Dollar is trading as the weakest one for today after it’s rally attempt failed. Additional pressure i seen in early US session after retail sales miss. Tension between the US and Saudi Arabia and the risks of sanctions are seen as a factor weighing down the greenback. Meanwhile, Sterling gapped lower at weekly open after weekend’s Brexit negotiations failure. But the Pound gradually regained footing even though there is basically no positive Brexit news. For now, there are still hope that the UK and the EU might agree to something after this week’s EU summit. Staying in the currency markets, Canadian Dollar follow the US as second weakest. Swiss Franc, New Zealand Dollar and Japanese Yen are the stronger ones.

In other markets, European stocks recover mildly today after initial selloff. At the time of writing, DAX is up 0.54%, CAC up 0.04%, FTSE up 0.21%. German 10 year bund yield is trading down -0.0022 at 0.497. Italian yield, though, is also down -0.0212 at 3.554. Earlier in Asia, Nikkei closed down -1.87%, Singapore Strait Times down -0.76%, Hong Kong HSI down -1.38% and China Shanghai SSE down -1.49%. Japan 10 year JGB yields dropped -0.0051 to 0.145. Gold extends recent rebound and breaks 1230 handle.

Technically, firstly, EUR/USD’s rebound from 1.1534 minor support suggests that rise from 1.1431 is not finished. Further rally is now in favor to above 1.1610. USD/JPY took out 111.82 to extend fall from 114.54. USD/CHF is also extending the corrective fall from 0.9954. More downside is mildly in favor for the Dollar in the latter part of the day.

US retail sales miss, Empire state manufacturing index improved

Released from the US, headline retail sales rose 0.1% in September versus expectation of 0.7% rise. Ex-auto sales even contracted -0.1% versus expectation of 0.5% rise. On the other hand, Empire state manufacturing index rose to 21.1, up from 19.0 and beat expectation of 20.4.

Released elsewhere, Swiss PPI dropped -0.2% mom, rose 2.6% yoy in September, versus expectation of 0.1% mom, 3.0% yoy. Japan industrial production was finalized at 0.2% mom in August. UK Rightmove house price rose 1.0% mom in October.

UK PM May to publish statement on Brexit, EU intensifying no-deal preparations

Brexit negotiation is the main theme today after the Irish border deadlock came up unresolved after the meeting between UK and EU in Brussels over the weekend. EU chief Brexit negotiator Michel Barnier tweeted after meeting UK Brexit secretary Dominic Raab in Brussels that “Despite intense efforts, some key issues are still open, including the backstop for IE/NI (Ireland/Northern Ireland) to avoid a hard border.”

UK Prime Minister Theresa May’s spokesman insisted that “there are a number of means of achieving what we want to achieve,” referring to the Irish border issue. May is expected to publish a statement to the parliament later today regarding the failure of the weekend talks.

European Commission spokesman Margaritis Schinas said in a regular new conference that “while we are working hard for a deal, our preparedness and contingency work is continuing and intensifying.” German government spokesman Steffen Seibert also said the cabinet will committee on Brexit will discuss the country’s preparedness for a no-deal scenario.

DUP Wilson: No-deal Brexit inevitable as EU is cornering Theresa May

Sammy Wilson, the DUP spokesperson on Brexit, told Belfast newsletter that a no-deal Brexit was “probably inevitable.” He said that “Given the way in which the EU has behaved and the corner they’ve put Theresa May into, there’s no deal which I can see at present which will command a majority in the House of Commons.”

He added that “anybody looking at it objectively would say that what is on offer from the EU is a far worse deal than a no deal, and therefore she’d be mad to be railroaded into accepting it.” In his view, UK Prime Minister Theresa May will not get what EU are demanding through the House of Commons.

Though, he also said, “No deal doesn’t mean there will be nothing agreed”. And, “it probably means there will be a lot of mini agreements on things which are essential, to keep planes flying, lorries moving, that sort of thing.” “There will be no overall deal but that doesn’t mean there will be nothing agreed at all because certain essential things are required, both on the EU side and on our side.”

EUR/USD Mid-Day Outlook

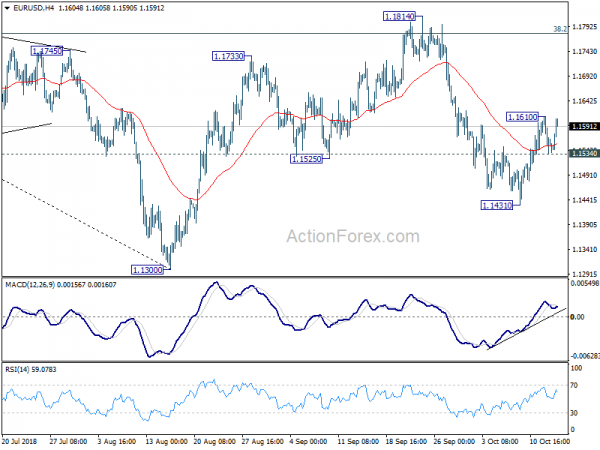

Daily Pivots: (S1) 1.1526; (P) 1.1569; (R1) 1.1602; More…..

EUR/USD rebounds notably after drawing support from 1.1534 minor support. But it’s staying below 1.1610 temporary top. Intraday bias remains neutral first. ON the upside, break of 1.1610 will extend the rebound from 1.1431 towards 1.1814 resistance. But we’d expect upside to be limited by 1.1779/1814 resistance zone to bring down trend resumption eventually. On the downside, break of 1.1534 will indicate completion of rebound from 1.1431. Intraday bias will be turned back to the downside for 1.1431 and then 1.1300 low.

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Oct | 1.00% | 0.70% | ||

| 04:30 | JPY | Industrial Production M/M Aug F | 0.20% | 0.70% | 0.70% | |

| 07:15 | CHF | Producer & Import Prices M/M Sep | -0.20% | 0.10% | 0.00% | |

| 07:15 | CHF | Producer & Import Prices Y/Y Sep | 2.60% | 3.00% | 3.40% | |

| 12:30 | USD | Empire Manufacturing Oct | 21.1 | 20.4 | 19 | |

| 12:30 | USD | Retail Sales Sep | 0.10% | 0.70% | 0.10% | |

| 12:30 | USD | Retail Sales Ex Auto M/M Sep | -0.10% | 0.50% | 0.30% | 0.20% |

| 14:00 | USD | Business Inventories Aug | 0.50% | 0.60% | ||

| 14:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals