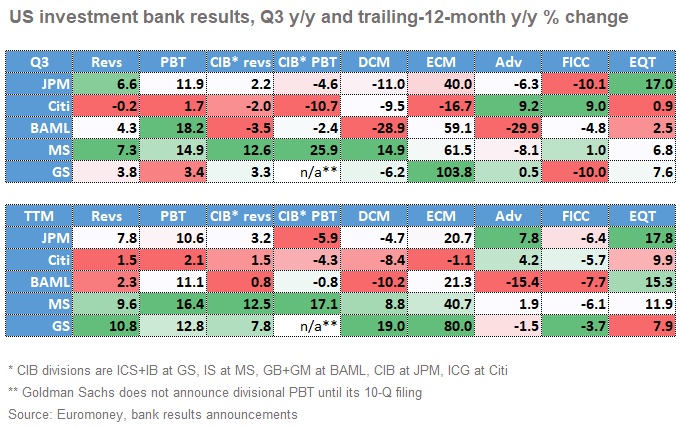

Morgan Stanley put on the strongest showing among the big five US investment banks in the third quarter results season, with the best year-on-year change across four of nine key categories, according to Euromoney’s latest analysis.

The bank reported its results today alongside Goldman Sachs, following Bank of America Merrill Lynch, Citigroup and JPMorgan in previous days.

Of the five, Morgan Stanley showed the best year-on-year progress in group revenues, CIB revenues and profits before tax (PBT), and debt capital markets revenues. Goldman does not report divisional PBT until it files its 10-Q form with the SEC in the coming weeks, but CIB PBT rose 26% at Morgan Stanley while they fell year-on-year at BAML, JPM and Citi.

Citi posted the least impressive year-on-year changes in five categories: group revenues and PBT, CIB PBT, equity capital markets revenues and equity sales and trading. However, it showed the best performance in advisory and fixed income sales and trading, with healthy increases that were in stark contrast to anaemic numbers elsewhere.

Citi was the only bank without an incease in group revenues, but it still managed a small rise in profits, the smallest of the five. In CIB divisions, revenues fell at Citi and BAML, while profits fell at JPM, Citi and BAML.

Debt capital markets was down everywhere except Morgan Stanley, while equity capital markets showed huge increases everywhere except Citi, where revenues fell year-on-year. Advisory continued to be an unhappy place at BAML, with a 30% fall, and only Citi showed a decent increase.

FICC was particularly mixed, falling at JPM, Goldman and BAML, but up at Citi and Morgan Stanley. Equities was up everywhere, but most at JPM.

Goldman’s only remarkable Q3 performance came from equity capital markets, where its revenues doubled from the same period in 2017. But its 10% fall in FICC, just ahead of a 10.1% drop at JPM, was disappointing given its focus in recent quarters on turning that business around.

That said, on a longer term view it is Goldman that just shades Morgan Stanley as the best of the five. Comparing the last 12 months with the previous 12 months, Goldman has seen the best results in four areas: group revenues, DCM and ECM, and – remarkably – FICC, where a fall of less than 4% is the most impressive of a tight range from the five firms. It did, however, post the smallest growth in its equities business over that same time.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals