- Pound unimpressed by EU leaders approving Brexit deal, as UK Parliamentary endorsement still looks highly unlikely.

- Euro drifts lower after soft PMIs heighten speculation for a cautious ECB. President Draghi’s remarks today will be watched closely.

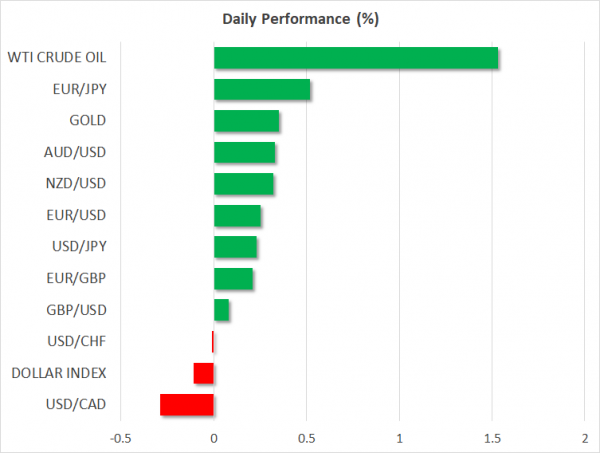

- Loonie unable to rally after decent data, as oil prices continue to plunge.

- Dollar capitalizes on risk-off mood, looks to key Fed speakers for direction.

Pound little changed as EU leaders approve Brexit deal

EU leaders approved the Brexit divorce deal over the weekend, with all of them – including PM May – echoing the message that this is the “best, and only deal possible”. The British pound for its part completely overlooked the headlines, trading nearly unchanged against its major peers today. Investors appear to be signaling it’s not time to get excited just yet, as the deal also needs to pass through the UK Parliament, which seems like a herculean – if not impossible – task considering it faces opposition from all sides. The caveat is that with markets looking almost convinced it will be voted down, most of the “bad news” may be priced in already and hence, anything that changes this narrative over the coming weeks could trigger a sizeable relief rally in sterling.

Beyond Brexit, BoE Governor Carney will speak today at 1830 GMT, though politics will probably continue to overshadow economics in driving the pound over the coming weeks.

Euro tumbles as disappointing PMIs hint at dovish tilt by ECB

The single European currency fell across the board on Friday but managed to recover some of those losses today, after the bloc’s preliminary PMI surveys for November disappointed yet again. The sustained weakness suggests the euro area remains in “low gear”, and may be a factor that lessens the ECB’s confidence in its normalization plans. While the Bank appears firmly committed to ending its QE program in December, further softness in economic data may lead policymakers to adopt a more cautious tone with respect to any tightening after that, for instance around the timing of the first planned rate hike.

Note that investors are no longer convinced a 10bps ECB rate hike will materialize in 2019, instead assigning a 84% probability to that scenario, according to EONIA swaps and Euribor futures. Remarks by the ECB’s Coeure (1230 GMT) and Draghi (1600 GMT) today may be pivotal; any hints of a more “measured” rate-hike approach against the backdrop of a slowing economy may spell more troubles for the euro.

In Germany, the Ifo survey for November is due out at 0900 GMT.

Loonie unable to rally on solid data as oil carnage accelerates

In Canada, the loonie was unable to draw strength from a batch of encouraging inflation and retail sales data on Friday. The culprit behind the currency’s underperformance was yet another plunge in oil prices, with WTI falling by nearly 8% on the day to touch a fresh one-year low amid continued concerns around both oversupply and a slowdown in demand. Both the loonie and crude prices are a little higher today, recovering some of their recent losses. It remains to be seen whether speculation around an OPEC supply cut will be enough to support oil prices as we draw nearer to the cartel’s next meeting on December 6. Until crude prices stabilize, any rallies in the loonie may remain relatively short-lived.

Dollar capitalizes on “Black Friday’s” risk-off mood, but sentiment rebounds

As for the dollar, it closed higher overall on Friday, capitalizing on the pullback in the euro and on the broader risk-off mood in markets, which tends to benefit the greenback due to its reserve currency status. US stock indices ended lower, though sentiment looks to have recovered on Monday as Asian markets closed mostly in the green, while futures tracking the major European and US benchmarks are pointing to a higher open as well.

Accordingly, the dollar is a little lower today, though the currency’s short-term direction may be decided mainly by the plethora of Fed speakers that are on the agenda this week, most notably Chair Powell on Wednesday and Vice Chair Clarida on Tuesday.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals