After yesterday selloff triggered by Fed Chair Jerome Powell, Dollar turns mixed today. It did try to regain some grounds in early European session. But the attempt falters after weaker than expected inflation reading from the US. Focus will now turn to minutes of the November FOMC meeting. It’s important to see whether it’s a consensus that interest now is now “just below” or “long way from ” neutral.

Staying in the currency markets, Australian Dollar is so far the strongest one for today. The break of 0.7314 key resistance in AUD/USD suggests medium term bullish reversal. But AUD/USD has yet to pick up momentum above 0.7314 to confirm. Yen is the second strongest one for today, followed by Euro. Meanwhile, Sterling is the weakest one, followed by Swiss Franc. The Swiss is firstly weighed down by surprised GDP contraction. Also, rebound in emerging market currencies, like Turkish Lira, on Dollar weakness also reduced safe haven demand for Franc. Canadian Dollar is mixed as WTI crude oil broken below 50 but quickly recovered.

Technically, Aussie’s strength is worth a watch today. 0.7314 in AUD/USD is a level to watch. Also, we’ll see if if EUR/AUD could sustain below 1.5519 support to confirm decline resumption. Sterling is another one to watch. GBP/USD might head back to 1.2725 temporary low. Also, EUR/GBP is eying 0.8939 resistance and GBP/JPY is heading back to 144.02 support. Break of these levels could prompt deeper selloff in the Pound.

In other markets, major European indices are trading all in black at the time of writing. FTSE is up 0.68%, DAX up 0.36% and CAC up 0.57%. German 10 year yield is down -0.0238 at 0.329. Italian 10 year yield is down -0.036 at 3.225. German-Italian spread stays below 300. Earlier in Asia, Nikkei closed up 0.39% while Singapore Strait Times rose 0.48%. However, Hong Kong HSI dropped -0.87% while Shanghai SSE dropped -1.32%.

One more thing to note is that 10 year JGB yield dropped -0.0195 to 0.081, a level we haven’t seen for some time. Japanese yield fell while Yen is rising. China and Hong stocks closed lower. These argue that traders are turning defensive ahead of the Trump-Xi meeting at G20 this weekend.

Dollar back under pressure as core PCE inflation slowed, jobless claims rose

Dollar is back under some mild pressure in early US session after mixed economic data. Inflation data missed expectations. Headline PCE was unchanged at 2.0% yoy in October versus consensus of 2.1%. Core PCE even slowed to 1.8% yoy, down from 2.0% yoy and missed consensus of 1.9% yoy. Though, personal income rose 0.5% while spending rose 0.6%. Both were above expectations.

Initial jobless claims rose 10k to 234k in the week ended November 24, above expectation of 221k. Four-week moving average of initial claims rose 4.75k to 223.25k. Continuing claims rose 50k to 1.71M in the week ended November 17. Four-week moving average of continuing claims rose 19.75k to 1.668M.

USTR seeks auto tariffs equalization from China

Just days ahead of the Trump-Xi meeting, the US Trade Representative Robert Lighthizer issued another statement regarding China’s auto tariffs today. Is it setting the stage for Trump to claim victory on some Chinese concessions?

The statement noted, “As the President has repeatedly noted, China’s aggressive, State-directed industrial policies are causing severe harm to U.S. workers and manufacturers. We are continuing to raise these issues with China. As of yet, China has not come to the table with proposals for meaningful reform.”

“China’s policies are especially egregious with respect to automobile tariffs. Currently, China imposes a tariff of 40 percent on U.S. automobiles. This is more than double the rate of 15 percent that China imposes on its other trading partners, and approximately one and a half times higher than the 27.5 percent tariff that the United States currently applies to Chinese-produced automobiles. At the President’s direction, I will examine all available tools to equalize the tariffs applied to automobiles.”

Eurozone business climate improved, economic confidence dropped less than expected

Eurozone (EA19) business climate improved to 1.09 in November, up from 1.01 and beat expectation of 0.96. Eurozone economic confidence dropped to 109.5, down from 109.7 but beat expectation of 109.0. Industrial confidence rose to 3.4, up from 3.0 and beat expectation of 2.3. Services confidence was unchanged at 13.3, above expectation of 13.0. Consumer confidence was finalized at -3.9.

Also release in European session, German CPI slowed to 2.3% yoy in November, down from 2.5% yoy but beat expectation of 2.2% yoy. German unemployment dropped -16k in November. Unemployment rate dropped 0.1% to 5.0% in October. French GDP rose 0.4% qoq in Q3, unrevised. UK mortgage approvals rose 1k to 67k in October. UK M4 money supply rose 0.7% mom in October.

EU Barnier: The Brexit deal on table is the only deal possible

EU chief Brexit negotiator Michel Barnier told the EU parliament today that given the “high degree of complexity of all the issues surrounding the UK’s withdrawal, the orderly withdrawal treaty that is on the table is the only deal possible”. And he added that “this is now the moment of ratification”.

Barnier also said “It’s not a question of winners and losers because Brexit is a lose-lose. There is no added value”. And “I am convinced we will be able to work together for a real and unprecedented partnership.”

Separately, UK Prime Minister Theresa May continued her brainwashing rhetorics today. She said told a parliamentary committed, “the timetable is such that actually some people would need to take some practical steps in relation to no deal if the parliament were to vote down the deal on the 11th of December.”

Swiss GDP contracted -0.2% in Q3, growth cycle suddenly interrupted

Swiss GDP unexpectedly contracted -0.2% qoq in Q3, much worse than expectation of 0.5% qoq expansion. The one and a half year strong continuous growth was “suddenly interrupted”. And |Swiss is following the “significant economic downturn” as seen in other European countries, “in particular Germany.

SECO also noted that GDP contract was due to “both the industrial and service sectors”. On the expenditure side, “domestic demand and foreign trade” had a negative impact. Looking at the details, export of goods were particular serious, down -4.2%. Import of goods excluding valuables also dropped -2.4%.

BoJ Masai: Best to sustain current ultra-loose monetary policy

Bank of Japan board member Takako Masai said price growth remained weak in Japan even though growth was solid. And, “as such, the best approach would be to sustain the current ultra-loose monetary policy. With that “the positive momentum is not disrupted,” regarding inflation moving back to 2% target.

She also noted that “Monetary easing can stimulate the economy. On the other hand, prolonged low rates could have adverse effects on bond market functions and financial institutions’ profits”. Thus, “in guiding monetary policy, the BOJ must thoroughly scrutinize the costs and benefits of its policy from various perspectives.”

On BoJ’s move to allow 10-year JGB yield to move from -0.1% to 0.1%, she that “Such flexible measures the BOJ took will help sustain sound market functions.”

Released in Asian session, Japan retail sales rose 3.5% yoy in October versus expectation of 2.7% yoy. New Zealand ANZ business confidence was unchanged at -37.1 in November. Australia private capital expenditure dropped -0.5% in Q3, below expectation of 2.0%.

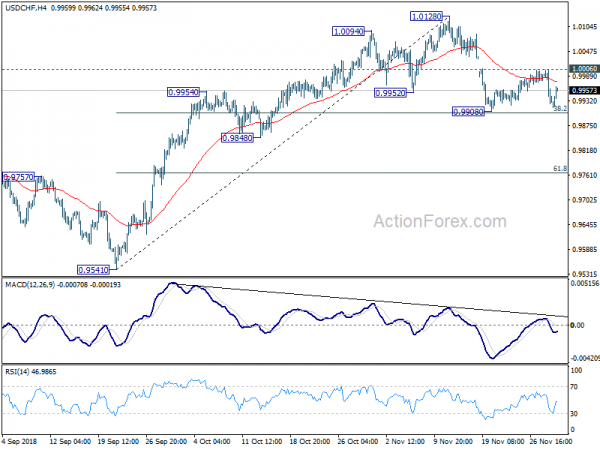

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9905; (P) 0.9956; (R1) 0.9986; More…

USD/CHF recovers ahead of 0.9908 support and intraday bias remains neutral at this point. On the downside, break of 38.2% retracement of 0.9541 to 1.0128 at 0.9904 will resume the fall from 1.0128 to 0.9848 key support level. Break there will indicate near term reversal and target 61.8% at 0.9765. On the upside, break of 1.0006 will argue that the pull back from 1.0128 has completed. Intraday bias will be turned back to the upside for retesting 1.1028.

In the bigger picture, rise from 0.9541 could have topped at 1.0128. But as long as 0.9541 support holds, we’d still expect rise from 0.9186 to resume at a later stage. Break of 1.0128 will target 1.0342 key resistance. However, break of 0.9514 will pave the way back to 0.9186 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Oct | 3.50% | 2.70% | 2.10% | 2.20% |

| 00:00 | NZD | ANZ Business Confidence Nov | -37.1 | -37.1 | ||

| 00:30 | AUD | Private Capital Expenditure Q3 | -0.50% | 2.00% | -2.50% | -0.90% |

| 06:45 | CHF | GDP Q/Q Q3 | -0.20% | 0.50% | 0.70% | |

| 07:45 | EUR | French GDP Q/Q Q3 P | 0.40% | 0.40% | 0.40% | |

| 08:55 | EUR | German Unemployment Change Nov | -16K | -10K | -11K | |

| 08:55 | EUR | German Unemployment Claims Rate s.a. Nov | 5.00% | 5.00% | 5.10% | |

| 09:30 | GBP | Mortgage Approvals Oct | 67K | 65K | 65K | 66K |

| 09:30 | GBP | Money Supply M4 M/M Oct | 0.70% | 0.30% | -0.30% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Nov | 1.09 | 0.96 | 1.01 | |

| 10:00 | EUR | Eurozone Economic Confidence Nov | 109.5 | 109 | 109.8 | 109.7 |

| 10:00 | EUR | Eurozone Industrial Confidence Nov | 3.4 | 2.3 | 3 | |

| 10:00 | EUR | Eurozone Services Confidence Nov | 13.3 | 13 | 13.6 | 13.3 |

| 10:00 | EUR | Eurozone Consumer Confidence Nov F | -3.9 | -3.9 | -3.9 | |

| 13:00 | EUR | German CPI M/M Nov P | 0.10% | 0.00% | 0.20% | |

| 13:00 | EUR | German CPI Y/Y Nov P | 2.30% | 2.20% | 2.50% | |

| 13:30 | CAD | Current Account Balance (CAD) Q3 | -10.3B | -11.9B | -15.9B | -16.7B |

| 13:30 | USD | Personal Income Oct | 0.50% | 0.40% | 0.20% | |

| 13:30 | USD | Personal Spending Oct | 0.60% | 0.40% | 0.40% | 0.20% |

| 13:30 | USD | PCE Deflator M/M Oct | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | PCE Deflator Y/Y Oct | 2.00% | 2.10% | 2.00% | |

| 13:30 | USD | PCE Core M/M Oct | 0.10% | 0.20% | 0.20% | |

| 13:30 | USD | PCE Core Y/Y Oct | 1.80% | 1.90% | 2.00% | |

| 13:30 | USD | Initial Jobless Claims (NOV 24) | 234K | 221K | 224K | |

| 15:00 | USD | Pending Home Sales M/M Oct | 0.80% | 0.50% | ||

| 15:30 | USD | Natural Gas Storage | -76B | -134B | ||

| 19:00 | USD | FOMC Minutes |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals