Sterling is trading the the biggest loser today as it gapped down on negative Brexit news. It’s getting unlikely to have breakthrough in the sticky issue of Irish border at the EU summit this week. Elsewhere risk aversion is back in Asian markets as selloffs in stocks resume. Reactions in the currency markets are back to “normal”. Yen is trading as the strongest one followed by Swiss Franc, and then Dollar. Australian and New Zealand Dollar are weakest, following the Pound.

At the time of writing, Nikkei is trading down -1.62%, Singapore Strait Times down -0.46%, Hong Kong HSI down -1.18%. China Shanghai SSE is down -0.79% at 2586.26, but it’s some way above last week’s low at 2536.66. In other markets, Gold trades firmer at 1221 for now, with sight on last week’s high at 1226.40. WTI crude oil is mildly higher at 72.11, up 1.08%.

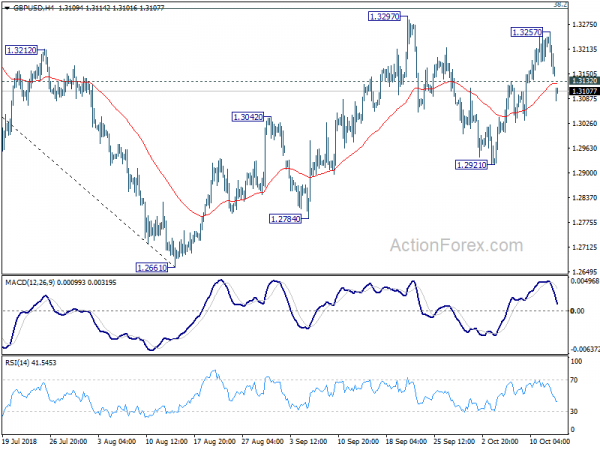

Technically, GBP/USD’s break of 1.3132 minor support argues that rebound from 1.2921 has completed at 1.3257. Deeper fall is in favor back to 1.2921 support. It’s not overwhelmingly bearish for the Pound yet, at least not until EUR/GBP breaks 0.8847 resistance and GBP/JPY breaks 145.67 support. On the other hand, EUR/USD is pressing 1.1534 minor support now and break there is needed to give more evidence on strength of Dollar.

Sterling gapped lower as Brexit talks stalled at Irish border backstop again

Sterling gapped lower as the week started with negative Brexit news again. The backstop on Irish border remained an unresolved issue despite efforts from both sides. And furthermore, as the negotiations stalled, there will be no more scheduled talks before the EU summit on later this week.

EU chief Brexit negotiator Michel Barnier tweeted after meeting UK Brexit secretary Dominic Raab in Brussels that “Despite intense efforts, some key issues are still open, including the backstop for IE/NI (Ireland/Northern Ireland) to avoid a hard border.”

Brexit Ministry said that there was progress “in a number of key areas”. “However there remain a number of unresolved issues relating to the backstop. The UK is still committed to making progress at the October European Council.”

PBoC Yi: Yuan volatility is normal, rate at reasonable and equilibrium level

China’s PBoC Governor Yi Gang tried to talk down recent Yuan depreciation despite having USD/CNH nearing the psychological important 7 level. Yi insisted that “the Yuan’s volatility is normal” and its rate is at a “reasonable and equilibrium level”. And, in spite of recent measures in stabilizing the markets, Yi also insisted that PBoC is having a “neutral” monetary policy stance. He said “So if you look at the broad money, if you look at the interest rate and you look at monetary conditions, basically you can have the conclusion that we have a prudent and neutral stance monetary policy.”

Regarding trade war, Yi said “downside risks from trade tensions are significant.” But he’s confidence that the PBoC has “plenty of monetary instruments in terms of interest rate policy, in terms of required reserve ratio.” And, PBoC has “plenty of room for adjustment, in case we need it”. Besides, he’s also confidence that China is on track to meet its growth target of 6.5% in 2018 and “maybe a little bit more”.

Yi also pledged in a statement that “China will continue to let the market play a decisive role in the formation of the RMB exchange rate”. And, we will not engage in competitive devaluation, and will not use the exchange rate as a tool to deal with trade frictions.”

BoJ Kuroda: Rise of protectionism and tightening of financial conditions call for vigilance

BoJ Governor Haruhiko Kuroda warned that “recent rise of protectionist moves and tightening of financial conditions in some economies remind policymakers of the importance of being vigilant at all times:. And he urged to “pay more attention to protectionist moves, as global economies have become increasingly interdependent through global value chains.”

Domestically, Kuroda said “when 2 percent inflation target is met or is close to be met, of course we can change the target, the monetary operating target of interest rate.” But he also reiterated that “at this moment, inflation is only 1 percent, so we will continue the current yield curve control at the current level of interest.”

Kuroda also talked down the impact of the planned sales tax hike in 2019 and said “at this stage, there would not be any major negative impact on the economy”. He expected to impact of growth would be “much, much smaller” than from an increase in 2014.

The week ahead: There’s something for every major currencies.

The coming week features a number of events that involves almost every major currencies. For the US, retail sales is a piece of key data to watch while FOMC minutes will be scrutinized. But we actually do not expect them to be more market moving that trade war development and treasury yields. Canada will release retail sales and CPI, which could seal the case for BoC rate hike on October 24.

For UK, the rhetorics leading up to EU summit on Brexit, as well as the outcome could finally tell us the chance of really hitting a deal in November. UK will also release employment, inflation and retail sales data. For Euro, the main focus will be on German ZEW economic sentiment, as well as EU’s formal reaction to Italy’s budget.

In Asia Pacific, China’s set of data including GDP will further reveal how the economy is performing after trade war with the US started. RBA minutes will likely reveal nothing new. Australian Dollar would be more sensitive to Chinese data and its own employment data. New Zealand Dollar will look at CPI. Japan will also release CPI and trade balance too.

- Monday: US retail sales, Empire State Manufacturing index, business inventories; Canada BoC business outlook survey

- Tuesday: New Zealand CPI; RBA minutes; China CPI, PPI; German import prices; UK employment; Eurozone trade balance; German ZEW; Canada foreign securities purchases; US industrial production, NAHB housing market index

- Wednesday: UK CPI, PPI; Eurozone CPI final; Canada manufacturing sales; US housing starts and building permits; FOMC minutes

- Thursday: Japan trade balance; Australia employment; UK retail sales; US Philly Fed survey, jobless claims, leading indicators

- Friday: Japan CPI; China GDP, fixed asset investment, industrial production retail sales, unemployment rate; Eurozone current account; UK public sector net borrowing; Canada retail sales, CPI; US existing home sales.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3113; (P) 1.3185; (R1) 1.3225; More…

GBP/USD’s sharp fall and break of 1.3132 support suggests that rebound form 1.2921 has completed at 1.3257. Intraday bias is turned back to the downside for 1.2921 support first. Break there will resume the fall from 1.3297 and target 1.2661/2784 support zone. On the upside, in case of another rally, we’d continue to expect strong resistance at 1.3316 key fibonacci level to bring down trend resumption eventually.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Oct | 1.00% | 0.70% | ||

| 4:30 | JPY | Industrial Production M/M Aug F | 0.70% | 0.70% | ||

| 7:15 | CHF | Producer & Import Prices M/M Sep | 0.10% | 0.00% | ||

| 7:15 | CHF | Producer & Import Prices Y/Y Sep | 3.00% | 3.40% | ||

| 12:30 | USD | Empire Manufacturing Oct | 20.4 | 19 | ||

| 12:30 | USD | Retail Sales Sep | 0.70% | 0.10% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Sep | 0.50% | 0.30% | ||

| 14:00 | USD | Business Inventories Aug | 0.50% | 0.60% | ||

| 14:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals