Swiss Franc is clearly the weakest one for today so far. In particular selloff intensifies somewhat in European session. Weakness of the Franc also drags down Euro, which is trading as the second weakest. On the other hand, Sterling is taking turn to be the strongest with New Zealand Dollar today. There are a lot of rumors and noise flying around on Brexit, but the Pound generally shrugs them off. EU chief Brexit Michel Barnier’s speech on the topic could probably give Sterling a decisive direction. Dollar is so far mixed, failing to ride on Friday’s late rebound. Mid-term election is likely a factor delaying movements in the greenback.

The global stock markets are rather mixed today. Major European indices are trading higher at the time of writing. FTSE is up 0.40%, DAX up 0.12%, CAC up 0.26%. But major Asian indices ended all in red. Nikkei closed down -1.55%, Hong Kong HSI down -2.08%, China Shanghai SSE dropped -0.41%. Singapore Strait Times fell -1.79%. German 10 year yield is up 0.002 at 0.434. Italian 10 year yield is up 0.0407 at 3.346. German-Italian spread remains below 300.

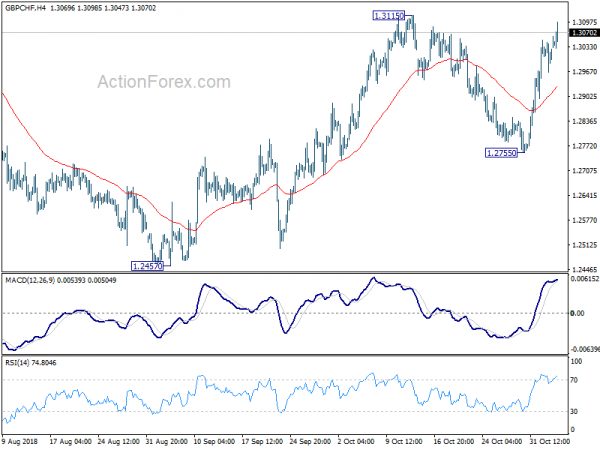

Technically, 113.38 in USD/JPY remains a focus, same as 0.8722 in EUR/GBP. GBP/CHF is now a pair note too with today’s rise. Break of 1.3115 will resume whole rebound from 1.2457. Otherwise, the forex markets lag decisive movements for now. Most pairs are just consolidation in familiar range.

Brexit noise floating around

There is a lot of Brexit noise today. It’s reported that EU is insisting on having an Irish backstop without time limit. On the other hand, UK Brexit Minister Dominic Raab pushing for a three-months expiry on the backstop. Prime Minister Theresa May’s spokesperson also said “we don’t want the backstop to be in place indefinitely and (we have said) that we would be looking to a mechanism to achieve that.”

Meanwhile, out of UK, there are rumors that there will no Brexit deal to be made this week. And more importantly, there are even reports saying that a no-deal Brexit would be most probable if no agreement would be made within a week. On the other hand, Susan Hooper, a British executive who sits on the board of the Brexit ministry, said “I cannot imagine that we will not get a deal”. But with regards to businesses, “the no deal is the hardest scenario and therefore I would plan for the hardest.”

UK PMI services dropped to 52.2: GDP growth to weaken sharply in Q4

UK PMI services dropped to 52.2 in October, down from 53.9 and missed expectation of 53.4. Chris Williamson, Chief Business Economist at IHS Markit, noted that “the disappointing service sector numbers bring mounting evidence that Brexit worries are taking an increasing toll on the economy”. And “combined with the manufacturing and construction surveys, the October services PMI points to the economy growing at a quarterly rate of just 0.2%, setting the scene for GDP growth to weaken sharply in the fourth quarter.”

Eurozone Sentix investor confidence dropped to 8.8, the zenith is clearly passed

Eurozone Sentix Investor Confidence dropped to 8.8 in November, down from 11.4 and missed expectation of 9.9. Sentix noted “The problem areas in Europe and the global economy remain largely the same, which does not make it any better. Germany’s weakness is also weighing on the Euroland economy.” Also, “the Eurozone economy passed its zenith in January. Since then, economic expectations have reversed and since April they have been negative.”

Sentix noted factors such as “US President’s trade policy”, “discussion about the future of the car industry in Germany”, the “weakness of the banking sector” and the “budget question in Italy” are contributing to the development. Additionally, there is an “increasing perception of inflation” as “investors expect inflation to continue to rise. Thus, “central banks can hardly deviate from their current course towards a more restrictive monetary policy, at least not only because of an economic slowdown.”

Eurozone FMs to discuss Italy’s recipe for reviving growth

Italy’s budget will certainly be a hot topic in the summit of Eurozone finance minister meeting in Brussels today. It comes at time time after European Commission rejected the country’s 2019 budget, with deficit target at 2.4% of GDP. The Commission demand Italy to revise the plan by November 13, But Prime Minister Giuseppe Conte insisted there is no “Plan B” for the program and indicated no intention to comply with EU’s demand.

Italian Deputy Prime Minister Luigi Di Maio, leader of the 5 Star Movement, said over the weekend that the coalition government “will not cede an inch” on the budget. He also hailed that their own plan will become a “recipe” for reviving European growth.

China Xi pledged unambitious USD 30T imports at CIIE

China is holding a week-long China International Import Expo, or CIIE, in Shanghai, starting today. President Xi Jinping said “CIIE is a major initiative by China to pro-actively open up its market to the world.” And, he noted “economic globalization is facing setbacks, multilateralism and the free trade system is under attack, factors of instability and uncertainty are numerous, and risks and obstacles are increasing.” That’s the usual rhetorics that China has been using to position itself as defender of free trade.

Nevertheless, Xi also pledged to cut import taxes further and spend more on foreign goods and services. He said China’s goods import will exceed USD 30T over the next 15 years. Meanwhile, Services import will exceed USD 10T. The figure on goods was somewhat raised from Xi’s prior promise of USD 24T. But the fact is, USD 30T over 15 years means only USD 2T per annum, which Chin has already nearly met back in 2013 and 2014. After a dip to USD 1.6T in 2016, import has already bounced back to USD 1.8T in 2017. So, Xi’s target is not that ambitious.

China Caixin PMI composite dropped to 28-month low, mounting downward pressure on the economy

China Caixin PMI services dropped to 50.8 in October, down from 53.1 and missed expectation of 52.9. That’s the lowest level in 13 months. PMI composite output index dropped from 51.2 to 50.5, hitting a 28-month low, lowest since June 2016.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said in the release that the fall in PMI composite indicated “mounting downward pressure on China’s economy”. Employment edged up but stayed negative, which ” could possibly be due to government efforts”. Future output index edged down, “reflecting weakening confidence among companies.”

BoJ Kuroda: It’s necessary to persistently continue with powerful monetary easing

BoJ Governor Haruhiko Kuroda delivered a speech to business leaders in Nagoya today. There he acknowledged that “the BOJ fully recognizes that, by continuing monetary easing, financial institutions’ strength will be cumulatively affected.” And, even though, “these risks are judged as not significant at this point”, he pledged to “scrutinize developments and encourage financial institutions to take action as necessary.”

US-China trade war is one of the risks surrounding Japan’s outlook. Kuroda said “the impact of such problems on Japan’s economy is limited for now … ut if the problems persist, the effect on Japan’s economy could become bigger”.

Overall, Kuroda reiterated that “it’s necessary to persistently continue with powerful monetary easing, while considering both the positive effects and side effects in a balanced manner.” But BoJ will “of course” exit ultra-easy monetary policy when the 2% price target is reached.

BoJ minutes: Need to explain thoroughly the intention to continue with powerful easing

Separately, BoJ also released minutes of September 18-19 monetary policy meeting. The minutes reiterated that the measures taken back in July, including introduction of forward guidance, were for strengthening the framework for “continuous” powerful monetary easing. However, A few members noted some market participants still viewed BoJ’s intention as “unclear”. Thus, “it was important to continue to thoroughly explain that the measure was intended to make clearer the Bank’s policy stance that it would persistently continue with powerful monetary easing while taking into account its side effects.

One member also pointed out that allowing long term yields to move in a “more flexible manner” prompted “heightened” volatility in JGB market. And, since it’s only two months past that meeting, with small transactions volume of JGB in summer, “it was necessary to continue to carefully examine the effects on financial markets”.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2932; (P) 1.2986; (R1) 1.3022; More…

With 1.2908 minor support intact, intraday bias in GBP/USD remains on the upside. Rise from 1.2692 is seen as the third leg of consolidation pattern from 1.2661. Further rebound should be seen back towards 1.3297 resistance zone. However, we’d expect strong resistance from 1.3316 fibonacci level to limit upside to bring down trend resumption eventually. On the downside, below 1.2908 minor support will turn bias back to the downside for 1.2692 instead.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes of Policy Meeting | ||||

| 0:00 | AUD | TD Securities Inflation M/M Oct | 0.10% | 0.30% | ||

| 1:45 | CNY | Caixin PMI Services Oct | 50.8 | 52.9 | 53.1 | |

| 9:30 | GBP | Services PMI Oct | 52.2 | 53.4 | 53.9 | |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Nov | 8.8 | 9.9 | 11.4 | |

| 14:45 | USD | Services PMI Oct F | 54.7 | 54.7 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Oct | 59.5 | 61.6 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals