Earlier in Asia, Nikkei lost -3.89% to 22590.86. Singapore Strait Times lost -2.69% to 3047.39. Hong Kong HSI fell -3.54% to 25266.37. China Shanghai SSE dropped -5.22%, to close at 2583.46, breaking key support level of 2638.3 (2016 low).

Technically, Dollar’s selloff against European majors and Yen will likely continue for a while. The question is whether commodity currencies would have that sustainable buying in the overall risk averse environment. In particular, USD/CAD retreats mildly but it’s still in proximity to 1.3081 resistance Firm break there will be a strong sign of bullish reversal in the pair.

US core CPI failed to accelerate, initial jobless claims rose

Dollar trades generally lower in early US session after slightly lower than expected inflation reading. Headline CPI slowed from 2.7% yoy to 2.3% yoy, missed expectation of 2.4% yoy. Core CPI was unchanged at 2.2% yoy, missed expectation of 2.3% yoy.

Initial jobless claims rose 7k to 214k in the week ended October 6, missed expectation of 205k. Four-week moving average of initial claims rose 2.5k to 209.5k. Continuing claims rose 4k to 1.66m in the week ended September 29. Four-week moving average of continuing claims dropped -10k to 1.656m, lowest since August 18, 1973.

Also released Canada new housing price index rose 0.0% mom in August, missed expectation of 0.2% mom.

Fed Bullard: No need to do more on monetary policy normalization

St. Louis Fed President James Bullard said “with respect to the (monetary policy) normalization, we have already reached a point when policy rates are in a good position.” And he suggested that Fed policymakers “don’t need to do much more to normalize policy.”

Separately, he also welcomed the USMCA North America trade agreement. He said “this is very good news, because it shows that despite the ups and down of negotiations, you can reach a conclusion …on trade relations.” And he hope the US “can get deals like this elsewhere and we might get the uncertainty down on this issue.”

ECB: Uncertainty around the inflation outlook was receding

The accounts of September ECB monetary policy meeting provide no surprise nor anything of particular importance. One thing to note is that the Governing Council was more comfortable with the inflation outlook. It’s noted that there was “broad agreement” on the “progress towards a sustained adjustment in the path of inflation”. And, “while measures of underlying inflation remained generally muted, they had been increasing from earlier lows.”

ECB added that “Comfort was drawn from the strengthening and broadening of domestic cost pressures, which were supported by the ongoing economic expansion, high levels of capacity utilisation and increasing labour market tightness, which was leading to rising wages.” Most importantly, “uncertainty around the inflation outlook was receding.”

ECB Hansson: Rather risky to be more precise in forward guidance now

ECB Governing Council member Ardo Hansson said urged not to be more specific on forward guidance yet. He said “To be any more precise than that, to lock in a date, to tie our hands would be rather risky”. Instead, “when we get closer, we can have another discussion if we need to adjust the language again, but this is not a debate we are going to have just yet.”

Separately, another Governing Council member Olli Rehn “core inflation is still rather weak in the euro zone at around 1 percent, as it has been for the last couple of years, so an accommodative monetary policy is still needed in Europe.”

IMF Lagarde urged to de-escalate trade wars for the innocent bystanders

In a conference in Indonesia, IMF Managing Director Christine Lagarde urged countries to “de-escalate” trade wars was they could hurt “innocent bystanders”. She said, “We certainly hope we don’t move in either direction of a trade war or a currency war. It will be detrimental on both accounts for all participants… and there would also be lots of innocent bystanders.”

Regarding recent depreciation of the Chinese Yuan, Lagarde said it’s mainly driven by the strengthen of Dollar. And she noted that Yuan has not depreciated as much against a basket of currencies. She acknowledged that “we’re seeing more and more countries, China included, let their currencies fluctuate.” At the same time she also supported “the move of China toward (currency) flexibility” and urged China to go down that path.”

EUR/USD Mid-Day Outlook

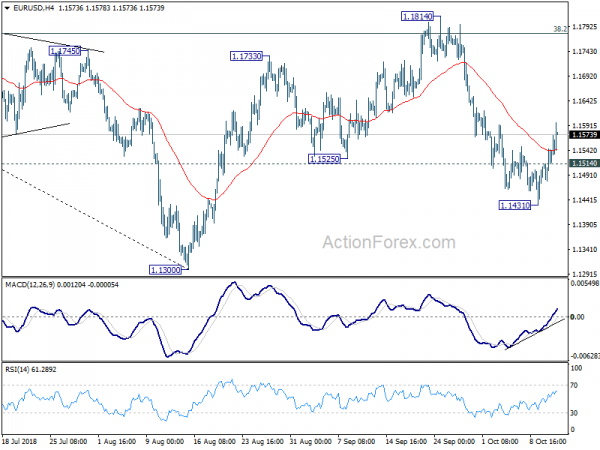

Daily Pivots: (S1) 1.1483; (P) 1.1515; (R1) 1.1550; More…..

EUR/USD edges higher to 1.1598 in early US session as rebound from 1.1431 extends. Intraday bias stays mildly on the upside for 55 day EMA (now at 1.1617) and possibly above. But we’d expect upside to be limited by 1.1779/1814 resistance zone to bring down trend resumption eventually. On the downside, below 1.1514 minor support will turn bias back to the downside. Further break of 1.1431 will bring retest of 1.1300 low.

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Sep | -2.00% | 2.00% | 2.00% | 1.00% |

| 23:50 | JPY | Domestic Corporate Goods Price Index Y/Y Sep | 3.00% | 2.90% | 3.00% | |

| 00:00 | AUD | Consumer Inflation Expectation Oct | 4.00% | 4.00% | ||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.00% | 0.20% | 0.10% | |

| 12:30 | USD | CPI M/M Sep | 0.10% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Y/Y Sep | 2.30% | 2.40% | 2.70% | |

| 12:30 | USD | CPI Core M/M Sep | 0.10% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Sep | 2.20% | 2.30% | 2.20% | |

| 12:30 | USD | Initial Jobless Claims (OCT 6) | 214K | 205K | 207K | |

| 14:30 | USD | Natural Gas Storage | 87B | 98B | ||

| 15:00 | USD | Crude Oil Inventories | 2.3M | 8.0M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals