Risk aversion dominates the global markets today and is intensifying. Major European indices are trading broadly lower with sign of downside acceleration. US futures also point to lower open, with DOW having triple-digit loss. In the currency markets, Australian Dollar is the weakest one for today. Euro follows as the second worst performing as German-Italian spread widens again. Swiss Franc and Japan Yen are the strongest one naturally. Sterling is mixed as UK Prime Minister Theresa May survived another day with no leadership challenge triggered yet.

Technically, there is no clear new development yet. Dollar could remain mixed as it’s pressured by Swiss Franc and Yen. However, the greenback could pick up some strength against Euro and Canadian, and even Sterling and Aussie. Euro also seem to be losing upside momentum against both Dollar and Sterling. But most importantly, EUR/JPY is starting to feel heavy and could have a take on 127.49 minor support shortly.

In Europe, at the time of writing, FTSE is trading down -0.49%, DAX is down -1.17%, CAC is down -1.13%. German 10 year yield is down -0.021 at 0.355. Italian 10 year yield is up 0.004 at 3.605. Spread widens to 325. Earlier in Asia, Nikkei dropped -1.09%, Hong Kong HSI dropped -2.02%, China Shanghai SSE dropped -2.13%, Singapore Strait Times dropped -1.24%.

From the US, housing starts dropped to 1.23M annualized rate in October. Building permits dropped to 1.26M. Both matched expectations. Released earlier, UK CBI trends total orders rose to 10 in November, much better than expectation of -5. German PPI rose 0.3% mom, 3.3% yoy in October, matched expectations. Swiss trade surplus widened to CHF 3.75B in October.

BoE Carney: No-deal Brexit is not a financial crisis round two, but real economy shock

At the Treasury Committee BoE Inflation Report hearing, BoE Governor Mark Carney emphasized that a no-deal Brexit is “not a financial crisis round two” where central banks take center stage. Instead, ” this is a real economy shock and therefore central banks have a role but we’re more of a sideshow.” He also added the real issues are going to be in the real economy. They’ll be about “how well the logistics system works, where business confidence is, what access, if any, is there in a true, no-deal transition Brexit.”

Carney acknowledged that “implied volatility in sterling is very high right now, much higher than it is for other major currencies” for “political discussions” with “importance” for the short to medium term outlook. And, “it will continue to be volatile for the next month at least”.

Chief economic Andy Haldane said “notwithstanding the fact that details of the (Brexit) deal remain to be agreed, we are seeing somewhat greater impact on the behavior of companies in particular in the last month or two.” And, “that could make for a somewhat weaker fourth quarter than we saw in the third quarter, and certainly a more volatile path for output I think over the next few months.”

EU Centeno: Italy’s growth and social issues can be achieved without putting fiscal consolidation at risk

Talking about Italy, Eurogroup President Mario Centeno expressed his empathy and said “I understand and share Italy’s concerns about sluggish growth and complex social issues”. However, he also emphasized that “this can be achieved without placing a trajectory of fiscal consolidation at risk.”

He also emphasized that adhering to fiscal rules is “not only in each country’s individual interest, but also in our collective interest”. He pointed to the Eurozone debt crisis and said it “has taught us that in an economic and monetary union, the responsibility to conduct sound and responsible policy does not stop at national borders.”

Regarding the Franco-German proposal of Eurozone budget, he said “a common fiscal capacity should not discharge countries from their obligation to conduct sound fiscal policies and respect the fiscal rules.” On the other hand, Eurozone statement would be better on reacting to asymmetric shocks, without overburdening the ECB.

Separately, ECB Governing council member Ewald Nowotny said Italy is not “an immediate threat” but rather a “political problem”. However, “in the longer term there is the question of whether I have enough trust on the capital markets.”

RBA Lowe reiterated three central messages of the central bank

RBA Governor Philip Lowe reiterated the three central messages in the meeting minutes, in a speech titled “Trust and Prosperity“. He noted:

“First, the economy is moving in the right direction and further progress is expected in lowering unemployment and having inflation consistent with the target.

Second, the probability of an increase in interest rates is higher than the probability of a decrease. If the economy continues to move along the expected path, then at some point it will be appropriate to raise interest rates. This will be in the context of an improving economy and stronger growth in household incomes.

Third, the Board does not see a strong case for a near-term change in interest rates. There is a reasonable probability that the current setting of monetary policy will be maintained for a while yet. This reflects the fact that the expected progress on our goals for unemployment and inflation is likely to be gradual. The Board’s view is that it is appropriate to maintain the current setting of policy while this progress is made.”

IMF: Australia’s growth to continue but risks tiled to the downside

IMF noted in a report that Australia’s recent strong growth is expected to “continue in the near term”. Also, “further reducing slack in the economy and leading the way to gradual upward pressure on wages and prices.” In particular, “private consumption growth is anticipated to remain buoyant, supported by strong employment gains.” Also, “rebound in non-mining private business investment and further growth in public investment is envisaged to offset a softening in dwelling investment.”

However, balance of risks is “tilted to the downside” with a “less favorable global risk picture”. IMF noted “weaker-than-expected near-term outlook in China coupled with further rising global protectionism and trade tensions could delay full closure of the output gap”. Also, “sharp tightening of global financial conditions could spill over into domestic financial markets, raising funding costs and lowering disposable income of debtors, with the impact also depending on the response of the Australian dollar”.

Also, “domestic demand may equally turn out weaker if wage growth remained subdued or investment spillovers were smaller.” Housing market downturn is “another source of risk”. But under the baseline outlook, the housing correction “remains orderly”. But negative risk developments could “amplify the correction and lower domestic demand.”

BoJ Kuroda: Negative rate still necessary but no need to take extra easing

BoJ Governor Haruhiko Kuroda ruled out the need to ramp up stimulus today. He said that “there’s no need to take additional steps. What’s important is to ensure our policy is sustainable, with an eye on balancing its pros and cons.”

But at the same time, he also ruled out an early end to the negative interest rate policy. He noted “I know there is various debate on the BoJ’s negative rate policy”, “but for the time being, it’s a necessary step that is part of our large-scale monetary easing program.”

Kuroda remained optimistic that “wage and price growth will likely accelerate” and lift inflation to 2% target eventually. But that change of doing that any time during fiscal 2020 is “slim”.

USD/JPY Mid-Day Outlook

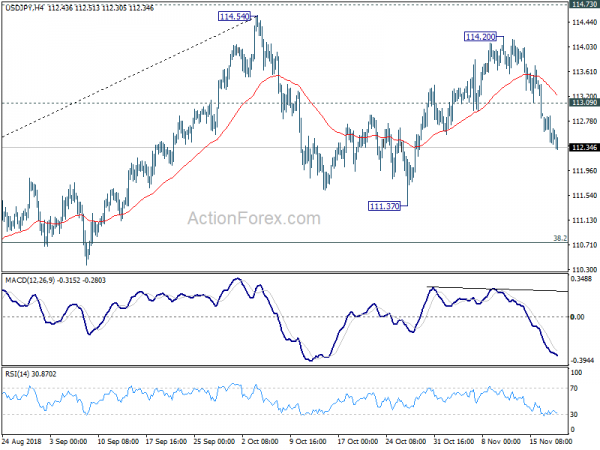

Daily Pivots: (S1) 112.36; (P) 112.61; (R1) 112.81; More..

USD?JPY’s fall from 114.20 is still in progress and intraday bias stays on the downside for 111.37 support and possibly below. Such decline is seen as the third leg of the consolidation pattern from 114.54. Downside should be contained by 38.2% retracement of 104.62 to 114.54 at 110.75 to bring rebound. On the upside, above 113.30 minor resistance will turn bias back to the upside for 114.54/73 key resistance zone.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minutes | ||||

| 07:00 | CHF | Trade Balance (CHF) Oct | 3.75B | 2.89B | 2.43B | 2.23B |

| 07:00 | EUR | German PPI M/M Oct | 0.30% | 0.30% | 0.50% | |

| 07:00 | EUR | German PPI Y/Y Oct | 3.30% | 3.30% | 3.20% | |

| 11:00 | GBP | CBI Trends Total Orders Nov | 10 | -5 | -6 | |

| 13:30 | USD | Housing Starts Oct | 1.23M | 1.23M | 1.20M | 1.21M |

| 13:30 | USD | Building Permits Oct | 1.26M | 1.26M | 1.24M | 1.27M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals