US equities closed sharply higher overnight with DOW ended up 2.17%. Optimism carried on in early part of Asian session but couldn’t persist. At the time of writing, China’s Shanghai SSE reversed earlier gains and is trading down -0.8%, breaking yesterday’s low to extend larger down trend. Riding on this, Dollar and Yen are trading as the two strongest ones for now. Canadian Dollar, Euro and Sterling has under some selling pressure.

But overall, the forex markets are in consolidative mode. EUR/USD’s spike to 1.1621 yesterday but quickly dipped back into established tight range. GBP/USD had much volatility this week but it’s also bounded in range below 1.3257. USD/CHF, USD/JPY, EUR/GBP, EUR/JPY, GBP/JPY and EUR/AUD are all clearly in consolidation. Trump’s another attack on Fed couldn’t trigger a breakout, nor stock rally. Let’s see if today’s UK CPI, EU summit and FOMC minutes could trigger some sustainable moves.

Technically, EUR/USD’s focus is back on 1.1534 minor support. 0.9954 in USD/CHF and 112.52 minor resistance in USD/JPY will also be watched today for clues on Dollar’s strength, if it exists.

Trump called Fed his biggest threat but added he’s not blaming anybody

Trump escalated his attack on Fed yesterday by falling it his “biggest threat”, “because the Fed is raising rates too fast”. Though, he repeated that Fed is “independent” and he “don’t speak to ” Fed chair Jerome Powell. But he also expressed that “I’m not happy with what he’s doing because it’s going too fast. Because – you look at the last inflation numbers, they’re very low.”

Trump also added “Can I be honest? I’m not blaming anybody, I put him there”, referring to Powell. “And maybe it’s right, maybe it’s wrong. But I put him there.”

Markets had little reaction to Trump’s words so far.

Fed Daly favors gradual pace of monetary policy normalization

New San Francisco Fed President Mary Daly expressed her support to continued gradual rate hikes in her first remarks as monetary policy maker. She said the labor market is “booming” and inflation at the at 2% target. And, she explained that Fed might not want to go too slowly on rates and risking falling behind the curve. Her approach is consistent with Fed’s and she favors “a gradual pace of normalization.”

Daly also used the analogy that “you put a toe in the water and see how much of a ripple it makes”. And, “the FOMC just raised rates in September, and we’re now in the watching phase — what’s going on in the economy, how does it react.”

She also tried to talk down last week’s stock market crash. She said “a correction in the stock market where it comes down a little bit is not necessarily a worrisome thing.”

May to address EU leaders in Brussels, Tusk said problem is still Irish border

UK Prime Minister Theresa May will address EU leaders in the summit dinner today, trying to sell her Chequers plan again. Ahead of that, European Council President Donald Tusk said “the problem is clear it is still the Irish question and the problem of the border between Ireland and Northern Ireland. And the so-called backstop. It looks like a new version of the Gordian knot.”

Tusk added that “We should … remain hopeful and determined, as there is good will to continue these talks on both sides. But at the same time, responsible as we are, we must prepare the EU for a no-deal scenario, which is more likely than ever before,”

Tusk said he will ask May whether she has concrete proposals on how to break the impasse. Only such proposals can determine if a breakthrough is possible.” Tusk also added that the unscheduled Brexit summit in November only makes sense if there negotiation is really close to a breakthrough.

RBA Debelle: Unemployment rate might drop further before material rise in wages growth

RBA Deputy Governor Guy Debelle welcomed the developments in the Australian labor market in a speech. He noted that “employment has grown strongly, the participation rate is close to its highest level on record and the unemployment rate has declined to be at a six-year low.” And, that is “consistent with the above-trend GDP growth in the economy.”

However, he also noted again there was “little” change in long term unemployment rate and “wages growth remains low”. Above averaged demand for labor and growth in economy should “gradually reduce the spare capacity in the labour market.” And that will lead to “gradual increase in wages growth and, in turn, inflation.” But the extend and timing are uncertain. Unemployment rate could drop further than historical experience before material increases in wages growth.

Debelle also noted that the drag on the economy from lower house prices is still unclear and RBA is paying close attention.

On the data front

Australia Westpac leading index dropped -0.1% mom in September. UK inflation is the major focus in European session, with CPI, RPI and PPI featured. Eurozone will release CPI final too. Later in the day, US will release housing starts and building permits. FOMC minutes will also be featured.

EUR/USD Daily Outlook

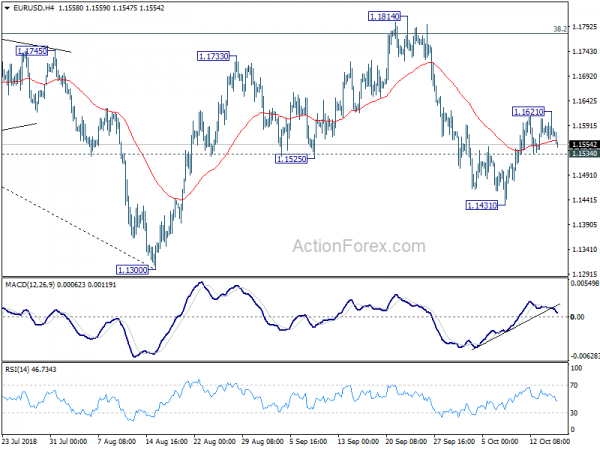

Daily Pivots: (S1) 1.1552; (P) 1.1587; (R1) 1.1609; More…..

EUR/USD spiked to 1.1621 but quickly retreated. Intraday bias is turned neutral again. On the upside, above 1.1621 will resume the rebound from 1.1431. But upside should be limited by 1.1779/1814 resistance zone to bring down trend resumption eventually. On the downside, break of 1.1534 will indicate completion of rebound from 1.1431. Intraday bias will be turned back to the downside for 1.1431 and then 1.1300 low.

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | USD | Net Long-term TIC Flows (USD) Aug | 131.8B | 50.3B | 74.8B | 66.7B |

| 23:30 | AUD | Westpac Leading Index M/M Sep | -0.10% | 0.10% | 0.00% | |

| 8:30 | GBP | CPI M/M Sep | 0.50% | 0.70% | ||

| 8:30 | GBP | CPI Y/Y Sep | 2.80% | 2.70% | ||

| 8:30 | GBP | Core CPI Y/Y Sep | 1.80% | 2.10% | ||

| 8:30 | GBP | RPI M/M Sep | 0.20% | 0.90% | ||

| 8:30 | GBP | RPI Y/Y Sep | 3.20% | 3.50% | ||

| 8:30 | GBP | PPI Input M/M Sep | 0.20% | 0.50% | ||

| 8:30 | GBP | PPI Input Y/Y Sep | 5.70% | 8.70% | ||

| 8:30 | GBP | PPI Output M/M Sep | 0.20% | 0.20% | ||

| 8:30 | GBP | PPI Output Y/Y Sep | 2.90% | 2.90% | ||

| 8:30 | GBP | PPI Output Core M/M Sep | 0.10% | 0.10% | ||

| 8:30 | GBP | PPI Output Core Y/Y Sep | 2.10% | 2.10% | ||

| 8:30 | GBP | House Price Index Y/Y Aug | 3.50% | 3.10% | ||

| 9:00 | EUR | Eurozone CPI M/M Sep | 0.20% | 0.20% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Sep F | 2.10% | 2.10% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Sep F | 1.00% | 0.90% | ||

| 12:30 | CAD | Manufacturing Sales M/M Aug | 0.90% | |||

| 12:30 | USD | Housing Starts Sep | 1.21M | 1.28M | ||

| 12:30 | USD | Building Permits Sep | 1.28M | 1.25M | ||

| 14:30 | USD | Crude Oil Inventories | 6.0M | |||

| 18:00 | USD | FOMC Minutes |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals