The forex markets are generally trading in tight range as the week starts. Yen, Dollar and Sterling are generally firmer. Australian Dollar and New Zealand Dollar are the weaker ones, together with Euro. But movements in the markets are very limited. Overall, the greenback stays relatively soft as markets started to pare back bets on Fed’s hike path. Sterling stabilized as there was, up to Sunday, not enough requests to trigger a challenge on UK PM May yet. But it remains vulnerable of more political shocks from the UK. And Euro is rather cautiously watching the drama of Italy-EU budget showdown.

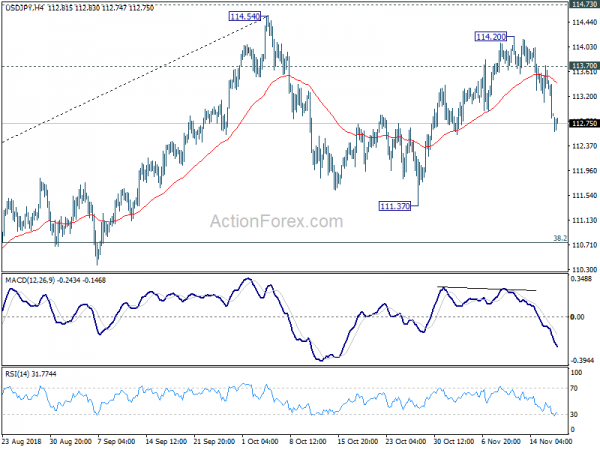

Technically, while the greenback has been weak since last week, there is no clear sign of reversal yet, except versus Yen and Aussie. EUR/USD is held below 1.1499 resistance, USD/CHF above 0.9952 support. USD/CAD is also holding well above 1.3056 support. USD/JPY’s break of 112.94 last week argues that recent consolidation from 114.54 is extending with another falling leg towards 111.37. But there is no medium term reversal yet. The bigger development was AUD/USD’s break of 0.7314 structural resistance. Sustained trading above there will indicate medium term reversal.

In other markets, Nikkei closed up 0.65% at 21821.16. Hong Kong HSI and China Shanghai SSE are up 0.32% and 0.60% respectively. But Singapore Strait Times is down -0.66%. Japan 10 year JGB yield id down -0.013 at 0.094, back under 0.10%! Gold is hovering in tight range below 1220. WTI crude oil is consolidation at around 57.3.

UK Brady predicts PM May to win leadership challenge, but 48 threshold not even met yet

As confirmed by Graham Brady, chair of the 1922 Committee, the number of requests for no-confidence vote on Prime Minister Theresa May haven’t met the threshold of 48 yet. He added, “if a threshold were to be reached I would have to consult with the leader of the party the Prime Minister.” And he expected the “whole thing” to be an “expeditious process”, if it happens.

Also, Brady predicted even if there is a leadership China, May is going to win it. He said “it would be a simple majority, it would be very likely that the Prime Minister would win such a vote and if she did then there would be a 12-month period where this could not happen again, which would be a huge relief for me because people would have to stop asking me questions about numbers of letters for at least 12 months.”

However, Brady is also dissatisfied with the May’s Brexit deal and branded it as “tricky”. He predicted that “it certainly doesn’t look like the current agreement will get through [the Commons} unless either the agreement changes or the statement of the political declaration, the future relationship, gives considerably stronger grounds for optimism a bout the nature of the final deal.”

UK May: Change of leadership risk delaying Brexit negotiations

UK Prime Minister Theresa May warned yesterday that “a change of leadership at this point isn’t going to make the negotiations any easier”. Instead she added “what it will do is mean that there is a risk that actually we delay the negotiations and that is a risk that Brexit gets delayed or frustrated.” May also emphasized that “these next seven days are going to be critical, they are about the future of this country”. And she pledged not to be “distracted from the important job.”

May is also expected to reiterate the same message in a speech to the CBI’s annual conference today. According to advance extracts, May would say “We now have an intense week of negotiations ahead of us in the run-up to the special European Council on Sunday (Nov 25).” And, “during that time I expect us to hammer out the full and final details of the framework that will underpin our future relationship and I am confident that we can strike a deal at the council that I can take back to the House of Commons.”

ECB Villeroy de Galhau: No rush to set out length of reinvestment period after asset purchases end

ECB Governor Council member Francois Villeroy de Galhau said today that net asset purchase will “very probably end in December” as planned. However, he emphasized that “the end of our net asset purchases will not, however, mean the end of our monetary stimulus, far from it.”

The pace of normalization would depend on incoming economic data. And three tools are at ECB’s disposal, including reinvestment of assets, interest rate and refinancing operations. Villeroy would prefer slowing the rate of reinvestment only after the first interest rate hike, which wouldn’t happen at least through the summer of 2019.

He also added that “we are not obliged to rush, as early as at our December meeting, to set out the precise length of our reinvestment period.”

SNB Maechler: Negative interest rate remains indispensable for Switzerland

Swiss National Bank Governing Board member Andrea Maechler said in newspaper Le Matin Dimanche interview that current monetary policy remains appropriate. She noted the fragility in the financial markets, with risks surrounding Brexit, Italy and trade war. Also, the exchange rate of the Swiss Franc remained high.

Therefore, Maechler said, “In the current context, the negative interest rate remains indispensable for Switzerland. It enables us to restore, at least partially, a difference between Swiss interest rates and those abroad, thus reducing the franc’s attractiveness.”

Also, “our monetary policy based on the negative interest rate and our capacity to intervene on the currency market if needed is appropriate.”

BoJ Kuroda: Mindful of banks’ engagement in excessive risk taking

BoJ Governor Haruhiko Kuroda noted in a speech that amid a persistent low interest rate environment, “possible changes in the risk appetite and risk profile of banks … is an issue” that BOJ is “highly attentive to”. And, in the short term, “as downward pressure on banks’ profits continues, we need to be mindful of the possible consequences of banks’ engagement in excessive risk taking.”

For banks with “abundant capital bases”, risk taking “provides financial support to firms’ production activities, thereby contributing to economic expansion”. However, without appropriate risk management measures, continued decline in profits would lead to to “insufficient capital bases”, and sharply higher credit costs. The stability of the financial system “could be threatened” in the event of a “large exogenous shock”. Based on October’s Financial System Report, the system has been maintaining stability on the whole.

On monetary, Kuroda repeated the same rhetoric that BoJ will continue with the current loose monetary policy. And, he’s confident that BoJ inflation will eventually move back to target.

On the data front

New Zealand PPI input rose 1.4% qoq in Q3, above expectation of 0.8% qoq. PPI output rose 1.5% qoq, above expectation of 0.9% qoq. Japan trade deficit widened slightly to JPY -0.30T in October. UK Rightmove house prices dropped -1.7% mom in November. Eurozone will release current account. US will release NAHB housing index.

Looking ahead

UK politics, Brexit negotiation, Italy-EU budget showdown, US-China trade negotiations, Fed rhetorics will be the focuses of the week. Also, RBA and ECB will release meeting minutes. In addition, US durables goods orders, Eurozone PMIs and Canada CPI and retail sales are of particular importance. Here are some highlights for the week:

- Monday: New Zealand PPI; Japan trade balance; Eurozone current account, US NAHB housing index

- Tuesday: RBA minutes; Swiss trade balance; German PPI; US housing starts and building permits

- Wednesday: Japan all industries index; UK public sector net borrowing; Canada wholesale sales; US durable goods orders, jobless claims, leading indicator, existing home sales

- Thursday: ECB meeting accounts; Eurozone consumer confidence

- Friday: Japan PMI manufacturing; German GDP final; Eurozone PMIs; Canada CPI, retail sales; US PMIs

USD/JPY Daily Outlook

Daily Pivots: (S1) 112.41; (P) 113.04; (R1) 113.43; More..

Intraday bias in USD/JPY remains on the downside for the moment. Fall from 114.20 is seen as the third leg of the consolidation pattern from 114.54. Deeper fall would be seen to 111.37 support and possibly below. But downside should be contained by 38.2% retracement of 104.62 to 114.54 at 110.75 to bring rebound. On the upside, above 113.70 minor resistance will turn bias back to the upside for 114.54/73 key resistance zone.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q3 | 1.40% | 0.80% | 1.00% | |

| 21:45 | NZD | PPI Output Q/Q Q3 | 1.50% | 0.90% | 0.90% | |

| 23:50 | JPY | Trade Balance (JPY) Oct | -0.30T | -0.48T | -0.24T | -0.14T |

| 0:01 | GBP | Rightmove House Prices M/M Nov | -1.70% | 1.00% | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Sep | 24.2B | 23.9B | ||

| 9:00 | EUR | ECB Financial Stability Review | ||||

| 15:00 | USD | NAHB Housing Market Index Nov | 67 | 68 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals